How do you manage your 2019 income to avoid $1000 (or more) tax landmines?

Posted on November 1, 2019

The purpose of this post is to describe seven hard-to-see tripwires for landmines that can result in taxes that you might be able to avoid. If you stumble on a tripwire and set off a landmine – cross a specific amount of income you record on your tax return by $1 – you could see your tax bill go up by perhaps $2,400. We retirees can avoid the tripwires: we have a degree of control over our taxable income. We choose where we get the money that we want to spend in a year. Our choices have different tax consequences. We can tweak our taxable income for a given gross amount that we want to spend and avoid taxes that we would otherwise pay.

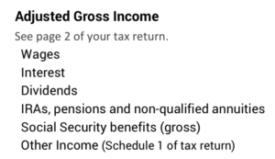

We can accidentally set off land mines that blow away up to $2,400 when we record a just a hair too much Modified Adjusted Gross Income (MAGI) on our tax return. Your MAGI is Adjusted Gross Income with the addition of some items you did not include on page 2 of your tax return. An example is that you add back tax-exempt interest to AGI to get to MAGI. My tax preparer emailed me a .pdf file of our 2018 return and a bunch of supporting schedules. One calculates our MAGI. Patti and I had nothing to add back to AGI to get to MAGI, and that will hold true for 2019. AGI = MAGI for us.

== Three kinds of Landmines: seven tripwires ==

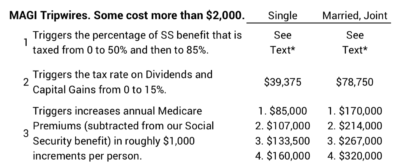

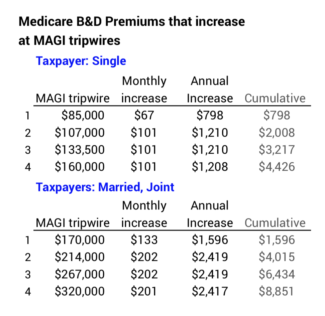

We have three kinds of landmines with specific tripwires that result in a big jump in total tax: 1) two tripwires result in a greater percentage of Social Security that is taxed – jump from zero to 50% and then 85% taxed; 2) a tripwire that jumps the tax rate on dividends and long-term capital gains from zero to 15% ; and 3) four tripwires each increase Medicare Premiums per year by roughly up to about $1,200 per individual.

[In this table I excluded tripwires at very high MAGI: the ~$435,000 tripwire for 20% capital gains for a single filer; ~$489,000 for joint, married. And the last $500,000 tripwire for greater Medicare Premiums for a single filer; $750,000 for joint, married.]

== Estimate your 2019 MAGI now ==

I estimate my 2019 MAGI using my 2018 return as the starting point. See spreadsheet that I use here. You’ll need to do this to find if you could stumble on a tripwire. I can tweak the three sources of our SSA to adjust MAGI if I think I might stumble across a tripwire described below. This spreadsheet also estimates my total taxes for the year so I know how much to withhold when I take our RMDs in early December. (Patti and I are both subject to RMD.)

== Landmines at relatively low MAGI ==

Retirees who have relatively low income other than Social Security benefits and financial nest eggs generally less than $500,000 per individual may be able to avoid two landmines. Folks with some outside investment income income and larger financial nest eggs – especially when subject to RMD – will blow by these landmines and incur greater taxes.

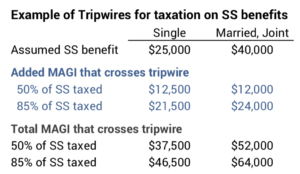

• Greater MAGI triggers a greater percentage of SS benefits subject to tax. You have to calculate to find your tripwires. Your tripwires are affected by the amount of your SS benefit. This blog post from two weeks ago has a more detailed discussion. This example below shows that a single filer will cross the first tripwire – resulting in 50% of SS benefits being taxed – if MAGI other than the SS benefit exceeds $12,500. They cross the second trip wire at $21,500 of added MAGI.

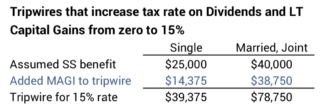

• Greater MAGI triggers a jump in the tax rate on Dividends and on Long term Capital Gains from the sales of securities. The rate jumps from zero to 15% when total MAGI crosses the trigger point of about $39,000 for a single taxpayer and about $79,000 for married, joint filers. Again, a single taxpayer reaches the tripwire without a large amount of MAGI in addition to the assumed SS benefit.

== Landmines at high MAGI ==

There’s a big jump in MAGI to reach the next set of landmines. Much greater MAGI trips added Medicare Premium payments. (See here for an earlier discussion.) The first tripwire hits at $85,000 MAGI for a single and $170,000 for married, joint. Tripwires are roughly every $25,000 thereafter for single and $50,000 for married. Each tripwire triggers about $1,000 added annual premiums per person. For Patti and me, increased Medicare Premiums would br deducted from our Social Security benefits because our basic Premium is deducted.

You don’t immediately see the effect if you cross over the tripwire. You see it a year later. Your 2019 return affects your premium penalty payments in your 2021 SS benefits. You send your 2019 return to the IRS in April 2020. The IRS calculates your MAGI. You get your statement of your 2021 SS benefits in late 2020. That statement will reflect the added premium for tripwires you crossed on your 2019 return. The 2021 premium increases will adjust for inflation and will be a bit higher than I display in the table above.

== Actions to take when near a tripwire ==

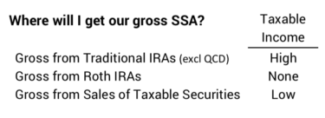

Back away when you are near a tripwire! Record lower MAGI! You can fiddle and keep the same gross amount for spending but lower MAGI. You have three choices to lower MAGI: distribute from your Roth IRA rather than Traditional IRA; get more of your gross cash for spending from sales of securities than from your Traditional retirement accounts. You could choose to pay yourself less than your SSA.

If you think you’re going to face the same landmine you want to avoid in future years, you could blow by the trip wire that’s close and get near to the next one. You’d choose to pay yourself more this year with the plan of plan of paying less in future years – you’re prepaying a bit of your future SSA in effect. You gain the same benefit if you convert Traditional to Roth IRA.

Conclusion: $1 of added income on our tax return can trigger up to $2,400 in added tax. The tripwires of Modified Adjusted Gross Income (MAGI) that result in these high costs are not easy to see. This post displays a total of eight trip wires. You need to estimate your taxes for this year to see if you are close to a tripwire. Back way if you are close! You back away by tweaking your reported income: you decide how you will get the cash you want to spend, and what you choose has different effects on taxable income.