Have you started on your tax planning for 2021?

Posted on August 6, 2021

My tickler file tells me that this is the week to take my first draft cut on my tax plan for 2021. This post is to describes my steps. I get three things from this process: 1) a rough guess of our Safe Spending Amount for 2022 (SSA; see Nest Egg Care (NEC), Chapter 2); 2) an estimate total income and taxes for the year; 3) a good estimate of the net cash we will have by the end of December for our spending in 2022.

This is the second year that I’ve done this in August, and its getting easier to complete. I suggest that you spend a bit of time to sketch out your 2021 tax plan. This post is similar to my post this same week last year; I think I improved the spreadsheet you might use for your tax planning.

It’s the same steps as last year:

Step 1. Estimate our Safe Spending Amount for 2022.

Step 2. Decide where I will sell securities to get our total SSA into cash.

Step 3. Estimate our total taxes for 2021 based on those decisions.

Step 4. Calculate the net cash we’ll have this December for spending in 2022.

In this post I ignore the wrinkle of how I handle money left over at the end of the year – our current SSA that I have not fully spent or gifted by the end of the year. We donate what is left over. I don’t throw it back into our Investment Portfolio. The math wrinkle is that I take an added Qualified Charitable Distribution or QCD for the amount we will donate. (Patti and are over age 70½ eligible for QCD.) You should always donate using QCD if eligible. You gain the full tax benefit of your donations in addition to your Standard Deduction.

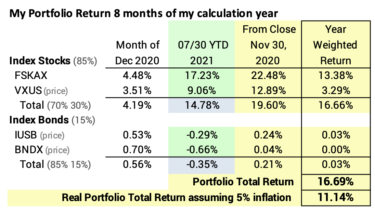

Step 1: Estimate our SSA for 2022. I made a rough guess of our SSA for 2022 assuming the full year will match our portfolio return for the 8 months December 1 – July 31: that’s +16% nominal return for the year. I estimate that’s +11% real return if inflation is 5%; that’s the average annual rate for the last three months. The 11% real return means we would earn more in spending power than the 4.85% that I withdrew last December: when you earn back more than you withdrew, you always get a real increase in SSA.

I plug +16% nominal returns and my inflation assumption in the spreadsheet from this post or the one in this post. Patti and I are on track for a 10% real increase in our SSA for 2022 – and 16% nominal dollar increase. Wow. This would be the fifth increase in seven years and +45% in spending power from the start of our plan in 2015. This is getting out of hand!

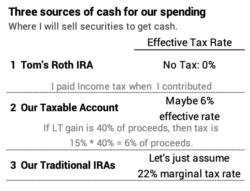

Step 2. Decide where I will sell securities to get our 2022 SSA into cash. Patti and I both are subject to RMD from our IRAs. After we withdraw our RMD, we have three sources for the added amount I should take to equal our SSA. I list them in terms of least tax consequences to greatest: 1) my Roth = 0% tax; 2) sales of securities in our taxable account = roughly 6% total tax; and 3) further withdrawals from our IRAs that I’ll assume are at 22% marginal tax for this post.

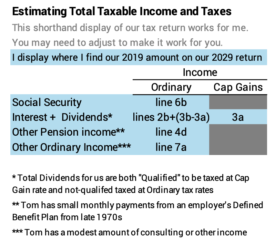

Step 3. Estimate our total taxes for 2021 based on those decisions. I have to add the impact of those decisions on a pro forma tax return for 2021. My accountant sends me a PDF of my 2020 tax return, and it’s a snap to get good estimates of most all the items for my 2021 return; they don’t change much from one year to the next. The biggest source of routine income for us, other than RMD, is the taxable portion of Social Security Benefits; that will be 1.3% more than last year.

When I look at the result – I focus on MAGI – I see I don’t need to tweak my initial decisions: I am not near a Medicare tripwire that would tell me that I should withdraw from my Roth to avoid it.

Step 4. Calculate the net cash will have for spending in 2022. That’s the gross sales of securities less the amount I’ll withhold in taxes in the distribution I’ll take from our IRAs the first week of December.

I pay some estimated tax in the year using EFTPS, but I pay about 75% of our total tax bill in that withholding. I’ve gotten free use of those tax dollars for roughly a whole year; I earned more than $2,000 on the free use this year.

== I always pay more than the absolute minimum taxes ==

I don’t minimize taxes each year. If I had done that, I would obviously have first DEPLETED my Roth account; then I would have DEPLETED our taxable holdings, and I’d derive all our spending from our IRAs: I’d take our RMD and then take more from our IRAs. I would have paid much lower taxes in early years of retirement and much higher taxes when I’ve depleted the first two. And I could be, at some point, in an uncomfortably high marginal tax bracket for IRA distributions, and that would defeat the whole benefit of tax-free growth in retirement accounts.

I try to keep about three or four years of spending in taxable securities + my Roth. I’ve had to work to keep that level: I refinanced our mortgage and took a bigger one to get cash out to increase our assets in our taxable account. I want to that level of three or four years now, and the excellent returns over the last three years have given me room to sell chunks each year, but I still withdraw more from our IRAs than just RMD for our spending. I’m more comfortable doing that – paying 22% marginal tax on some of our spending and not 6% or 0% – to preserve a level of lower tax-cost sources.

In my mind, those lower tax-cost sources are a form of insurance that will help preserve the health of our portfolio in times of stress. The biggest stress relief for our portfolio is to use out Reserve for spending and skip a whole year of withdrawals from our Investment Portfolio. Keeping low tax-cost sources is similar. I could decide to withdraw less than our SSA; if I use more of the sources with low tax cost and less from our IRAs, I’d have much less impact on the net that we can spend.

I’m very stingy on withdrawing from my Roth. I already paid income tax on the amount I contributed. I want to get the best tax benefit when I withdraw from it for our spending. The painful tax or cost Patti and I could incur is a tripwire that increase Medicare Premiums; those premiums are deducted from our gross Social Security benefits, and the amount deducted increases if we cross specific levels of income (Modified Adjusted Gross Income or MAGI). The first tripwire costs us $1,700 and others are more expensive. I get biggest bang when I use Roth as a source for our spending and lower our total income to avoid crossing a Medicare tripwire. (A Roth distribution as not part of MAGI.)

== What I now know ==

1. I have a reasonable estimate of our gross, pre-tax SSA for 2022: that could be +15% nominal increase!

2. I do not need to withdraw from my Roth this year: I am not near a Medicare tripwire that I can avoid.

3. I know the total amount of taxes to withhold from the distribution I will take from our IRAs the first week in December.

4. I have a reasonable estimate of the cash I will have in December for our spending in 2022. I know our monthly paycheck that I transfer from our Fidelity account to our checking account could be 15% more than our current pay.

Conclusion: We all should spend time thinking through our tax plan for 2021. We all have choices as to what securities we will sell to get the cash for our spending. The wrong decisions could result in added taxes that we don’t need to pay. This post discusses the steps I take develop our draft plan.

I draft my tax plan for the current calendar year in the first week of August. That’s 8 months into our calculation year which runs December 1 – November 30. I now have a reasonable expectation of 15% increase in our Safe Spending Amount for 2022; I ~know what I should withhold for taxes when I take our withdrawal from our IRAs in December; our net pay for 2020 may increase by 15%.