Monthly Older Posts: November 2019

Your RMD will likely double in your lifetime: is this a concern?

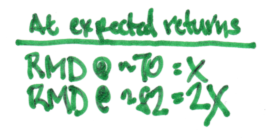

We retirees with Traditional IRA accounts will record increasing taxable income over time. That’s due to RMD, a big component of taxable income for those over age 70½. At expected returns for stocks and bonds, your taxable ordinary income will DOUBLE in real terms