Monthly Older Posts: January 2021

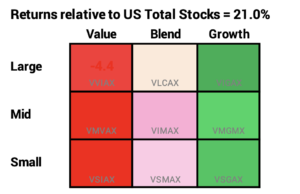

What segments of US stocks outperformed in 2020?

I like looking at the Vanguard Style Box (I call it a Nine Box.) at the end of the year to get a snapshot of what outperformed and what underperformed the US stock market as a whole. This post shows 2020 results. Large-Cap Growth again