Can you lower the portion of Social Security that is taxed and avoid $1000s in tax?

Posted on October 18, 2019

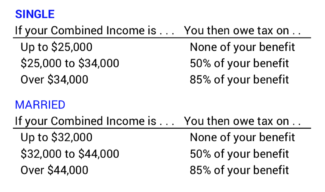

Depending on the amount of your income, 0%, 50% or 85% of your Social Security (SS) benefits is taxed. Retired folks under age 70½ have flexibility as to how they get the cash to pay themselves throughout the year – what is taxable income on their tax return. They can pay themselves a significant amount for spending – more than $50,000 total in a year – but avoid crossing income points that trigger roughly $1500 or $2,500 in taxes. Folks over 70½ incur RMD that limits their ability to get cash for spending that results in low taxable income. This post explains how Social Security benefits are taxed and how you may be able to avoid tax.

== Tax bite depends on income ==

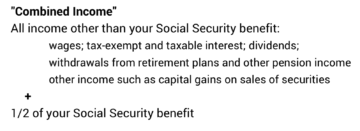

The calculation to figure the percentage of Social Security that is taxed is as clear as mud to me. This IRS worksheet is almost undecipherable. The percentage that is taxed is based on your “Combined Income,” which is a new term to me. Your “Combined Income” is the sum of income other than Social Security + ½ of your Social Security benefit.

Here’s how it works.

== Example: Pay yourself the wrong way ==

Sue is single and over age 65 but not 70½. She is not subject to RMD. She made the right decision to take Social Security early and will receive $25,000 in 2019; she receives about $1,950 per month after the Medicare Part B deduction. She has a nest egg. She calculates her Safe Spending Amount for 2020 is $30,000. She plans to get this all in cash by the end of this year and pay herself a monthly amount.

How will she get that $30,000 and what will she net after allowing for taxes? Sue decides to take half that ($15,000) from her retirement accounts and half ($15,000) will be the gross proceeds from the sale of shares in several mutual funds; her cost basis is 2/3 of this; her gain is 1/3 of this. She estimates the impact of this for her 2019 tax return. Here’s a summary of her 2019 return.

Sue will pay a total of just under $3,600 in taxes in 2019. She pays tax on 85% of her Social Security benefit because her Combined Income of $34,500 crossed the $34,000 trigger point.

The $3,600 in taxes will be a reduction from the gross $30,000 from her nest egg. Her net monthly pay in 2020 from her nest egg is about $2,200. Her net from Social Security will increase to $1,975 – the combination of 1.6% more for Cost of Living Adjustment and about $10 more/month for Medicare Part B deduction. Her total monthly paychecks will be about $4,175 for 2020.

== The cost of wrong ==

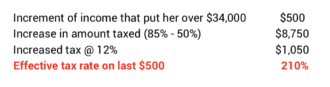

Sue crossed the threshold that triggered taxes on 85% of Social Security by $500. If she had $500 less income, she would have paid tax on 50%. The difference is $1,050 increased taxes on the added $500 of income: +200% tax rate!

== Example: Pay yourself the right way ==

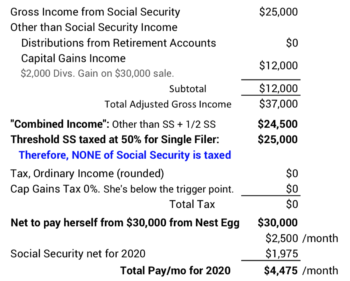

Sue decides to take the $30,000 from her nest egg as the gross proceeds from the sale of shares in a mutual fund and nothing from her retirement account. Here is what her 2019 tax return would look like:

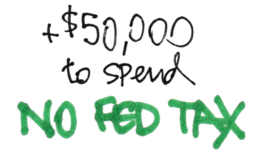

Wow. Sue pays NO TAXES to the IRS. She pays 0% on her Social Security: her Combined Income was less than the trigger point for 50% being taxed. Sue also pays 0% on her Capital Gains because she fell under the trigger point that kicks in the 15% tax rate. (No tax on capital gains if MAGI < $39,375.) Sue’s paying herself – her direct deposits into her checking account from SS and her nest egg – more than $53,000 in 2020 with NO TAX to the IRS.

Relative to the first alternative, Sue pays herself the $3,600 she does not pay to the IRS. Her total monthly pay increases by $300 per month. That’s more happiness, especially since that $300 per month comes out of the pocket of the IRS.

These tactics won’t work year after year. Sue will have to withdraw from her IRA for her spending, and she’ll eventually pay tax on 85% of her SS benefits: she eventually won’t won’t have enough in taxable securities as the low tax-cost source of cash for spending and she’ll have to withdraw more from her retirement accounts; she’ll also have to withdraw more when she is subject to RMD in a few years, and her Safe Spending Rate (SSR%) will increase over time resulting in greater withdrawals. But it’s the smart move not to pay the taxes that she can avoid now.

Conclusion: Some retirees – primarily those who are not subject to RMD – can pay themselves a significant amount from their nest egg and pay low taxes on their Social Security benefit. They may be able to plan taxable income such that they pay tax on either 0% or 50% of their Social Security benefit, not 85%. They can avoid several $1,000s in tax.