Monthly Older Posts: February 2018

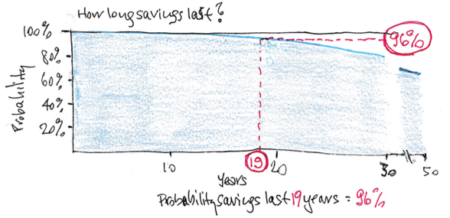

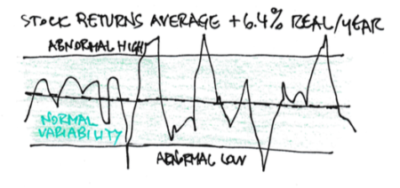

Vanguard improves their Retirement Withdrawal Calculator. A lot.

Vanguard recently improved its display(s) of results of their Retirement nest egg calculator – their Retirement Withdrawal Calculator (RWC). I describe RWCs in Nest Egg Care (Chapter 2 and Appendix C), but here is a separate description. I rely on two key RWCs in Nest

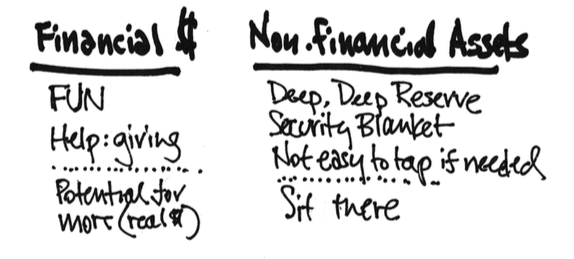

Why am I pouring my FUN MONEY into a non-productive asset?

What’s it all about now that we are retired? Enjoying More, NOW and helping others to Enjoy More, NOW. Why would we spend money on something that subtracts from what we could ENJOY?

Every year at this time I ask the question when two