Do you earn back enough on your credit card?

Posted on March 19, 2021

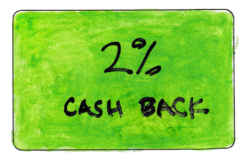

It can be really hard to figure out what you earn back on your credit card purchases. The purpose of this post is to say, “If you aren’t clearly getting 2% back as cash value on all purchases, it’s time to switch.”

== How much is a point or a mile worth? ==

We’ve held a credit card for many years that pays us “miles” that we could use to buy American Airline (AA) tickets. AA is a main airline from Pittsburgh. We get 1 mile per dollar spent for most purchases, 2 miles on hotels and car rental, and 3 miles when we pay for an AA ticket with our credit card. Patti loves this since she’d tell me we had a free ticket for some of our trips – even business class Pittsburgh to Manchester, England.

A year or so ago, I tried to figure out how much a mile was worth. I think I calculated we earned the equivalent of more than two percent back on our cash purchases. That was not an easy calculation. This can get very confusing.

• I had to make some assumptions on the mix of our spending – how many total miles did we earn over, say, six months so I had a handle on the average miles earned per dollar spent.

• I had to sort out how much dollar value we were getting per 1,000 miles when we applied them to a ticket, and the dollar value of 1,000 miles applied to a free or upgraded ticket is not a constant.

In a case or two, Patti used miles that translated to a value of $17/1000 miles, and I think that meant we were getting a bit more than two percent value back on our purchases.

The bottom line was that Patti had to be able to get $17 of value for each 1,000 miles used toward a ticket. If she didn’t get that value, we weren’t getting the equivalent of 2% cash back on use of our credit card.

== Going simple with 2% cash back ==

This all came home about a week ago when Patti was considering buying tickets from Pittsburgh to Rome for October. She proudly told me that my ticket AA ticket would be free if purchased it with miles. I reminded her that she had to figure out the dollar value we would get for miles redeemed. She has to do that calculation every time, and that’s a headache. I had to dig to remember the target of $17 of value per 1,000 miles redeemed. Another headache.

The bottom line was if she had purchased that ticket with miles, she would have earned A LOT LESS than $17 per 1,000 miles used. That meant we would earn a lot less than 2% back on our credit card purchases. She charged the ticket to our credit card.

The other headache is that we have to build up a bank of miles to have enough to be able to redeem them on a flight. And now that bank is large. We obviously didn’t travel and redeem any miles in 2020. We won’t use any on our two big flights in 2021. I can imagine that I’ll die with a small mountain of unused AA miles and wasted potential cash.

We bit the bullet: no more miles; no more calculation of how much value we’re getting for the miles we redeem for a ticket. Just cash back.

We now have a new primary credit card. We’ll stop using the AA card; I’ll eventually use up my accumulated AA miles. We get 2% cash back on all purchases from a card offered by Fidelity. At the end of each statement period, cash goes straight to our taxable account at Fidelity: more money to spend! At a different point in life, I could have directed the 2% to an IRA or to a 529 account; that would have been a great way to build up savings that grow tax free.

You have quite a few options for cash-back cards. A similar card from Charles Schwab is 1.5% cash back. This site is lists a number of other cash-back cards. Most have different cash-back percentages for various categories of purchases. Some of those look very confusing to me. The top rated one from Chase might be good for us, since most all our discretionary spending is travel. That five percent on travel – airline tickets, hotels, and rental cars purchased through Chase – is three percent more than with our Fidelity card. But even with the amount we travel, that card isn’t going to be better by than a couple of $100 more per year for us, because it is .5% less on everything else. Patti’s our travel purchaser; she’s used to dealing directly with airlines and the car rental companies. I’m not sure she’d like the Chase portal for purchases, but she’ll explore how it would work for us.

Conclusion: Most all of us earn points or miles on our credit card purchases. Patti and I have had a card for years that gave us miles we could use to buy American Airline tickets. It’s confusing to understand how to redeem them to get at least 2% value on our purchases. I concluded we don’t clearly get 2% value on the miles we earn. We’ll drop our current card and get a card that simply gives us 2% cash back at the end of every month. If you aren’t clearly getting the equivalent of 2% back, it’s time to change.