How big is your retirement pay raise for 2022?

Posted on December 3, 2021

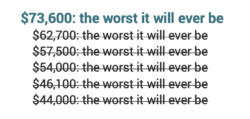

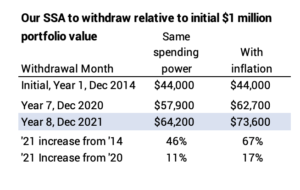

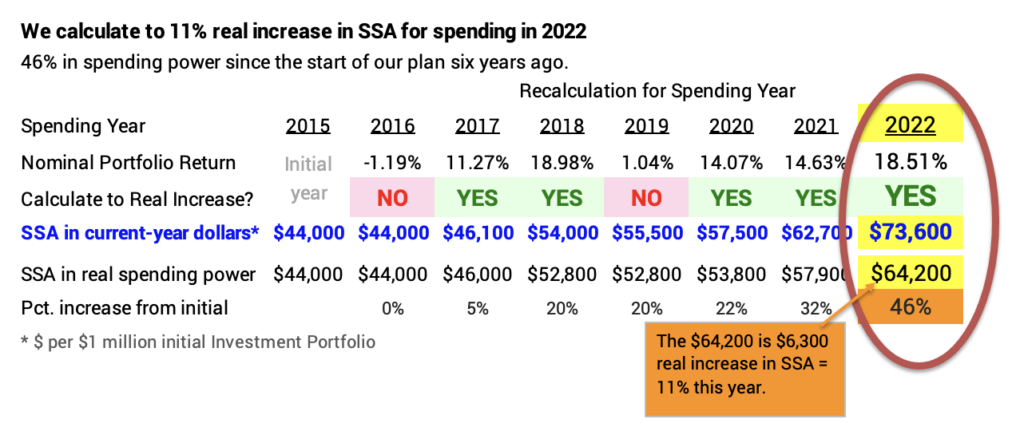

If you use November 30 to calculate your Safe Spending Amount (SSA) for the upcoming year, you AGAIN calculated to a healthy real increase for your spending in the upcoming year. Patti and I calculate to an 11% real increase for next year; our SSA has increased by 46% in spending power from the start of our plan (See Chapter 2, Nest Egg Care [NEC].) All nest eggers have a new “the worst it will ever be”. The purpose of this post is to provide a quick summary of my calculation to our 11% real increase in our SSA for 2022.

This year marks the fifth real increase in our SSA in the seven years that I’ve recalculated from start of our plan in December 2014.

I show details of our calculation for all years on my long-form spreadsheet. Here is the pdf. I also entered five data points in the short form spreadsheet that you can download; I tweaked this version from the one I provided last December 10. Use that short-form spreadsheet if you recalculate using the same 12-month period that I do. The spreadsheet has a hypothetical Multiplier to show how you get to your total SSA for 2022; you’d use your Multiplier that you set last December.

If you want more detail, I described the calculation steps and annotated my long form sheet in last year’s post. I also discuss the calculation steps in Chapter 9, NEC.

== I’ve almost completed my year end tasks ==

I sold securities to get the total that I’ll withdraw. Stocks dipped from right before Thanksgiving, so the task of selling did not feel good this year; I will never pick the perfect time to sell. I polished the cash and tax planning that I first drafted in August. After a couple of transactions settle, I will distribute/transfer money from our Traditional IRAs to our Taxable Account: our RMD less QCD + any other that I want to withdraw. I will withhold my estimated taxes for 2021 when I transfer. I rebalanced in our Traditional IRAs to get back to the proper percentages of the four securities we own. After we receive our December “paycheck” from last year’s SSA, I’ll change our Automatic Withdrawal schedule at Fidelity for the monthly paychecks to arrive in our checking account throughout 2022.

== Highlights ==

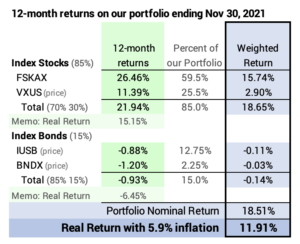

• Our nominal return rate for the year was 18.5%. With inflation near 6%, our real return rate was 11.9%. Our real return for stocks was 15.2% and -6.5% for bonds.

