Could you ever trip into the 32% bracket because of the size of your IRA?

Posted on February 8, 2019

We’re consumed about Never Running Out of Money when we’re retired. We always spend and invest thinking we will hit the worst sequence of returns in history. But we may have a different – but nice – problem if returns are average: we’ll have a growing retirement portfolio that can kick us into a 32% tax bracket and unnecessarily eat the amount we can spend and enjoy. And the problem could be bigger if future returns are better than average

I never thought I’d be thinking about this because that 32% marginal rate kicks in at a very high threshold: about $348,000 of Normal (Ordinary) Income (MAGI) for joint married filers and about $174,000 for single filers (half that of joint). For most of us, this is not a concern. But my discussion with my friend John convinced me that at least some of us should be taking action now to avoid that tax bracket. This post discusses how that bracket can come into play and what we might do now to avoid that bigger tax bite.

==== 32% is a big jump from 24% ====

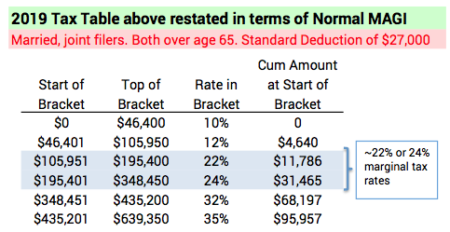

I discussed this in this post: we basically pay taxes on two kinds of income: 1. We pay 15% tax on Capital Gains Income. 2. We pay tax using a tax table on Normal Income; accountants call it Ordinary Income.

Here’s the tax table for Normal Income for 2019 based on MAGI – Modified Adjusted Gross Income; it assumes the taxpayer takes the Standard Deduction. I show this for married, joint filers, both over age 65. (The start of a bracket would be half that shown for a single filer.) The brackets adjust for inflation each year, so we can think about what can happen in the future by thinking Real.

We have a long run of Normal Income from about $106,000 to about $348,000 where we get to keep either 78% of 76% of each additional dollar of Normal Income; that’s the range for 22% or the 24% marginal tax brackets. But after $348,000 there is a jump of 8 percentage points: we keep 68%, not 76% of each additional dollar of Normal Income; that’s the 32% marginal tax bracket. That’s $800 more in tax per $10,000 that crosses the threshold. That may or may not concern you, but I think with some planning now, you won’t have to pay that added tax.

==== Could you fall into the 32% bracket? ====

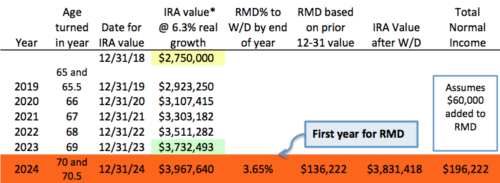

My friend John turns 65 this year. His wife, Sue, is also turns 65 this year. John has been self-employed for a number of years. He contributed to his SEP-IRA as well as a Traditional IRA. Sue has worked and has also contributed to her employer’s plan; she received the maximum match from her employer. She also contributed to a Traditional IRA. They invested well. The sum of both their IRAs is $2.75 million now.

They both must take their first Required Minimum Distribution (RMD) five years from now in 2024. That will be 3.65% of the value of their IRAs on the 12-31-2023. They look at the $2.75 million today and judge that that looks roughly like $100,000 RMD then (3.65% * $2.75 M). That RMD would be added to other Normal Income. Their biggest source is Social Security, which is $50,000 Normal Taxable Income, and they estimate another $10,000 in Interest, the portion of total dividends not taxed at capital gains rates, and other income. The sum – $160,000 – really makes them happy and clearly does not budge their anxiety meter about the 32% tax bracket.

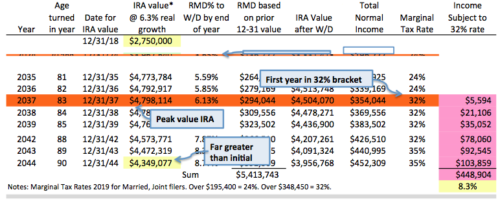

But let’s see what happens if returns are expected – match the long run average real returns for stocks and bonds. I’ll use 6.3% for the expected real annual return on their IRAs for their chosen mix of stocks and bonds (Stocks real = 7.1%; Bonds real = 2.3%.) Here’s the .pdf of the spreadsheet I use for this post.

