What do I do to minimize taxes and keep more for us?

Posted on November 16, 2018

Our Safe Spending Amount (SSA) is the pretax amount we can withdraw and spend from our nest egg that ensures we have zero probability of depleting our portfolio for the number of years we have selected. Nest Eggers always take their full SSA. Patti and I both now must take RMD, but we still we have to find other sources to get to our total SSA. This post describes the steps I take to spend less in taxes so that we keep more to enjoy. I’m basing our actions on the current structure of federal income tax rates; I’m not going to guess if, when, or how they might change in the future.

Here’s my summary: I always take one simple step that will always lower taxes we pay: donate using QCD. I’ll spend more effort to “manage our taxable income” if I think I can avoid passing a trip point that cuts the net we get to keep beyond that point: there’s a big one at high taxable income and a lot of smaller trip points along the way. Personally, I’m not going to sweat those smaller trip points unless I get far more energetic about the task of controlling taxable income.

==== Too many trip points ====

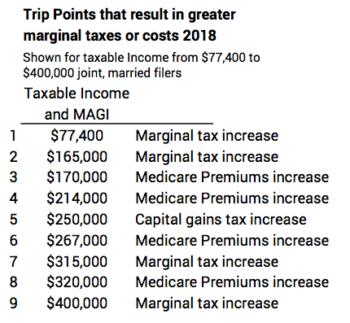

This table below (more detail here) shows quite a few trip points that lower the amount we get to keep as our taxable income increases. I count nine trip points between $77,400 to $400,000 of taxable income for Patti and me (filing joint, married).

That’s too many trip points for me to track and worry about: most of them have relatively small effect on the amount we get to keep. I’m going to focus on the big changes that can come from increases in tax from marginal rate increases in Federal income tax. I am not going to work very hard to avoid the trip points on Medicare premiums or capital gains taxes. The exception might be the two trip points close to each other at about the $250,000 mark. Of course, if I know I’ll be well below that $250,000, for example, I don’t have much of a task to try to manage our taxable income.

==== Try not to fall off a ledge ====

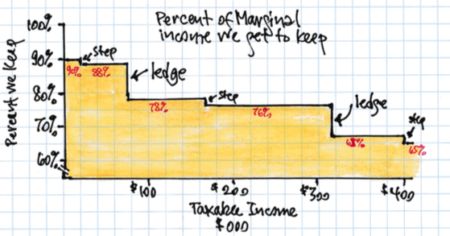

I like to display the current income tax table in terms of how much we keep at different levels of taxable income rather than the marginal tax rates we pay. In the graph you see two ledges where we keep much less of the marginal income that goes past a ledge. In between the two ledges we see a long run of income with a small step down in the percentage of income that we get to keep.

The first big ledge is at $77,400 (joint married; $38,700 for single filers). That’s an immediate ten-percentage point reduction in the amount we keep of income after that ledge. For discussions here, I’m assuming we all are beyond that ledge.

Then we have a long run from $77,400 to $315,000 ($38,700 to $157,000 for single filers) – over $235,000 of taxable income – with just a small step down at about 35% along the way. Patti and I get to keep 78% before that step or 76% after. The difference is 2.6% less that we keep. I’m not going to obsess over the 2.6%. Or, really those other trip points along that run. I’ll let the chips fall where they may unless I get really energic and precise in controlling taxable income. .

The second big ledge is far out there at $315,000 ($157,500 for single filers); Patti and I get to keep 8 percentage points less of the income that goes over that ledge. That’s so far out that most all of us won’t ever cross it. We don’t have to do anything special to avoid it. But if I ever thought I’d get close to that ledge – and perhaps other trip points – I would want to “manage our taxable income” to avoid crossing that ledge. How might I do that?

==== Act to lower taxes you pay ====

We all can act to avoid or lessen taxes and the chances that we’ll ever have income that falls over that big ledge at $315,000 or other trip points you might select.

1. Always use QCD for donations if you are eligible – over 70½. I explain the benefits here. You always get a full deduction from income and therefore full benefit of lower taxes with donations from QCD. That almost certainly is not the case now if we stick with the option we’ve used for donations used for years: submitting them as part of itemized deductions: stanadard deduction before you get the benefit of itemized deductions is much higher now.

