Are you getting nervous about stock returns?

Posted on February 9, 2018

The point of this post: it’s waaaay to early in the year to be concerned about the rapid decline in stocks.

I liked reading Thinking, Fast and Slow by Daniel Kahneman. Kahneman is a psychologist who won the Noble price in economics. He’s the only non-economist to win the prize. His contribution is behavior finance. His book describes how we make decisions and how we often make irrational financial decisions by not thinking it through.

One example from the book describes how we feel and how we should think about an event if we spend time to do a few calculations. The example I remember is two investors:

• One starts with $1,000. The stock market varies about plus or minus 1% over a period and at the end of the period, the ending value is $1,000.

• The other starts with $1,000. The stock market races to +5% but then decreases to an ending value of $1,000.

Which one feels just fine, and which does not? The former is fine, and the latter is unhappy. The reality: no difference.

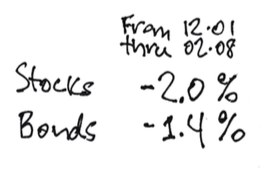

Yep, the market raced in January to its best month in 30 years. And now it’s quickly given more than that back. How should I view that?

1. My next withdrawal for spending – my next sale of securities for spending – is early December. That’s ten months from now. Stocks declined by about -6% in January 2016. They wound up at +11% for the year. A lot can change between now and early December.

2. Since I Recalculate based on results at the end of November, that’s the start I should be using for Year-To-Date results. The change does not register on my worry-meter.

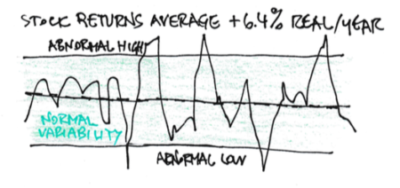

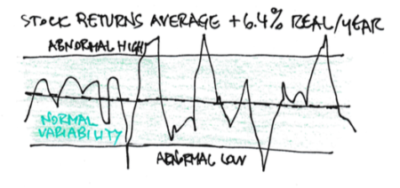

3. My Fidelity statement tells me my 12-month return rate ending January 31 was +26% for stocks and +3% for bonds. You hit those marks, too, following the recommendations in Nest Egg Care. That stock return is well above average. Real returns will gravitate toward 6.4% over time. We should expect some down years.

Perspective: we should not be worried about normal variability of stock returns. In my mind normal variability is the band of returns that hold 80% of all returns. 10% of all returns are above the band and are abnormally high. We’re concerned about the 10% that are abnormally low. That’s the time for concern or even worry. Below the band is about -17% real return for the whole year. We’re a long way from that.