Part 1: Is your retirement portfolio at its peak value for the rest your life?

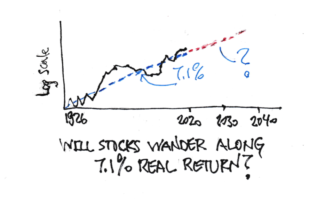

Last week I read this article “The Long-Term Forecast for US Stock Returns = 7.5%”. The article assumes 2.5% future inflation. That means the forecast translates to ~5% real return for stock vs. the historical average of ~7%. That’s 30% lower ((5-7)/7). I