Do you have check writing for your retirement account?

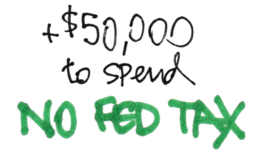

If you are over 70½ you want to make contributions from your retirement accounts using QCD – Qualified Charitable Distributions. I wrote about this a year ago. You get the full tax benefit of donations when you make them from your retirement account. You