Tax planning: put your focus on MAGI.

Posted on January 25, 2019

It’s simpler and clearer to understand how we make the most of our money – pay the least in taxes – when we understand and plan our Modified Adjusted Gross Income or MAGI. When we understand MAGI, we know how to pay the least taxes from withdrawals from our nest egg for our spending. We correctly decide where to get cash from the two components of MAGI, each of which is taxed differently. Let me explain.

First: what’s MAGI? Modified Adjusted Gross Income (MAGI) for most retirees is the same as Adjusted Gross Income (AGI) shown as a line item on your 1040 tax return. The IRS refers to MAGI and not AGI for certain Federal benefits and tax calculations. In this post I discuss two important costs to retirees – marginal tax rates on normal or ordinary income and Medicare premiums. I’ll dicuss how MAGI affects taxes on Social Security in another post.

• AGI is the sum of all wages, interest, dividends, IRA and pension income, Social Security, and other income. Patti and I have no wages. Other income is mostly capital gains income from the sale of securities that we need for our annual Safe Spending Amount.

• To get to MAGI you add back certain items that are not taxed. Tax exempt interest is the most common item added to AGI to get to MAGI. Patti and I have no tax exempt interest exception, and I’d guess that most retirees don’t either.

Patti and I withdraw from our nest egg each December for spending in the upcoming year. Our calculated Safe Spending Amount (SSA) is always greater than our Required Minimum Distribution (RMD). Therefore, I need to complete the puzzle of where we get the added cash for our spending. The question I ask: “How do I manage total MAGI and its two components to pay the lowest taxes on our total cash withdrawals from our nest egg?”

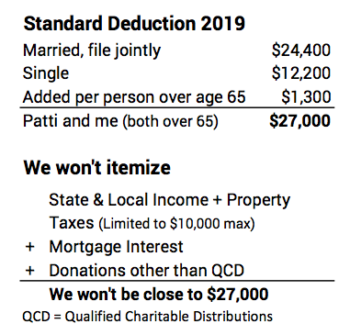

==== Forget itemized deductions ====

I can focus on MAGI because I no longer have to spend time thinking about the effect of itemized deductions. Why? Patti and I won’t have itemized deductions in the future. The Standard Deduction in the new tax law is much greater than in the past – $27,000 for Patti and me in 2019. I just need to manage the income before that $27,000 deduction. That income is MAGI.

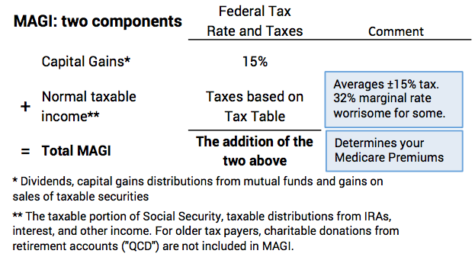

==== Two components of MAGI ====

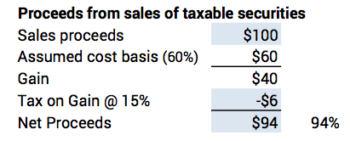

MAGI has two components of income that I have to think through. Each is taxed differently. One I’ll label Capital Gains that’s taxed at 15% (That rate is for dividends and on the gains on sales of taxable securities.) I’ll label the other Normal Income that’s taxed – on average – at roughly 15% (Range is 11% to 18%. Details to follow.) (I think accountants use the term “ordinary” for this income.) Note: folks with really high MAGI will pay more than these percentages.

I highlight on the table the two concerns that could result in greater taxes than we need to pay if we don’t think about managing our MAGI: 1) Medicare premiums increase as MAGI crosses certain thresholds. (Medicare premiums are deducted monthly from gross Social Security payments for both Patti and me.) 2) Retirees who saved early and invested wisely in their regular retirement accounts could incur a much greater marginal tax rate that they don’t like. I’ll discuss the details of these two in the next two posts.

==== Setting priorities ====

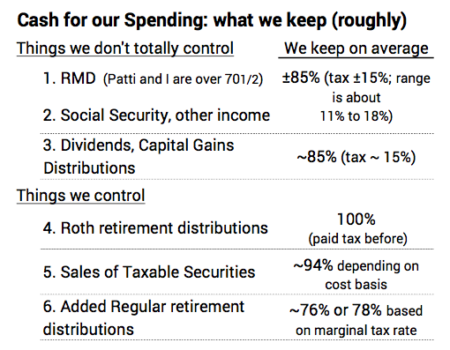

I have these general priorities in mind when I am considering where to get the cash we want for spending. I want to take cash where the average and marginal tax rates are lowest.

This chart says for Patti and me: we’ll always have a relatively large amount of income we don’t control because of RMD. All retirees must take RMD are going to be in this boat. After that source of cash for spending, the two least cost – lowest taxed – options we control are distributions from Roth retirement accounts and sales of taxable securities.

I keep this added detail in mind: I need to be wise in distributing from Roth accounts. I really should use Roth to avoid a higher marginal tax rate than I paid when I contributed to the Roth account. To possibly overstate the case, I don’t want to withdraw from Roth if I’m in a 12% marginal tax bracket when I previously paid a marginal 24% tax to get the money for the Roth. I’m losing, in essence, 12 percentage points of the amount I withdraw.

==== Taxes on Normal Income ====

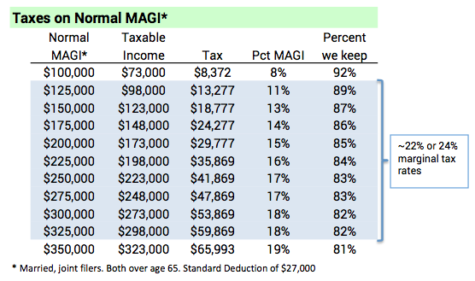

I used to obsess over marginal tax rates, but when I display federal taxes in terms of the average rates that we pay on Normal Income, I think about this differently. For my general planning, I’m using that we pay an average of 15% on Normal Income. Yes, it’s 15% plus or minus a couple of percentage points (range is 11% to 18%), but 15% is good enough for my planning. That 15% means we get to keep 85%. See here for a detailed table. A table for single filers is here.

I highlighted a range of MAGI from $125,000 to $325,000 on the table. The percent we get to keep in that wide range is fairly constant, especially after MAGI of about $175,000. That’s because the marginal tax rates change little over that wide range – the marginal tax rate is either 22% or 24% for MAGI from $106,000 to $348,000.

Conclusion. We retirees need to think through where we take the money we want for spending. If you pay yourself your Safe Spending Amount (SSA), you’ll always take more than your RMD. You want to focus your planning on the details of the two components of MAGI with the objective of lowest taxes on your total withdrawals for spending. This post shows typical tax bites on each source of cash.