How much should you pay yourself from your nest egg?

Posted on July 1, 2022

Last week I described that Patti and I fall in the category of having More Than Enough that I describe in Chapter 10 of Nest Egg Care (NEC). Our current portfolio value supports a Safe Spending Amount (SSA; Chapter 2) that means our total pay is greater than our actual spending. Our planning focus is different than when we started our financial retirement plan: I can work from what we spend (described last week) to what we should pay ourselves (this week) to how much portfolio we need to have (next week). The purpose of this post is to give you my thoughts on that second step: how much we should pay ourselves from our next egg relative to our spending? I settle on total pay that is about 15% more than our spending.

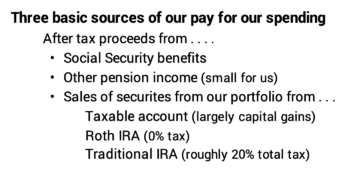

Total pay for Patti and me equals the after-tax proceeds of Social Security benefits and other pension income + the after-tax proceeds from the sales of securities from our nest egg that I distribute each month into our checking account.

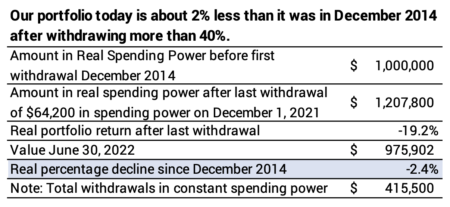

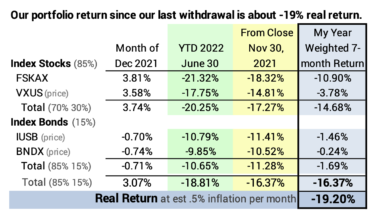

Even with the steep decline in our portfolio so far this year, Patti and I – and you most likely – remain in the category of having More Than Enough: for example, Patti and I have almost the same amount we had in December 2014. If you started you retirement plan and withdrawals later than we did, you have more now than in December 2014. (The historical data for this display is from the spreadsheet you can download in this blog.)

== Sloppy checkbook: $10,000 minimum balance ==

I wrote in this blog that I like to keep a sloppy checkbook. I want to have healthy checkbook balance. I formally decided this week that I want to target a minimum balance of $10,000, an amount that many would judge as too much.

I learned my lesson this year. I used some of the cash balance in our checking account to buy a $10,000 I-bond in May; the rest of the cash came from advanced pay from the cash I have set aside for our total pay for 2022 in our Fidelity investment account.

I found the effort to maintain a low cash balance was a hassle. I checking on our checking balance too often to make sure we’d have enough to fully pay our credit card statement that is debited on the 22nd of each month. I hate thinking I need to carry that thought around in my head. That is a tiny bit of stress I do not need. It’s much better for me if I keep a high checkbook balance.

I estimate that I might be giving up 6% annual return on the excess that others might be able to keep. (+6% is the expected real return rate for our mix of stocks and bonds.) That might mean I’m forgoing $40 or $50 per month in added return so I can avoid the hassle of thinking about not having enough to pay all our bills. That’s worth it to me.

== Total pay: 15% more than we spend ==

Does the 12-month total for spending I found last week really represent typical spending? I remembered that Patti used frequent flyer miles for our airline tickets for our upcoming trip to England in August. I adjusted the 12-month total to include the price of those tickets. We don’t have many miles left and we won’t be earning more any since I switched our credit card to 2% cash back.

I decided to pay ourselves 15% more than our average monthly spending. I think the lowest I would go is 10% more, so 15% is more on the sloppy – too much – side, but I’m happy with that.

My friend Steve does not pay a regular monthly amount from his nest egg. He is proud to say, “I only sell when I need money.” He’s passionate about keeping a bigger percentage of his total portfolio invested. I would not like that approach. I think it is constraining. I don’t think he and his wife spend their annual Safe Spending Amount. I don’t want to have to have a discussion with Patti on whether or not we can afford taking a trip and go through the anguish of judging whether or not it is a good time to sell – as in now, for example.

I like selling once in the year (the first week of December) and paying the total out monthly. I like the subtle pressure to think about enjoying and spending more. If Patti suggests we travel to visit our nephew and family in Seattle, I don’t want to hesitate. I want the money sitting in our checking account to pay for it.

The extra I pay means we likely will build an excess in our checking account toward the end of the year; that’s happened in most years. We then have the decision of 1) donating the excess; 2) giving it to heirs; or 3) using it, in effect, to lower spending for the next year; we’d do that by just applying it to next year’s target for spending. We’d sell fewer securities in the first week of December to get the cash we need for our spending in the upcoming year; this third option looks more probable this year than in any other year.

== What we need for 2023 and beyond ==

I now have a very good handle on the total cash I want to have in early December for our spending in 2023. I don’t think our spending pattern is going to change in the future. I’ll just have to adjust the amount for 2023 for inflation in the following years; I’ll similarly adjust the amount of securities we need to sell from our nest egg.

== My remaining task ==

My remaining task is to calculate how much portfolio value we need for the annual gross withdrawal from our nest egg. We’ll have an excess, and we need to decide what to do with it. I describe the basic calculation and options in Chapter 10, NEC, but I’ll discuss more of my thinking next week.

Conclusion: Patti and I fall in the category of having More Than Enough – greater portfolio value than we need for our spending: excellent stock returns are the primary reason. Our calculated Safe Spending Amount added to our Social Security and other income is more than we spend. I can start from what we spend, decide on what to pay ourselves, and then derive how much portfolio value we need and find the amount that is More Than Enough.

Last week I found out how much we spend in a year from our checkbook statement of spending: “Checks & Deductions”. I can then figure out how much I want to pay ourselves in the year. Patti and I are at the age where we DO NOT want to think about not having enough to enjoy. I want to pay ourselves MORE than we spend: I want the subtle pressure to spend to ENJOY MORE. I made two decisions. The minimum balance in our checking account should be $10,000. I decided that our total pay should be 15% more than what we spend.