What taxes will you pay in 2021?

Posted on January 23, 2021

I added a January task to my annual work plan for our financial retirement plan. I display in this post the information I gathered on 1) 2021 tax brackets for Ordinary Income and 2) important income tripwires on a 2021 tax return that can be very expensive: cross a tripwire by $1 of too much income and your taxes – in effect – increase dramatically.

This information is more important for us retirees in the spend and invest phase of life. We have some degree of control over the taxes we pay each year unlike most folks in the save and invest phase of life. We get our cash to spend by selling securities from different kinds of accounts, each with a different impact on taxes we pay. And we have an ugly set of tripwires that younger folks don’t have. I’ll take my first cut at my decisions that will determine my taxes for 2021 in August. You can see my thinking last August here.

== Tax brackets for 2021 ==

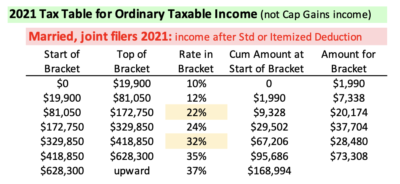

I show the tax brackets for Ordinary Income for Married, Joint filers and a Single filer for 2021. The brackets adjust for inflation each year. That means in real terms, they are unchanged. (You also have income subject to Capital Gains Taxes, generally taxed at 15%; the point where that 15% rate kicks in increased slightly for 2021.)

I highlight two brackets with big increases in marginal tax rate. You get to keep more – pay less tax – if you can plan the sources of your Safe Spending Amount (SSA, Chapter 2, Nest Egg Care) to stay in a lower tax bracket now and in the future. Two brackets have big jumps in marginal tax, meaning you get to keep more if you can manage to not cross into those higher tax brackets: the ten percentage-point jump from the 12% bracket to the 22% bracket or the eight percentage-point jump from the 24% bracket to the 32% bracket.

== Medicare Tripwires ==

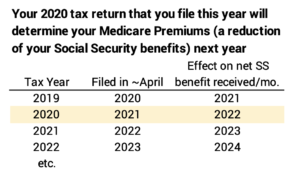

Tripwires are sneaky and important: cross a tripwire by $1 and your tax – in effect – jumps by a BIG amount. I want to be careful if I ever get close to a Medicare Premium tripwire that I could otherwise avoid. I show the tripwires for Married, Joint files and a Single filer here.

As an example, if Joint, Married filers accidentally cross a tripwire from too much income that they could otherwise avoid, they could see their Medicare Premiums increase by as much as $2,600 – they could lose more than $200/month in Social Security benefits because of $1 of too much income! Here’s more detail.

The tripwires that trigger much greater Medicare Premiums in the future did not adjust for inflation this year and that means they are really closer than they were before. The penalty when you cross a tripwire increased roughly in line with inflation, though.

Your MAGI – modified adjusted gross income – determines if you cross a tripwire that results in higher Medicare Premiums. For most all of us retirees MAGI is the same as Adjusted Gross Income (AGI): the sum of Ordinary Income and income taxed at Capital Gains tax rates before your Standard or Itemized deductions. That’s line 8b on your 1040 tax return.

There is a lag in effect as to when you incur higher Medicare Premiums as a result of the MAGI on your tax return: for example, you will file your 2020 return in April this year; your MAGI on this return will determine the added monthly Premiums, if any, that you pay throughout calendar 2022. That’s when you’d see lower monthly Social Security benefits.

Conclusion: I added a routine task in January for my retirement financial planning. I enclose in this post the tax brackets for Ordinary Income for 2021. I also enclose the tripwires of income that could result in a big increase in Medicare Premiums, a deduction in the monthly Social Security benefits that Patti and I receive. I’ll refer back to these two tables when I take my first cut of our 2021 tax plan in early August.