Would you rent your furnace for $36 per month? I did.

Posted on May 17, 2019

I now have made two monthly payments that are, in effect, rent on our new furnace installed right at the end of last December. As I mentioned in this post, I decided not to use our financial assets to invest into non-financial assets. This post re-examines: was this the correct decision? Would you decide to rent your furnace or other capital expenditures to maintain your home? I think renting makes more sense the older Patti and I get.

I am renting in effect, because I paid for the furnace with our Home Equity Line of Credit (HELOC). We pay interest only, and I don’t ever plan on paying back the $8,000. Our monthly interest is now $36 per month.

== Years to build two kinds of Assets ==

We all have two kinds of assets: financial and non-financial. We retirees spent decades in the Save and Invest phase of life. Patti and I saved and built both financial and non-financial assets – the equity in our home; we don’t have other non-financial assets. (I don’t add in cars and furnishings in our statement of assets.) We didn’t plan on how much we should invest in financial assets vs. non-financial assets. Those investments just happened.

• In our 20s and 30s. We were renters until our early 30s, so any that we saved was invested in financial assets. We both saved and invested in our taxable investment account, but we worked to get as much as we could into tax-advantaged retirement accounts starting in our early to mid 30s. That’s when IRAs and employer defined contribution retirement plans were options for us.

• In our 30s, 40s, and 50s. We spent a significant amount building our biggest non-financial asset – our home. We made the down payment on our first home when I was in my mid 30s, and then we continued to invest in our home over decades when we paid our mortgage each month. Each payment decreased the principal balance of our loan and consequently increased our equity in our home. We invested when we improved our home with two air-conditioning units and duct work. (Our house was first built in 1918; for decades summers weren’t that hot here.) I’m sure we redid the kitchen twice. We added a large back deck.

• In our 60s. We sharply lowered financial assets because of a big shift to non-financial. We poured financial assets into the purchase and renovation needed for our current home, the one we will live in for the rest of our lives. We put in much more than the net proceeds from the sale of our prior house into this one and the new mortgage on this home.

== Building is over ==

• In our late 60s and 70s and beyond. We don’t have the outside income for Save and Invest. That phase of life is over. Now it’s Spend and Invest. The game now is to be able to safely spend (and gift) as much as is safely possible: our annual Safe Spending Amount (SSA).

In Nest Egg Care (NEC), Chapter 1 I based our retirement plan only on our financial assets and recommended you do the same. I considered our non-financial assets as a deep, deep Reserve. At the start of our plan, I thought the mix between our financial and non-financial assets was about right.

== Why add to non-financial assets now? ==

Time is not on our side. This December will be five years from the start of our plan. I use a Probability of Living Calculator and find that the expected number of years that Patti and I would both be alive will be just over eight years: 50-50 chance that we will both be alive nine summers from now! We need to FOCUS on what we both Enjoy Now. Shifting financial assets into non-financial assets doesn’t fit with that.

We’re putting stress on financial assets every time we put money into a non-financial asset. Every time we sell securities to withdraw our SSA for the upcoming years we are stressing our financial nest egg. Patti and I started our plan at 4.4% Safe Spending Rate (SSR%). Now we’re at 4.75%. When we’re in our early 80s, the SSR% that we could use will be more than the expected 6.4% real return on our portfolio (See Appendix D, NEC) . That math means our portfolio will likely decline, and that’s fine. Our life expectancies will be short – too short – then.

It’s unfair because our non-financial assets sees no stress. I find I’m continually taking money from our financial assets to spend on our home. Our home just loves this. It sits there and says to itself, “This is terrific. I’m getting a free ride here. When I need money, good old financial assets will pay 100% of what I need to keep me in style. Too bad if Patti and Tom have less to enjoy. That’s just the way it goes.”

That’s not right! Non-financial assets should carry more of their own weight – feel a little stress and not just pass it off to financial assets. Our home – our big non-financial asset – needs to cough up some cash to keep it in comfortable style.

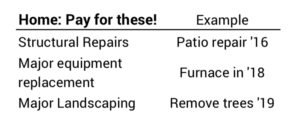

I don’t know what’s fair to ask of our non-financial asset, but I think it should at least pay the capital costs to maintain its health or operating capacity. I’ve worked with non-profits who don’t exactly get the concept that a business has to earn enough profit (or surplus in the language of non-profits) to at least provide enough cash for capital equipment to maintain its competitive capacity. This is the same thing: non-financial needs to provide enough cash to carry it’s own weight. Here are some things that I think our non-financial asset – our home – should pay.

== The $8,000 Furnace ==

I want our home to cough up that $8,000. This conversation should not remotely come to our mind: “Oops. $8,000. We weren’t expecting to pay that. That’s a lot. Does this mean we can’t take that vacation we had planned?” That’s EXACTLY the wrong thought to have at this stage of life.

I obtained a Home Equity Line of Credit (HELOC) in 2012. The largest credit amount they would give me. It just sat there for years at a $0 loan balance. The only way Non-financial Asset can cough up cash was to have it borrow the $8,000 and transfer that to Financial Assets. That’s what I made it do.

== Am I harming heirs by this action? ==

Many retirees will think of this as lowering the ultimate value of their estate that would pass on to their heirs. I don’t think about it that way at all.

1. Our home is not going to appreciate in real value over time. Inflation distorts our understanding of this; it will be worth more paper dollars but not worth more in real terms. Our home and the money we add to the equity value of our home is going to keep its current real value over time, which means it’s going to earn 0% real return over time.

2. Compare that to the expected approximate 7% real return from financial assets. If I really thought I was harming heirs, I’d still have Non-financial Asset cough up the $8,000, decide to forego the vacation, and gift the $8,000 to our heirs. My favorite gifts are to 529 plans, their retirement accounts, and their HSA account, if applicable. All three have terrific tax benefits. I think of the Rule of 72 and think that $8,000 could be $32,000 in today’s spending power in 20 years – $64,000 in 30 years.

== Is the $36/month rent payment significant? ==

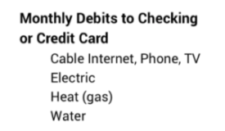

Nope. It gets lost in the other debits that hit our checking account or credit card statement. The monthly sum of these will vary by more than $36.

Conclusion: At some age – clearly the 70s for us – it makes NO sense to convert financial assets into non-financial assets. Enough with that! I drew the line this year when I made our non-financial asset – our home – cough up $8,000 that it needed for a replacement furnace. I didn’t pay for the $8,000 out of our annual Safe Spending Amount (SSA). Our Non-financial Asset borrowed the $8,000 and transferred it to our Financial Assets. This makes perfect sense to me: the $36 I have to pay each month, effectively as rent for our furnace, gets lost in the noise of other routine charges to our checking account or credit card.