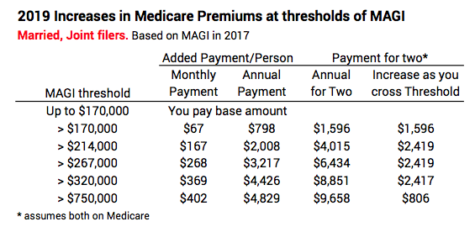

This seems incredible: $1 more MAGI can trigger added $2,400 in Medicare premiums

Posted on February 1, 2019

Last week’s post discussed MAGI (Modified Adjusted Gross Income). We retirees want to understand MAGI and estimate our MAGI for our current tax year. What I failed to appreciate in prior years is the fairly BIG BITE that can hit retirees when MAGI crosses specific thresholds: our Medicare premiums increase in large chunks as we cross these thresholds. A small amount of incremental income can trigger $1,500 to $2,400 or more in added Medicare premiums. A retiree could pay incredibly high incremental taxes on the income that just crosses a threshold.

The purpose this post is to describe the greater Medicare Premiums (an added tax, in effect) that you might pay and how you might be able to avoid recording income – MAGI – that cross important Medicare thresholds.

We see in this table derived from here that greater Medicare premiums generally hit folks with high MAGI. In my mind, that translates to folks with healthy retirement accounts subject to Required Minimum Distributios (RMD). But if we experience an average or above average sequence of returns in the future, many of us will have significant retirement accounts even if we are taking RMD. (This sheet shows this data for single filers.)

==== The mechanics of Medicare premiums ====

In December Patti and I received the letter from Social Security that told us our gross payments for 2019 and the deductions Medicare will take monthly for our share of Medicare Part B (medical insurance) premiums – everyone pays at least $135.50 per month in 2019 – and any surcharge for Medicare prescription drug plan (Part D). Added costs for higher income retirees are determined by MAGI on their tax return Social Security had in their hands at the end of 2018, and for Patti and me that was our 2017 tax return filed in early 2018.

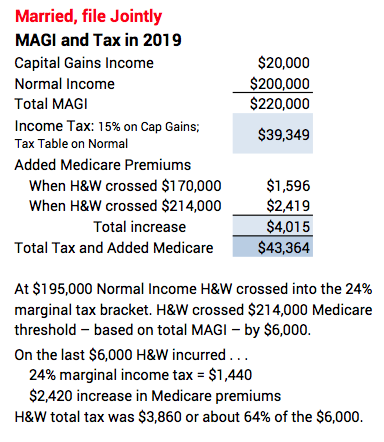

What does this mean? If you cross a threshold that trips premium increases, you may be unhappy with incremental added income tax + Medicare premiums you will pay. Here’s and example for Herb and Wendy of how the last $6,000 of income can cost $3,860 in added tax. That’s 64% of that last $6,000 of income. (If I had used the example of just $1 over the threshold, the added cost for that $1 of incremental income would be $2,419!)

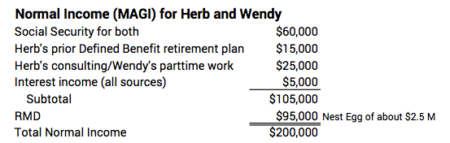

You can see that this example applies to folks with high MAGI. Here’s my hypothetical example of the $200,000 of Normal Income for Herb and Wendy in the table above. They have a healthy retirement portfolio (subject to RMD) of about $2.5 million. (They would have crossed that first threshold at $170,000 with a retirement portfolio subject to RMD of a bit over $1 million.)

==== My preliminary 2019 tax planning ====

What does this mean for our 2019 tax planning? We don’t exactly know the thresholds that Medicare will use in the future. Unlike tax brackets, the thresholds are not adjusted for inflation every year. But I’m going to assume that the current thresholds will apply. That means, if possible, I want to plan my MAGI for 2019 to avoid crossing a current threshold. We’ll file that return in early 2020, and Medicare will use MAGI on that return to determine added premiums in 2021.

What might I do to avoid a threshold? Here are four tactics in my head right now. You can see my general priorities in last week’s post. Patti and I both are subject to RMD, so we have less flexiblity than folks not subject to RMD.

1. ALWAYS donate using QCD from our retirement accounts. QCD donations are not included in MAGI, but QCD counts as part of RMD. This lowers RMD that is recorded as MAGI and the source of cash we want for spending.

2. Increase sales of taxable securities for the cash we want to spend. We get to keep roughly 94% of the sales proceeds and 6% is MAGI. This obviously depends on the cost basis of securities we sell.

3. Distribute from Roth accounts for cash we need for spending. Roth is obviously a wise choice if it helps avoid 64% marginal tax. We previously paid tax when we put money into the Roth, so we pay no tax – incur no MAGI – when we withdraw from Roth.

4. Distribute more from traditional retirement accounts; I’d surpass our RMDs. Let’s assume I cross a threshold by $10,000 and can’t figure out how to cut that $10,000 this year. I might as well blow by that threshold but stay below the next threshold. Thresholds jump by about $50,000. Let’s assume I take an added $40,000. That could mean I can figure out how to take $15,000 less in each of the next two years and dodge the threshold for those two years.

Conclusion. Added Medicare premiums affect higher income retirees, generally those with healthy retirement accounts subject to RMD. If you cross a MAGI threshold by a little bit, you (assumes married, joint filer) can be hit with $1,500 or more added cost – a really high tax hit on the small amount of money that crossed the threshold. Estimate your MAGI for 2019 now and see where you fall relative to the thresholds. You may be able to figure out how to avoid crossing a threshold. You may be able to save $1,500 or more.