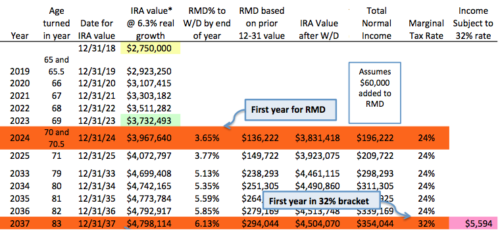

John and Sue could have more than $3.7 million on 12-31-23 in today’s spending power. That means their first RMD would be $136,000. With their added $60,000 of other Normal Income, they just cross into the 24% tax bracket in 2024, and they are very far away from and the 32% bracket. They have more than $3.7 million in their IRA after their withdrawal at the end of 2024: they withdrew 3.65% based on the 12-31-23 value but their portfolio grew 6.3% in 2024.

Their RMD increases each year for two reasons. The RMD percent they withdraw each year for many years is less than the 6.3% expected growth. The RMD percent increases each year. The combination of the two effects means their RMD starts at $136,000 when they are 70 and grows to almost $300,000 – more than double – when they are 83. That’s the first year they cross into the 32% marginal rate for some portion of income. That’s 18 years from now.

RMD continues to grow thereafter. More and more is taxed at 32%. Eventually, in their late 80s, their income increases such that more than 20% of the total is taxed in the 32% bracket. Assuming they both live to age 90, they take more than $5.4 million in RMD and about $450,000 is subject to 32% or greater. That’s about 8% of their total RMD. This issue may still look small to John and Sue, and it affects them many years in the future. They continue to put this out of mind.

(Note: the value of their IRA peaks at $4.8 million at age 83. That’s stated in constant dollar spending power and is about 75% more than they have now. At age 90, they still have far more than they have today.)

==== Oops. John dies before Sue ====

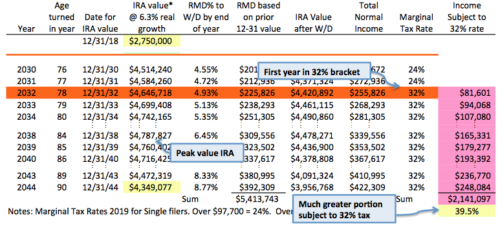

Let’s assume that John dies, unfortunately, at age 78. Sue now inherits his IRA. Let’s assume she folds it into hers. She is a single filer, and the 32% bracket starts at $174,000.

Uh oh. A MUCH greater portion of income will now be taxed at 32% starting at her age 79. In just a few years, nearly half her total income is taxed at 32%. Assuming she lives to age 90, nearly 40% of all RMD over her lifetime is taxed at 32% or greater.

==== What could John and Sue do? ====

John and Sue can take actions now to lessen the chance that they’ll pay 8 percentage points more of tax in the future. These actions reduce their total IRA subject to RMD.

1. Convert Traditional to Roth: prepay taxes and get a 25% discount. You pay 24% tax, for example, now but you then distribute from Roth to avoid paying 32% in the future. You can also use Roth to distribute cash for spending and avoid MAGI that kicks in greater Medicare premiums as discussed last week.

2. Prepay future donations. John and Sue think they want to make greater donations to charities in the future. They can take a large distribution from their IRA now and contribute it to a Donor Advised Fund like the ones associated with Fidelity,Vanguard, or Schwab and others. In effect John and Sue are prepaying donations. They get a big tax deduction in the year (or years) they donate to their Donor Advised Fund, and each year they direct their fund to grant to the charities they want to support. They also always come out ahead by using QCD for donations when they are eligible at age 70½.

3. Sue can disclaim a portion of John’s IRA at his death. The amount she disclaims becomes inherited IRAs for John’s contingent beneficiaries – generally their children. (I like this article on options for an inherited IRA.)

Conclusion: The amount you have now in your IRAs, your age, and the sequence of future returns will affect your RMD and future Normal Income. You and your spouse as joint, married filers may be a long way from the 32% marginal tax bracket. But you or your surviving spouse as a single filer could fall into the 32% marginal bracket and pay tax than you otherwise could avoid. You can take three actions: 1) prepay, in effect, taxes now and get a 25% discount by converting Traditional IRA to Roth; 2) prepay donations; you donate a large amount to a donor advised fund and then direct annual grants from the fund; 3) plan for the surviving spouse to disclaim a portion of the IRA that would be inherited.