This seems so obvious to me: take your Social Security early

Posted on September 28, 2018

I took my Social Security (SS) early, right after Full Retirement Age, currently age 66. That made perfect sense to me. Here’s a recent article/video that says the opposite: sell from your IRA rather than taking Social Security early. Many say, “Wait, and each year you wait you get guaranteed 8% more per year for the rest of your life. That’s the best investment deal ever.” That’s not correct. The purpose of this post is to explain why I think taking your Social Security early is a pretty obvious decision.

Here’s a quick summary: when you take your SS earlier, you are able to invest the the amount you get early (or otherwise avoid selling securities you have invested for your spending). Over your life expectancy, the dollar return you will earn from the SS you Take Now will be more than your return from Wait.

Eventually there is a break-even point in years where Wait can overtake Take Now. But that is many years beyond your life expectancy. In my opinion, Take Now makes sense as early as age 62; that assumes you don’t have earned income that lowers your SS payments.

== Tom age 69: Take Now or Wait? ==

Here’s how I worked through this. Since Social Security adjusts for inflation, it’s easiest to put all the numbers in terms of constant dollars and in real return rates.

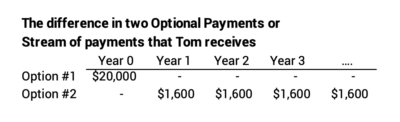

I start with the simplest example. If I get this example correct, I can extend the analysis. My example is a male, Tom, who has just turned 69. Tom can take $20,000 in Social Security now and in every future year for the rest of his life, or he can wait one year and take 8% more or $21,600 per year for the rest of his life. We can look at just the differences in the two options: 1) Tom gets $20,000 now or 2) Tom gets $1,600 more per year for the rest of his life. What makes most sense? I’ll ignore taxes for now and come back to that at the end.

Tom’s Life Expectancy (50% of males alive and 50% dead) is 16 years, age 85. I get that from the Social Security calculation of life expectancy.

== Two cursory looks say Wait ==

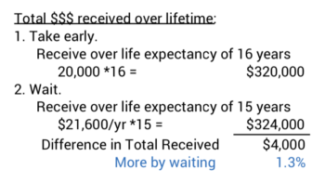

1. The total dollars that Tom can expect to receive over his Life Expectancy from the two options is very similar. Waiting a year results in 1.3% more dollars (spending power) over his life expectancy. This quick look would imply Wait if Tom thinks he’s going to be in the 50% set of folks his age who at least live to their Life Expectancy.

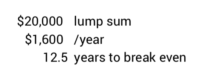

(You should get the idea from looking at this that it does not take much in return on that lump sum of $20,000 to make up the $4,000 difference over 16 years. The simple math says Tom should Take Now if he can earn more than $250 per year on the $20,000 for 16 years: that adds to the $4,000. )

2. Tom’s, break-even to obtain the same dollars (to be paid the $20,000 in total from the added $1,600 per year) is 12.5 years, less than his life expectancy. He uses the probability of living calculator and finds that 65% of today’s 69 year-olds today will be alive then. That looks like a reasonable bet: Tom’s in good health; it’s 65% probable that he will live at least 12.5 years. He will be ahead by waiting to start his SS a year from now. This says WAIT.

== The time value of money: TAKE NOW ==

We’ve ignored the time value of money. We need to account for the different timing of the payments to Tom and what Tom could earn on the two Options. We can be more precise as to what Tom has to earn to make Take Now better than Wait. The calculation that takes in the effect of the time value of money weights the early Take Now dollars more than the later Wait dollars. Early Take Now dollars are more valuable since you can invest them for longer.

We can look at the question as to which option is better in a number of ways.

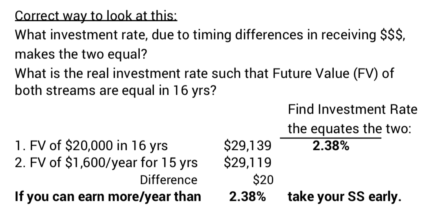

• We can find the return rate that equates the two options for Tom’s 16-year life expectancy. What investment rate makes the two options equal in value in 16 years? The answer is ~2.4%. Tom’s indifferent as to which option to pick for over his expected lifetime if thinks he will earn an average real return of 2.4% or more per year for 16 years. If he thinks he will earn more than that, he should Take Now.

