Monthly Older Posts: July 2021

How do Fidelity index funds compare to Vanguard’s?

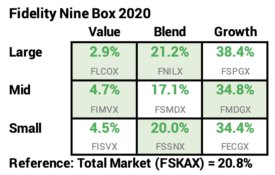

Every January, I complete the Morningstar nine-box display of returns for segments of the market: the box is a matrix of annual returns by company size category (Large, Mid or Small Cap) and investment style (Value, Blend, or Growth). I did not realize that Fidelity

Part 2: Is your retirement portfolio at its peak value for the rest your life?

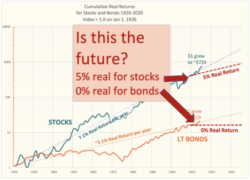

Two weeks ago I read this article “The Long-Term Forecast for US Stock Returns = 7.5%”. When I adjust for the assumption for inflation, the article forecasts a ~5% real annual return for stocks vs. the historical average of ~7%. That’s 30% lower