What’s our Financial Retirement Plan for 2018 look like?

Posted on December 22, 2017

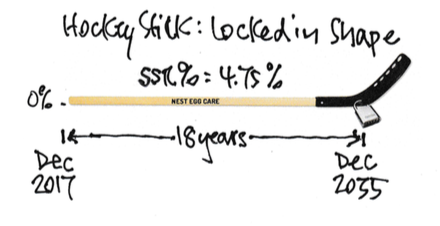

Yep. It’s a hockey stick with that inflection point locked in right where I want it to be – 2035. That’s zero probability of depleting our portfolio for 18 years. The Safe Spending Rate (SSR%) of 4.75% and other original design decisions determined the shape of this stick.

Financial risk is generally defined by the variability or unpredictability of results, and there is no unpredictability in the shape of this stick. The stick assumes we hit the MOST HORRIBLE sequence of financial returns history: BIG negative returns very soon. Maybe even worse than -35% real return for stocks in 2018. (Oh, let’s hope that doesn’t happen, buy it has happened three times since 1926.) So, there is no downside market uncertainty or risk in the stick. It can’t be worse. Only better. Therefore, I control all design decisions that determine the length of the shaft – the number of years of zero probability of depleting our portfolio – and the resulting blade angle.

Is this stick “Aggressive” or “Conservative?” (That’s how financial professionals like to characterize a financial retirement plan.) Is it “High” or “Low” in Risk Tolerance? It has ZERO TOLERANCE FOR RISK. There’s NO UNPREDICTABILITY to that inflection point. It’s LOCKED IN PLACE as determined by my design decisions: spending rate and the key ones as to how to invest.

I guess you could quibble with my choice for 18 years from now for the shaft length (to Patti’s age 88 and my age 91). We have some “life span risk”, but that’s different than unpredictable results from other factors out of our control.

Patti and I see our 18-year choice as worry free. Here are two reasons:

• Of our parents, only Patti’s mother lived longer than 88 (to 89); all others died before 84. It’s just 19% probable that I’ll live to 91, for example.

• Patti and I and you – as fellow readers of Nest Egg Care – know that 2035 is not frozen in concrete: we know what to do to push to later years if we need to or want to. Our Safe Spending Amount with our current stick is 20% more than we started with. Going back now to our original spending of $44,000 in constant dollars, we’d be using a spending rate that would push out the inflection point to 2040, for example – to my age 95 with just 7% probability of being alive then. Since it’s almost certain that we’ll be better off in the future than now (even after this 20% increase), we’re certainly not going to lower our current Safe Spending Amount now.

I can only mess up this stick by doing stupid stuff that inadvertently shortens the shaft to fewer years. Here’s stupid stuff WE WON’T DO.

1. Patti and I won’t spend more than the stick says we should. This stick is a Safe Spending Rate (SSR%) of 4.75% that leads us to our Safe Spending Amount. (We likely will find that both our SSR% and SSA will increase in time.) We rigidly control spending by paying ourselves our annual SSA in monthly paychecks and no more. We know to never spend one dime more in a year. (And we have no need to spend one dime less!)

2. I will make no changes to our portfolio to give us a less than the certain result of 99.93% of what the market as a whole will give all investors. I’m not trying to beat the market to get more than 100% of what the market gives. I’m not adding costs to fiddle with our portfolio. EVER.

3. I won’t fail to rebalance our mix of stocks and bonds right after our withdrawal for the upcoming year. (That’s early December for us.) Rebalancing takes less me less than 15 minutes, so it’s inexcusable if I forget to do that.

Conclusion: Our financial retirement plan (your plan) can be viewed as a hockey stick. If you follow the decision steps in Nest Egg Care, you wind up with ZERO RISK TOLERANCE in your plan for the number of years you pick for zero probability of depleting a portfolio (and your probability of outspending and outliving your portfolio in the years thereafter is extremely low.) You LOCK IN the shape of your stick with your design decisions. The only risk in the shape of your stick is if you do stupid stuff and inadvertently shorten the stick. DON”T DO STUPID STUFF!