• Two factors led to 11% real increase in our SSA.

1. We earned back more than the 4.85% we withdrew for our SSA last year. The 11.9% real return on our portfolio means we have 7% more in real spending power this November 30 than we had before our withdrawal for our SSA last year. I therefore have More than Enough for our current SSA: that always leads to a real increase in SSA. (The alternative is that I could withdraw some of the More-than-Enough and not increase our SSA as much or at all.)

2. Because we recalculate to More than Enough, we can apply our greater, age-appropriate SSR% to our portfolio to calculate our SSA. In essence, we’ve ripped up the old plan that assumed the Most Horrible sequence of returns started December 1, 2020. We are starting the first year of a new plan that assumes the Most Horrible sequence of returns started a few days ago. Our age-appropriate SSR% on this plan is 5.05%, a 4% increase from the prior 4.85%.

The combination 7% greater portfolio value and the 4% greater SSR% leads to the 11% real increase in our SSA.

• Our SSA is 46% greater in real spending power than at the start of our plan. Our first SSA for 2015 was $44,000 per $1 million portfolio value. It’s $64,200 for 2022 in the same spending power. Inflation makes the nominal dollar amount $73,600 that I can pay out this next year.

• Our portfolio on November 30, before my withdrawal for 2022, is 27% more in real spending power than it was before our first withdrawal for spending in 2015. On the basis of a starting $1 million in December 2014, I’ve withdrawn $351,000 in spending power and have $272,000 more in spending power than I started with.

• I’ve recalculated seven years to see if our SSA could increase in real spending power. I’ve recalculated to a real increase in five years. Portfolio returns were poor in two years, and I only inflation-adjusted the prior SSA. Over those seven years, the real return on our portfolio averaged 8.6% per year, while our expected return for our mix of stocks vs. bonds is 6.4%. You’ve also had a very good last seven years – actually more than that.

I’m happy that returns have been good, but I’m really not trying for MORE. I JUST DON’T WANT TO RUN OUT OF MONEY. I’m happy when we’re not hit with a Really Bad year for stocks. Our worst year in the last seven, 2018, was just -1.7% real return for our portfolio; that’s a good year in my mind, because it wasn’t a Really Bad year. I hope we keep avoiding them, but the chances are that we will hit one sometime. The 46% real increase in our SSA means I have a low level of anxiety if we’re hit. It is very easy for Patti and me to lower our spending + gifts/donations; that’s a Big Boost to safety of our plan. We are not going to outlive our money.

Conclusion. I calculate our Safe Spending Amount for the upcoming year based on our 12-month returns ending November 30. All retirees who follow the steps in Nest Egg Care calculate to a healthy real increase in their SSA for 2022. Ours is +11%, and that’s +46% from the start of our plan eight years ago. This post shows the detail of our calculations and provides a spreadsheet that you could use to calculate your SSA for 2022.

I also used November 30th to calculate my 2022 withdrawals. After putting aside funds for taxes and increasing my emergency fund, we got a 10% pay increase! Sorry to see the end of year market decline, but that just means my starting point for next year is lower which could result in a bigger increase at the end of 2022! I’m an optimist! Have a merry Christmas and enjoy a more prosperous new year.

Hi Tom ===

Great! I think all who use that date found we had about a 10% real increase and with inflation about 16% in dollars.

Yes, that dip right before Nov 30 meant a little less for 2022, but the starting point for next year is therefore slightly lower.

I no longer set aside a reserve. I therefore use my total portfolio to calculate my SSA for 2022. I no longer use a Reserve since I discovered it is better to use a tactic of only selling bonds when stocks crater. See blog post on October 8, https://nesteggcare.com/is-this-a-better-rule-as-to-how-to-use-your-bond-insurance-for-your-spending/

That would mean your SSA for 2022 would be more than you calculated or just wait a year to make that change. If you still like to keep a Reserve for your mental health (a bit of belt and suspenders), that’s fine, too!!!

ENJOY 2022!!!

Best,

Tom