Monthly Older Posts: July 2022

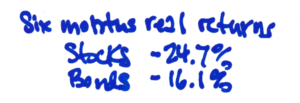

Where might this year rank in returns?

I don’t need to tell you: stocks have nosedived. Bonds usually work as insurance, meaning their returns have averaged 27 percentage points better than stocks when stocks crater. Bonds clearly aren’t providing their historical value: they’ve nosedived, too, and are only 8 percentage points better

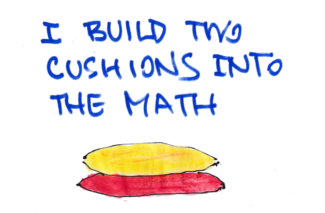

How much should you pay yourself from your nest egg?

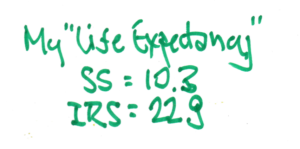

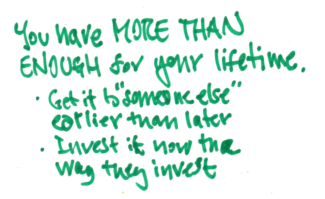

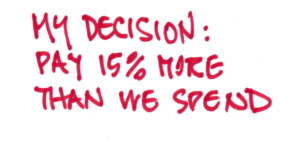

Last week I described that Patti and I fall in the category of having More Than Enough that I describe in Chapter 10 of Nest Egg Care (NEC). Our current portfolio value supports a Safe Spending Amount (SSA; Chapter 2) that means our