Why do investors pay fund and advisor fees that make no sense?

Posted on May 10, 2019

The last post said you will be a successful investor – almost certainly better than the 94th percentile of investors over time – by investing solely in Index funds. But very few individual investors do this. This post examines why they don’t simply stick with Index funds. Basic answer: our brains are wired to make bad investing decisions.

Here’s a longer answer: folks pay high, totally unnecessary fees for three main reasons.

1. Our brains are inoculated against the evidence that simple, low cost Index funds are clearly the path to investment success. Our brains form incorrect beliefs about investing and damn the evidence that tells us those beliefs are incorrect.

2. It also takes effort – using the thinking, computational part of our brain – to understand the evidence. Worse, no one makes it easier for us to understand the evidence – what we are paying each year on our investment portfolio is an example. It takes too much work to find and process the evidence.

3. We are driven to act to control an uncertain future. We know market returns will vary. The evidence is that we retirees should set our portfolio of stocks and bonds with just a very few mutual funds or ETFs (I have four that own almost all the securities in the world.) and stick with that for the rest of our life. Our brains think that is not enough. We feel much better with a portfolio that appears more complex and sophisticated, and then we want to fiddle with it to reinforce a sense of control.

As a result, our brains are willing to pay high costs for Actively Managed funds + Financial advisors despite the evidence that it makes NO SENSE.

(I credit this book and this book for helping me understand why our brains don’t follow evidence. This is also discussed, but less clearly, here.)

== The quick logic and evidence ==

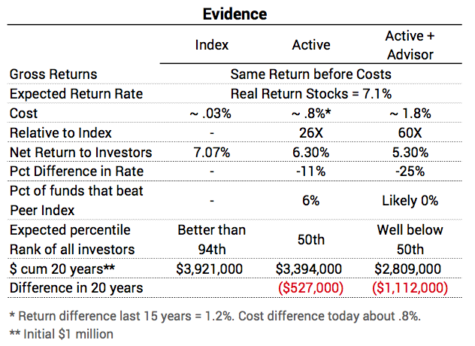

Actively Managed and Index funds must have the same returns in aggregate before consideration of Investing Costs: that’s a mathematical certainty. The difference then is that Actively Manage funds will return, in aggregate, less to their investors by the amount of greater costs they charge investors. The cost difference now is about .8% per year. (This cost difference was greater in the past, and over the last 15 years the average Actively Managed fund underperformed by 1.2% per year.)

While some Actively Managed funds in some years can overcome their cost disadvantage, we investors have no reason to base our financial plan assuming that we or anyone else can pick the funds that will outperform. We retirees, in particular, need to build a financial retirement plan based on accepting market returns (at some small cost) and not on the assumption we can beat returns.

Since stocks return about 7% real return on average that .8% difference compounds to a LOT less from Actively Managed funds than from Index funds: $10,000s if not $100,000s over time. Those who pay an advisor, say an added 1%, are really throwing money in a hole.

== Here’s my imagined internal dialog ==

1. Our human brains tell us we’re smart and above average. “I’m above average. I perform better than average in everything I’ve set my mind to. Heck, that’s why I have a nest egg now and most folks don’t. NO WAY can I settle for just targeting to just earn the average that stock and bond returns give to all investors. If I invest in Index Funds I’m guaranteed to NEVER EVER beat the market. That concept is for those average folks. NOT ME. I can do better than that.

2. Our brains tell us we can figure out what to do to control an uncertain future. “This investing game is uncertain and really important now that I’m retired. I DON’T WANT TO RUN OUT OF MONEY. Something this important requires me to figure out a solution or to hire someone who is really good at this. It just CANNOT be as simple as investing in just a few Index funds – even if they hold pieces of all the stocks and bonds in the world. That leaves me at the mercy of market ups and downs: that’s just not right! I can control the ups and downs by my investing strategy. I can smooth out annual variability for both stocks and for bonds. I need to hold a lot of mutual funds. Every year or so I need to add good funds and drop the laggards. I need to increase and decrease my investment in individual funds based on their performance. It’s complex, but I can control this tiger!

3. Our brains assign skill to those we judge to be above average. “It’s complex to figure out how to be above average in this investing game. I need help. Maybe I can develop my own method to sort out the best funds or stocks. I’ll subscribe to services that provide recommendations or provide a lot of performance data that I can sift through. I even think this is fun to do.

“Maybe I just don’t have the time for that. My skill is that I can pick out other people who are above-average performers. That confident, friendly financial advisor I’ve chosen exudes Above Average. I can tell he’s (she’s) smart. Really smart. I can tell he’s a hard worker. The company’s offices looked great to me: quality folks all around. Those monthly reports I get are full of detail. I have quite a long list of funds that I own, and I’ve never heard of many of these mutual fund companies. My guy has really researched and picked the best funds from boutique firms for me. I feel that I’m in an exclusive club. It’s amazing that my advisor is able to follow all this. He must be spending a lot of time looking out for me.”

4. Once we’ve made a decision and formed a belief, we can’t easily step back to question that decision. “I trust that I or my guy can pick winning mutual funds even though my guy didn’t really tell me he could beat the market. Now that I’ve made the decision to buy a fund or pick my guy, I know that was the correct decision. I’m sticking with these decisions. To change is to admit that I made a mistake – paying far too much over the years – and I didn’t make a mistake. Besides that, a discussion with my financial advisor about not using him in the future is too uncomfortable for me.”

5. We don’t engage the computational part of our brain to figure out what we pay. “I have no clear idea of what I’m paying the financial industry – fund plus advisor fees – in total. I can’t find a summary of what I pay on the statements I receive from my broker: I don’t see the Expense Ratio that I pay for each fund I own; I don’t find the addition of all costs I pay in a year. My financial advisor said his fees were competitive, so I think I’m getting a good deal since I know he’s better than others I’ve met.”

6. We don’t engage the computational part of our brain to see how well we are doing relative to a benchmark using Index funds. “I can tell I’m doing just fine. The market was up in 2017 by quite a bit and my portfolio also was up by quite a bit. I was down in calendar 2018, but so was just about everyone. I’m doing great so far this year. I’m not bothered that my brokerage statement does not show how I do for my mix of stocks vs. bonds and my weights of US vs. International relative to a similar portfolio that uses those average-performing Index funds. Heck, I can’t really find my mix of stocks vs. bonds and US vs. International on my brokerage statement.”

Conclusion. To make the correct decisions for our retirement financial plan, we should realize that our default process is to make decisions based on intuition and emotion. We don’t use evidence and the computational part of our brain to guide our decisions. We have a drive to act to control the future that leads us to complexity and cost in our financial retirement plan. Understand these three tendencies, I think it is easier to dig for evidence and use evidence to guide your decisions and beliefs. The evidence says to ONLY invest in Index funds for your retirement financial plan.