You have an added potential benefit when you use QCD. QCD is not included in Adjusted Gross Income (AGI) or Modified Adjusted Gross Income (MAGI).* You may avoid crossing a trip point that is calculated on the basis of MAGI: added payments for Medicare premiums or for higher capital gains taxes. The mechanics to donate using QCD are not simple for me, but in our case we’re lowering our income taxes by a couple of $1,000 by using QCD. It’s worth the extra effort.

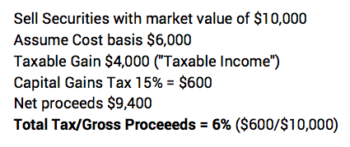

2. Net the most from sales of securities from your Taxable account by selling your highest cost shares first. Selling securities from your taxable account will always net more than the alternative of withdrawing more from your Traditional IRA retirement accounts and record far less taxable income. (See below). You can even do better. Choose to sell specific, higher cost shares, and this results in lower taxable income and lower capital gains taxes now. (You’re actually deferring to a larger tax bite later when you must sell the lower cost shares.)

3. Judiciously withdraw from your Roth account for your spending. (Note: at this point Patti and I do not have Roth retirement accounts.) In my opinion, you want to use your withdrawals from any Roth funds you have to avoid a higher marginal tax bracket or perhaps other trip point you can avoid. I think many folks don’t think this one through correctly. I explain the differences in the benefits of Roth vs. Traditional IRAs here.

It’s appealing to think that you should use Roth first – and not sell taxable securities for your spending – since it’s a “tax free” distribution or withdrawal. It’s tax free now because you previously paid tax at a marginal rate to get the money to put in a Roth account. Roth benefits you, relative to your Traditional IRA, if you withdraw to avoid paying a greater marginal tax than you originally paid.

Here’s the error that some fail to avoid. Let’s assume you paid a 25% marginal tax to get the money you put into a Roth. You now don’t want to withdraw funds from your Roth account to avoid, for example, paying taxes on withdrawals from your Traditional IRA in the 12% marginal tax bracket (for a portion of your first $77,400 of taxable income). If you do this, you have immediately “lost” 13% of the amount of Roth you withdraw relative to using money from your Traditional IRA.

Again, if you paid 25% marginal tax to get the money to put into your Roth, you don’t want to use Roth to avoid paying 22% or 24% marginal tax. Again, you’re really losing money on the Roth relative to using the money in your Traditional IRA.

4. Consider paying more in tax now to avoid a greater marginal tax bracket later. I discussed this in the same post as above. In my view this would be an obvious consideration for someone who thinks they may at some point cross that $315,000 line but is in a relatively low marginal tax bracket now.

A good example is my friend, Jay. He’s 66. He may retire soon. His earned income will fall dramatically. He has a very significant retirement account. He foresees that he could cross that $315,000 ledge in the future. He has the potential to withdraw the same amont for spending over time but spend less total tax. His strategy would be to convert a portion of his current IRA to a Roth account. He’d incur (we’ll assume) a 22% tax now. He’ll withdraw from his Roth later to avoid recording income that would result in crossing the $315,000 line. He would immediately “make” about 14% on the amount he converts.

Conclusion: Act to lower your taxes. You have one simple task that almost certainly lowers your tax bill: use QCD for donations if you are eligible.

Selling securities from our taxable account is a low cost way to get cash for your Safe Spending Amount (SSA) – or to get to the balance you need if you have to take RMD. You can do better if you sell specific, higher cost shares.

I would use money you have in Roth accounts judiciously to tactically avoid hitting trip points triggered by increased taxable income.

It takes more work to control your taxable income to avoid sharp increases in marginal income tax or other trip points. I would work hard on this task if I ever thought Patti and I would record taxable income more than $315,000 ($157,000 for single filers). I might get more energic on two trip points near $250,000 of income: I’d sweat the details of paying more tax now to avoid a greater marginal tax later. I’d convert Traditional to Roth.

* AGI is the income calculated at the bottom of page 1 of your 1040 return. MAGI adds back some deductions that were used to calculate AGI. For most all retirees AGI = MAGI. Taxable Income is AGI less deductions, such as the standard deduction of $26,600 for joint filers, married and both over age 65 in 2018.