Have you started on your tax planning for 2020?

Posted on August 7, 2020

I spent some time this week planning for 1) where Patti and I will get our Safe Spending Amount for 2021 (SSA; see Nest Egg Care (NEC), Chapter 2) and 2) how much we will pay in total tax in 2020. I subtract 2) from 1) and get the net amount we can spend from our nest egg in 2021. I liked doing this now, well before I have to make final decisions in early December. This post simple describes what I did this week, and I provide a copy of the spreadsheet I used that may be of some help to you.

The task is pretty straightforward, especially in the earlier years of your plan, but a spreadsheet helps to finalize the details. I wrote a post on tax planning about six months ago, but I think this post and its spreadsheet are clearer.

== The BIG STEPS ==

Step 1. I have to estimate the gross amount – the amount before taxes – that I will withdraw in early December as our SSA-spending for 2021. That amount is the gross proceeds of securities I will sell.

Step 2. I estimate the total taxes I will pay in 2020; I’ve paid some using EFTPS for the first three quarters, because we don’t have Social Security withhold taxes; I subtract those payments and then know much to withhold in the withdrawal from our Traditional IRA I’ll take in December.

Result: I know how much cash, net of all taxes, Patti and I will have for our spending in 2021. I’ll disburse the amount out as monthly “paychecks” – automatic transfers – to our checking account.

== The smaller steps ==

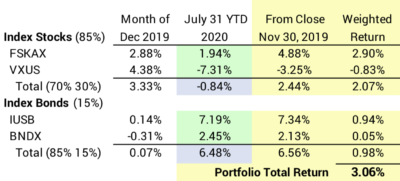

1. Estimate our SSA that I’ll withdraw from our Investment Portfolio in December. I made this simple at this time. I just used the same gross amount that I calculated for 2020, $57,500 per $1 million relative to our starting portfolio in December 2014. I set a multiplier at the start of our plan – our initial Investment Portfolio divided by $1 million – that I use each year to get to our total SSA. (See Chapter 1, NEC.)

I’ll be more accurate in December. This surprises me: we could have a real increase in our SSA for 2021. Our portfolio return for the eight months is on track for a real increase. I only need about a one percent real return our portfolio this year to justify a real increase.

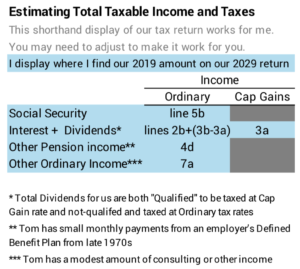

2. Estimate Social Security and other income. I need to estimate Social Security (SS) and other items of taxable income to make sure my final estimate of taxes to be withheld for the year is correct. I refer to my 2019 tax return. I increased SS by 2%, roughly increase from 2019. I use the exact other amounts from our 2019 return. Those other items are small for us and don’t change much.

I need to track the two kinds of income: 1) ordinary income – that’s primarily Social Security – and 2) income taxed a capital gains rates – “qualified dividends” on securities in our taxable account. (My brokerage tax reporting statement shows that I also have dividends that are not “qualified”, meaning they are taxed as Ordinary Income.) Ordinary income is subject to tax at marginal tax rates that run from 0% to 37%. For most of us, long term capital gains income is taxed at 15%.

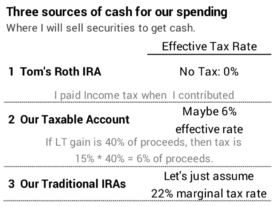

3. Decide on the sources for our gross SSA withdrawal. The biggest part of our taxable income – and taxes – are from the sources of our SSA. I sell securities for our SSA in the first week of December each year and our total taxes for the year depends as to where I sell them.

I have three basic sources: 1) sell securities and withdraw from our in our Traditional IRA(s), 2) sell securities in our taxable account; 2) sell securities and withdraw from my Roth IRA (Patti does not have a Roth IRA.). I just listed those in order of amount in our portfolio, but I always arrange these three sources in my head from lowest tax cost to highest tax cost. I keep these three numbers in mind: 0%, 6%, and 22%.

I’ll always minimize taxes if I take my withdrawals in that order. In general, that’s exactly what you do. In general, you want to minimize taxes at the start of your plan, since your SSR% and your SSA will be lowest then: you want to net a greater percent after taxes for spending. You should be less concerned about greater taxes later because, unless you ride a MOST HORRIBLE sequence of financial returns, your SSA will increase in real spending power. SSA for Patti and me has increased by 22% in real spending power in the first five years of our plan.

