Is it possible to mismanage a retirement portfolio any worse than Pennsylvania’s pension fund for teachers?

Posted on May 14, 2021

This article in the New York Times (FBI Asking Questions After a Pension Fund Aimed High and Fell Short) prompted me to look at the performance results for Pennsylvania’s Public Schools Employees’ Retirement System (PSERS) pension fund. What a mess, and I CANNOT BELIEVE the low, low investment returns of this pension fund relative to the performance of simple index funds recommended in Nest Egg Care (NEC). The fund may be HALF the size it should be if it had followed the basic portfolio that we nesteggers follow. This post compares the 10-year performance of PSERS to a simple portfolio of index funds. The miserable performance of PSERS and the impact on Pennsylvania tax payers and schools is a disgrace.

== $30 billion difference from equity returns? ==

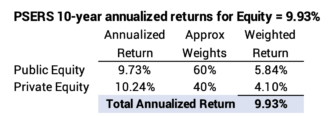

This link shows the performance of PSERS over the ten years ending June 30, 2020: The highlight of the components of the fund is the annualized 10-year return for equity of 9.93%. This is the combination of the 10-year returns for public equity and private equity.

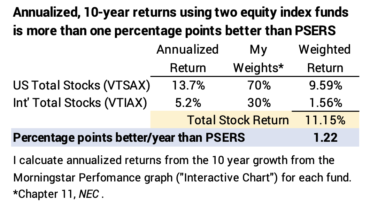

How does 9.9% compare to the portfolio recommended in Nest Egg Care? I show the results for US and International stock index funds for the same 10-year period. (Patti and I own FSKAX, which is basically the same as VTSAX, but does not have the same 10-year record to compare; and we own VXUS, which is the ETF of VTIAX.) I use the weights for US and International that I recommend in Chapter 11, NEC. The annualized return is 11.2%. That’s from just taking what the market gave. That’s more than one percentage point better than PSERS.

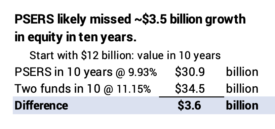

What does that difference translate to dollar return? The June 2010 statement for PSERS says it had $12 billion in public equity – publically traded securities; that’s out of the total of $26 billion in total equity. The 1.2 percentage point difference cumulates in a decade to a difference of about $3.5 billion. (I’m glad I didn’t start with the total $26 billion that underperformed!!!)

== Who pays the cost? ==

The pension fund is a defined benefit plan. Its obligations to retirees have to be paid from the contributions of current employees and from the growth of the pension fund over time. Because of the poor performance, $ billions have to come from revenues that schools would otherwise use to better education. The plan now requires current teachers to contribute at least 8% of gross pay to PSERS and requires school districts to contribute more than 34% of each employee’s gross pay. A total of 42% of employee pay goes to PSERS. And employee costs are about 70% of school spending.

Where does that money come from? Taxpayers. That high 8% employee contribution likely results in greater teacher pay, since that is a big bite out of take-home pay. The higher pay and 34% school district contribution is largely paid by local property taxes, and our property taxes are near highest in the US.

== Your annual “pay” would be $375,000? ==

Can you imagine how well off you’d be if your employer had contributed 34% of your pay to your 401k pension plan year after year? YEOW. It’s almost unbelievable:

I’ll inflation-adjust $60,000 in today’s pay; that’s close to the average teacher salary here. That would have been about than $25,000 in 1985. A 34% contribution by an employer would have been $7,500. It’s easy to look back and see how much that would have grown with a simple portfolio of index funds. I take that snapshot every January, and my contribution to my IRA in 1985 grew 50 TIMES by the start of this year: $7,500 contributed would be $350,000 to spend in 2021. And I would have had a similar amount – in the ballpark of $375,000 – in prior years and in future years! From a salary of no greater than $60,000 a year!!!

Conclusion: A New York Times article this week states that the FBI is investigating the Pennsylvania Public Schools Employees’ Retirement System (PSERS) plan. I looked at the performance of the pension fund, and it’s hard to imagine WORSE performance. Returns for equity investments lag a simple stock portfolio by almost nine percentage points per year. I don’t think ANY of the 3,600 stock mutual funds that exist today managed to underperform the market that much. This miserable performance by PSERs is a HUGE drain on current teachers, schools, children and Pennsylvania taxpayers.