Monthly Older Posts: November 2018

What are Time-Weighted Returns and Money-Weighted Returns?

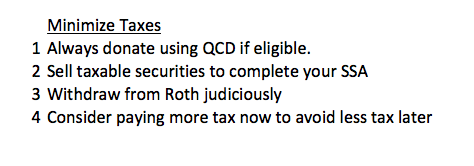

Patti and I follow the CORE in Nest Egg Care (NEC). We Recalculate annually to see if our Safe Spending Amount (SSA) can increase by more than inflation. (I recommend you Recalculate at least every three years; see Part 3, NEC.) Patti and I

I helped Alice with her year-end tasks this week

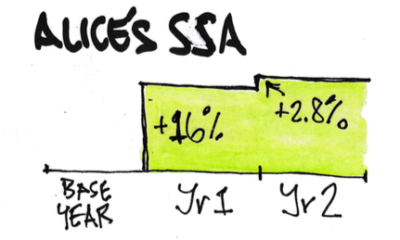

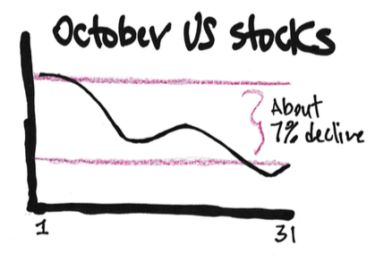

Alice’s Recalculation date is October 31 (see Nest Egg Care, Part 3). She follows the CORE and recalculates each year. Returns in 2017 were terrific, and Alice’s Safe Spending Amount (SSA) calculated as +16% last year – well above the 2% inflation rate. Returns