== My order of sources is constrained ==

Patti and I are both over age 70½. We must first withdraw from our Traditional retirement accounts. (The CARES act waives RMD for 2020, but I don’t see an advantage of not withdrawing from our IRAs this year.)

(I ignore the wrinkle of Qualified Charitable Distributions or QCD for this post. If you are over age 70½ and wish to make charitable donations, you are best to donate directly from your Traditional IRA. You gain the tax benefit of the donation in addition to your Standard Deduction.) There is no limit to QCD this year, again due to the CARES act.

== I don’t absolutely minimize current taxes ==

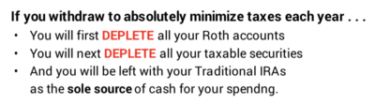

Once we’ve taken our RMD in a normal year, I logically should take the balance first from Tom’s Roth IRA and then from sales of securities from our taxable account. That would give us the lowest possible tax bill every year. But I don’t ABSOLUTELY minimize current taxes each year.

Why not? If you carry the steps minimize taxes every year to its logical end, you first DEPLETE your Roth IRA(s), then you DEPLETE your taxable securities, and you are left in you later years with your Traditional IRAs as your only source of spending.

Patti and I have been depleting our lowest tax cost sources faster than our highest cost source. We started our plan with most of our Investment Portfolio in our retirement accounts. We’ve withdrawing from our nest egg for a number of years, and in the early years – before age 70½ – I resisted withdrawing from our Traditional IRAs.

I decided that I do not want to deplete by Roth + Taxable securities. Maybe I’ll rethink that in a few years. I set a rough target of no less than two years of spending in those two low-tax cost sources. If I used those two sources for our spending for 2021 – not taking anything from our Traditional IRAs – I can see that I could dwindle to that level pretty quickly. I therefore typically withdraw more than RMD from our Traditional IRAs for our spending. I don’t pay the minimum taxes that I could.

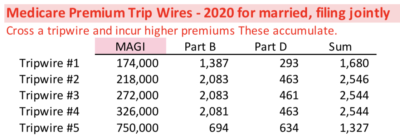

I particularly value my Roth. I already paid income tax on the amount I contributed. I want to get the best tax benefit when I use it for our spending. The painful tax – or cost – Patti and I could incur is a tripwire that increases Medicare Premiums; these are deducted from our gross Social Security benefit; if we stumble across a tripwire by $1, we could incur more than added $2,500 cost – lower net payment from Social Security in a year. That would be a VERY EXPENSIVE $1 of income.

The tax rates that trip added premiums for a single taxpayer is half these shown in this table; when one of us dies, the other very likely could cross a tripwire.

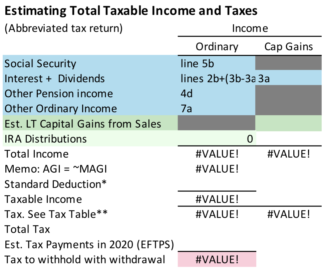

4. Enter taxable income and calculate tax to be withheld for the year. I enter all the withdrawals from our Traditional IRAs as ordinary income. I estimate the capital gain on sales of securities in our Taxable account. The spreadsheet adds to total ordinary Income and income taxed as long-term capital gain. I can use the 2020 tax table for find ordinary tax, and I multiply capital gains income by 15%. I add those two to total 2020 taxes

I add our first three quarters of estimated payments that we will make. (We each could have SS withhold taxes, but we don’t.) I subtract that from the total and find the net I have to withhold in the December from the gross withdrawals from our Traditional retirement accounts. Final Result: I have a good estimate now of the cash we’ll have for our spending in 2021.

Conclusion: I made a stab at our tax plan for 2020. I first estimated our Safe Spending Amount for 2021; at this time I just kept it the same as this year’s, even though looks like it could be more. I therefore have a pretty good estimate of what I need to sell – gross sales proceeds = SSA – the first week of December.

I figured out where I would sell: my Roth account (0% tax); our taxable account (roughly 6% effective tax); or our Traditional IRAs (let’s assume 22% marginal tax.) I can then estimate total tax for the year and the amount I will withhold from our gross distribution from our IRAs the first week of December.

Result: I have a pretty good handle on the net amount of cash we’ll have at the end of December that I’ll pay to our checking account throughout 2021. I’ll refine all this in the first week of December.