Monthly Older Posts: January 2019

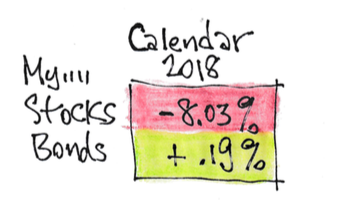

How badly did actively managed funds perform relative to index funds in 2018?

The answer: it looks very bad for funds and fund families that pride themselves on being better than average. That’s what I conclude as I look over the results of Fidelity funds and the flagship fund from American Funds. This post highlights the poor

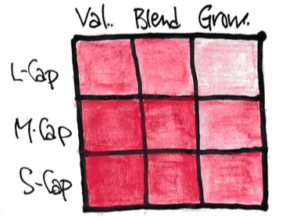

What segments of US stocks outperformed in 2018?

I like looking at the Vanguard Style Box (I call it a Nine Box.) at the end of the year to get a snapshot of what segments of stocks outperformed and underperformed the US stock market as a whole. This post discusses the 2018 snapshot.