Tom’s expected return rate on his portfolio for his mix of Stocks and Bonds is more than 6% for his mix of Stocks and Bonds. (Real stock returns average 7.1% and bonds 2.3%.) I’d judge this as a pretty obvious decision. Take Now. This is the exact opposite conclusion when one ignores the time value of money.

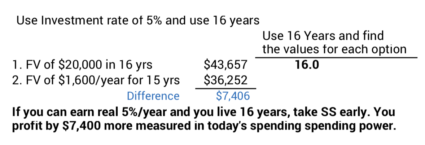

• Another way to look at it: Tom assumes (bets) he can earn 5% real return in the future. That’s less than the expected +6% real return on his portfolio. How much better off is he in 16 years by taking his SS now? Tom’s about $7,400 ahead, measured in today’s spending power.

This is not a huge amount, but I’d go for it. I like preserving my Nest Egg for future potential emergencies. Better said, I do not like unnecessarily depleting my Nest Egg when those early SS payments preserve it. I also go for the time value of ENJOY NOW, meaning I envision a lot more FUN with $20,000 in my pocket now to spend than the fun Patti and I would have with $1,600 more per year.

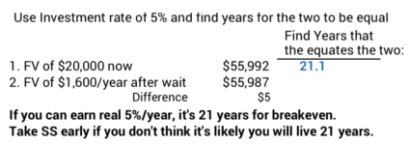

• Here’s a final way to look at it. What’s the break-even in years if Tom estimates a 5% return rate? It’s 21 years. That’s five years beyond his life expectancy and about nine years more than we calculated when we ignored the time value of money. Tom uses a probability of living calculator and finds that only 21% of his peer 69 year-olds will be alive at that age. Now we are getting there: Tom should Take Now if he thinks he will earn 5% real return and live up to 21 years,

== More years than this example of one year ==

We can extend this same analysis back in time (take SS two years earlier, etc.) and find the return rate Tom would have to earn to break even at his life expectancy. Example: Tom, age 68, can take $20,000 now and the next year or he wait two years and get $23,328 ($20,000*1.08*1.08). That would be $3,328 more per year for rest of his life. I won’t go through each of those calculations, but the table below shows that you would always take SS early if you assume you could earn more than the return rates displayed.

I do not show the investment rates you have to earn if you take your SS at age 65, 64, 63, or 62 – before Full Retirement Age– but I calculate the rate you would have to earn increases by about .35% per year. You’d need to judge that you would earn more than about 4.5% at age 62 to justify Take Now. Again, this is significantly less than than expected return rate for your portfolio if you follow the recommendations in Nest Egg Care. Yes, actual returns could turn out to be lower, but the chances of that are low.

== Other considerations ==

When Tom dies, his spouse will be able to collect his Social Security amount assuming Tom’s is greater. Their age difference could sway Tom’s decision, meaning his younger spouse’s life expectancy may stretch well beyond his break-even years.

(Some spouses have a very low potential Social Security benefit relative to yours. They are eligible for a spousal benefit, payments that are a portion of your benefit. If that is the case, you and your spouse should file for that benefit at the time you file to take your Social Security early. Spousal benefit does not change the math or conclusion.)

Taxes: consideration of taxes generally will favor taking SS early. If you (and spouse) have no or low other earned income, your marginal tax rate when you take SS before age 70 will be low. But in the year you turn 70½ you must take your Required Minimum Distribution from your retirement accounts, and you may be in a greater marginal tax bracket then or in later years. You’ll likely move toward a higher marginal tax bracket later because – at normal returns for stocks and bonds – your RMD will increase. That’s because IRA will grow even after you take RMDs and your RMD percentage increases.

If you (and maybe your spouse) are working and you take your SS early, you might be in a slightly greater marginal tax bracket now than later (e.g., 24% now vs. 22% then); that difference, while important, does not change the math enough and the conclusion that it’s best to Take SS Now.

Conclusion: The idea of waiting just 12 months to receive 8% more Social Security for the rest of your life sounds appealing. More than appealing to most. When I run through the numbers, it just doesn’t make much sense to wait. Most all of us should take it early. I did.