Monthly Older Posts: May 2019

Would you rent your furnace for $36 per month? I did.

I now have made two monthly payments that are, in effect, rent on our new furnace installed right at the end of last December. As I mentioned in this post, I decided not to use our financial assets to invest into non-financial assets. This

Why do investors pay fund and advisor fees that make no sense?

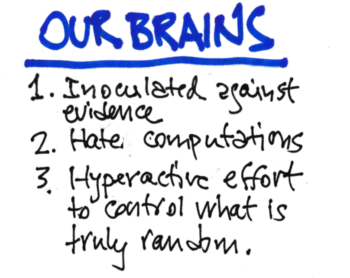

The last post said you will be a successful investor – almost certainly better than the 94th percentile of investors over time – by investing solely in Index funds. But very few individual investors do this. This post examines why they don’t simply stick