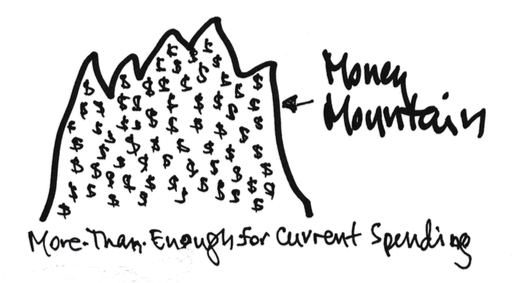

Tell me again: why do Patti and Tom have this mountain of cash that is More-Than-Enough for current spending?

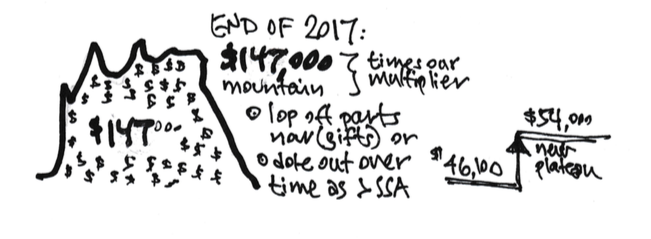

In our Recalculation the first week of December, Patti and I found that we had far more than enough to support our current spending. A small mountain of cash: +$147,000 per $1 Million starting Investment Portfolio (December 2014). And a calculation of a new Safe