If you don’t have one, should you open a Roth IRA account?

Posted on February 22, 2019

YES. And NOW. I’m 74 and I just opened my first Roth IRA account in December. I should have opened one years ago – more like 10 or 15 – and gotten money into Roth at lowest tax cost. This post explains why you want to have money in a Roth account and a bit of the mechanics of opening an account.

==== Traditional and Roth IRAs ===

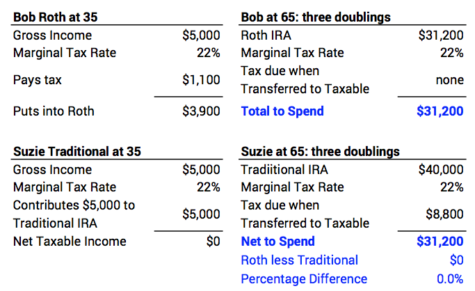

I think you know the difference between the two. I wrote about this here. You pay no tax when you put money into Traditional but pay tax on the amount you withdraw. You pay tax before you put money into Roth but pay no tax on the amount you withdraw. Traditional and Roth have the exact same result in term of after tax proceeds if your marginal tax bracket at the time of your contribution equals your marginal tax bracket at the time of withdrawal. Here’s the example of Bob Roth and Suzie Traditional.

If you think your current marginal tax bracket is greater than the one you’ll be in at the time of your withdrawal for spending, you’d choose Traditional. (SEP-IRA, 401k or 403b plans are always Traditional.) If your view on marginal tax rates is the opposite (greater later than now), you’d choose Roth. (Roth is a great choice for younger savers in low tax bracket now.)

==== Your view of future taxes ====

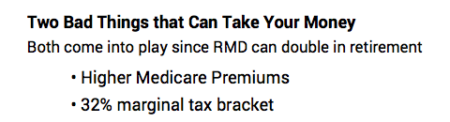

Now that you’re retired or nearly so, you have a much clearer view of your future taxes. If you are 70½ and taking your Required Minimum Distribution (RMD), it will double from your initial amount when you are in your mid 80s if future returns are typical. That doubling results in two potential tax bites you would like to avoid.

1) Medicare Premiums increase as you cross income thresholds. The increases in essence are added taxes. A small amount of income that crosses a threshold could cost you more than $2,000 (I state this for married, joint filers). Some taxpayers will eventually rack up nearly $5,000 per year in increased Medicare premiums; some couples nearly $10,000 per year.

2) The 32% tax bracket. That 2X RMD means some would have a significant portion of their lifetime retirement income taxed in the 32% marginal tax bracket. In the example in the post, by age 90 the retiree had nearly 40% of lifetime retirement income taxed at 32%. 32% is 33% more tax than 24% tax. Not good.

The chance that you are hit by these two is a function of how much you have in your Traditional IRA accounts that is subject to RMD. The more you have in Traditional, the lower your ability to avoid these two taxes.

==== Shift money from Traditional to Roth ====

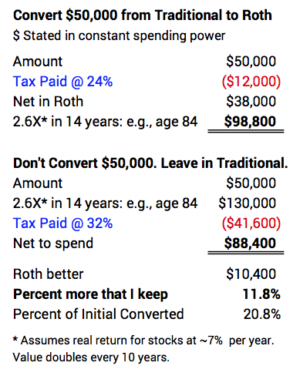

We can shift money from Traditional and therefore lower future RMD: we convert Traditional to Roth. When we convert, we pay tax now on the amount we convert. Paying more taxes now sounds crazy, but it makes sense. We pay tax now for the ability to avoid a much greater tax bite later.

I like to think of it this way: I NEVER* LOSE by converting to Roth. I WIN (keep more; pay less tax) when I use Roth judiciously to avoid a threshold that would result in greater tax.

Let’s assume I pay 24% marginal tax now when I convert and avoid 32% later. I always keep about 12% more of what I would have when I do this. You can think of immediately earning 12% of the amount your convert. That difference compounds to a larger increase in real spending power. In this example, I get +20% of the amount I originally convert. That’s one heck of a return for not a whole lot of work. (*NEVER assumes that future withdrawals from Roth are never in lower marginal tax bracket than when I converted.)

===== Why didn’t I open Roth before? ====

Most all our retirement contributions were to SEP-IRA plans and 401k plans that are Traditional plans: pay no tax going in; pay tax coming out. We were always consistent in contribution to annual IRA plans – the one that now is $6,000 per year, and we did most of that before Roth started in 1997 – or I should say the value of our Traditional IRA is largely from the compounding of contributions in the 1980s and the early 1990s.

Also, it was always (incorrectly) in my head to postpone paying taxes now. I did not understand the basic benefit of having Roth: lower the amount in Traditional to lower RMD; lower the chance of tipping into too high of marginal tax bracket and higher Medicare Premiums.

==== The best time to convert to Roth ====

The best time to convert traditional to Roth is before you are age 70½ – before the age you are first subject to RMD – and if you are retired and have years of lower taxable income. You’ll have the greatest flexibility in the amount that you can convert. You’ll be in a lower marginal tax rate than you will after you start taking your RMD.

==== Mechanics of my new Roth account ====

I opened a Roth account in December at Fidelity. All our nest egg is there. I converted $100 total (!) from my traditional IRA to the new Roth account. I did not convert more since I did not have a handle on my Modified Adjusted Gross Income (MAGI) for 2018. I have a preliminary tax plan for 2019 now. I’ll convert a lot more near the end of the year when I have a really good handle on our 2019 MAGI.

It took me less than ten minutes to open the account online, designate beneficiaries (Patti is primary), grant Patti full trading authority, and to nickname the account “T’s Roth Account;” that reminds me what it is when I look at the display of all my accounts. I could have funded the account online, but I chose to call Fidelity. The rep helped me put a total of $100 into the account: shares worth $70 of FSKAX and $30 of FTIHX. That took less than five minutes.

Patti had to complete the online task of verifying her identity to complete the authorization of full trading authority. I remember this was a straightforward process when we granted full trading to each other on all our accounts several years ago. Patti may not have remembered from before. This was not smooth as silk for her, and I think it took her about 15 minutes to complete this task.

As reference, I liked this series of articles on converting Traditional IRA to Roth. An article explains the detail of a five year aging period from the start of your Roth account for all gains to by untaxed at the time of withdrawal; you can withdraw the amount you convert at any time without tax consequences.

Conclusion: We all should have a portion of our IRA in a Roth account. You NEVER* LOSE by converting Traditional to Roth. You WIN when you judiciously use your Roth for spending and avoid higher taxes. You keep more of your money.