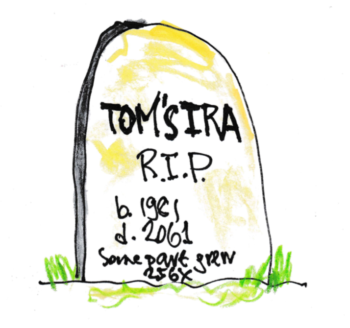

Will your heirs get $thousands less from your inherited IRA?

A possible change in tax law would require heirs of our IRA to fully distribute them over fewer years. The change, described here, (“… It Could cost Your Kids Thousands.”) would require that our IRAs be fully distributed within ten years of our death.