It’s December 15. My day spent bottling the wine I’ll drink next year.

Posted on December 15, 2017

This is my imagined task every December 15. I even mark this day as Bottling Day on my calendar. Why do I do this? To imagine my portfolio differently.

We all need to form our view of risk tolerance. The real shape of my and your risk tolerance curve looks like a hockey stick. You lock in your stick – the number of years you want of zero probability of depleting your portfolio – with your spending rate and other decisions. It’s already assumed HORRIBLE sequences of bad variability in returns (early, big negative returns); we logically don’t need to pay attention to bad variability of returns.

But sticking with the stick – trusting the stick – is hard to do. We’ve all spent decades thinking that risk is the ups and downs of market returns. The financial pros only talk about risk tolerance this way. (That’s not correct! But it helps them if you fear these ups and downs.) While I want to think only in terms of our hockey stick, I also look at our portfolio in a way that helps me be more accepting of bad variability when it will inevitably strike.

I don’t view our portfolio as one big lump – one pile of money – that moves up and down with market variability. I view it in parts that move up and down differently. Each part has a different holding period. (Holding period is the length of time one holds on to an investment before selling it for spending.) The mix of stocks and bonds varies with holding period.

I don’t want much variability in the parts with short holding periods. I’ll be selling securities relatively soon for our spending; I want more bonds. I’m accepting of more variability in the parts with longer holding periods; I’m good with more stocks. Since I have many years to wait before I will sell, I have plenty of time to recover from bad variability. (I have this same view for a Trust where I am Trustee; you can read about that here.)

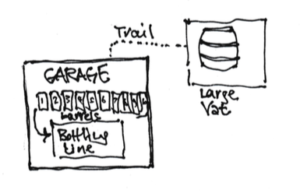

I envision that that our portfolio is in ten wine barrels, aging over the years in a precise way, and in a large vat. (It’s far too hard for me to actually display our portfolio this way on my login screen for our investment accounts, but I’d really like to. I just have to do the calculations this time of year as if it were in the wine barrels and the vat.)

Each of the ten barrels holds about one year of spending. The barrels are in a precise mix of stocks and bonds. I consulted with a world-class vintner who told me that the number of years (10) was the right amount of aging and that the mixes in the barrels are ideal. He told me to think that each drop of wine I drink has followed his precise aging and mix schedule. (Just that thought seems to make it taste better!)

The ten wine barrels are in my garage in sequence; I have bottling equipment in the garage, too. The large vat is out back down a short trail from the garage.

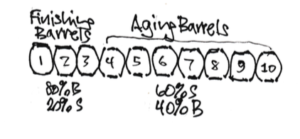

• The first three barrels are the Finishing Barrels, and they’re invested in 80% bonds and 20% stocks. That means their volume isn’t going to change much year to year. That barrel closest to the bottling line sat with that mix for three years.

• The next seven barrels are the Aging Barrels, and they’re invested in 60% stocks and 40% bonds. Barrel #4 has aged for seven years now.

• The Large Vat out back is 100% stocks. It will have the most variation in volume. I won’t touch the first drop of that for a decade. I have 10 years to recover from bad variability in the vat.

I woke up early today. Brrr. It was cold and icy, 17 degrees. I went out to the garage to bottle the wine that I’ll consume in the upcoming year (2018).

I opened the Finishing Barrel closest to the bottling line. (I’d written “1” in chalk on it last year.) and that’s what I bottled. Later today I’ll take the bottles to the house and put them in a wine cooler in the basement. I’ll consume and give away all those bottles during 2018.

After I emptied and bottled the first barrel in line, I had some work to prepare for next year. I rolled empty barrel #1 to the end of the line. I rolled the full barrels forward to make space for it in position #10. I wiped out my prior chalk marks and renumbered the barrels from #1 to #10.

I adjusted the mix in my new #3 from 60% stock and 40% bonds to 80% bonds and 20% stocks. And I got wine from the Large Vat to fill #10: I adjusted that to 60% stocks and 40% bonds. (Getting that wine from the Large Vat to the garage is the most physically taxing work. Also, the trail can be icy, like it is this year. I think I may hire someone to help me with that next year.)

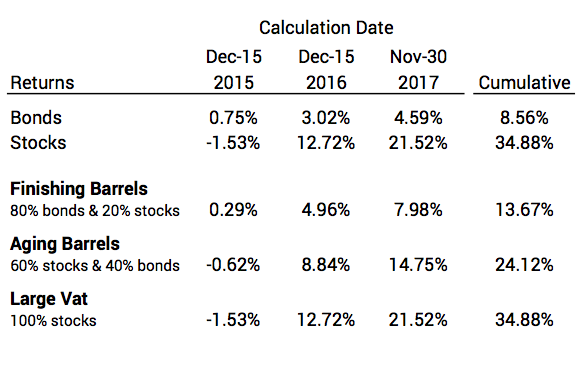

Okay. Now I’m ready for next year, and I’m ready to show you how those two groups of barrels and vat performed over the past three years.

You can see the range or variability of returns is smallest for the Finishing Barrels (roughly 7.7 percentage point spread) and greatest for the Large Vat (roughly 23.5 percentage point spread). That’s what I’d expect.

I’ve had three years of positive returns in the Finishing Barrels; that’s probably a bit unusual. In the first year I had small negative returns in the Aging Barrels and the Large Vat. But those return rates don’t approach what I think of as bad variability.

The cumulative returns are positive for all three. The greatest cumulative return is in the Large Vat. That’s also what I would expect.

Conclusion. None of us should view our portfolio as one big lump that rises and falls with market returns. That tends to make us too sensitive, too emotional when we are hit with bad variability in returns. It’s really our hockey stick that defines our risk tolerance, and it already has assumed the most HORRIBLE sequence of market returns.

It helps to view our portfolio in parts related to different holding periods. Each part should have an appropriate mix of stocks and bonds. This example is three parts starting with 80% bond and 20% stock and ending with 100% stocks. Each part will have its own degree of variability.

It’s too difficult for me to actually arrange my portfolio into parts with different mixes of stocks and bonds for our investment accounts, but I can calculate at least once a year to see the results as if it were organized this way. Looking at that longest holding period (10 years away before I spend any) helps distance my potential emotional panic when I’ll be hit (We’ll all be hit.) with bad variability of stock returns: I’ll know I have a decade to recover.