Are you giving money to your kids and grandkids this year?

Posted on November 29, 2019

I think many retirees hang on, hang on, and hang on to their nest egg waiting for their heirs to get their money after they are dead. They keep thinking about the step-up in value on death that avoids capital gains taxes. This makes very little sense to me. Give your money now. 1) Maybe your heirs really need the money now. 2) If they spend it now I’d bet they will enjoy it with their families a lot more now than later. 3) They can invest your gift and they will have MORE in the future than if you keep it until you die. The purpose of this post is to describe that latter point: if you give now and your heirs invest it correctly, they will net more in the long run.

Giving now is an easy decision for Patti and me. We have no distracting thoughts about gifts and added taxes: we’ve already paid taxes on the money we know will be left over to gift from our 2019 Safe Spending Amount (SSA; see Chapter 2, Nest Egg Care). That’s because we had our SSA for 2019 in cash at the end of last December. We paid the taxes to get that cash on our 2018 return. We know we can gift with no further tax consequences.

Many folks think differently. They equate giving money to their kids and grandkids with having to sell securities and then paying capital gains taxes. It bugs them to think they would pay capital gains tax now as compared to totally avoiding any tax when the kids inherit the securities when they die. Estates escape capital gains taxes. Heirs get the full market value at death. If that is the way you think about it, you want to answer two questions:

1) If you sell a security and give the proceeds now, can your kids or grandkids ever have more than the alternative of your keeping the security until you die? [Spoiler alert: Yes.]

2) If so when will they have more? [Spoiler alert: ~10 years, but I say far fewer than 10.]

== Give more by giving now ==

We need an example and a spreadsheet that compares two options: keep it until you die or give it now.

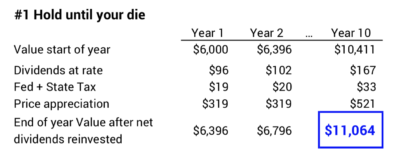

Example: You now have a security worth $6,000. This is a mutual fund, stock ETF, or a stock. This investment will earn the expected, real 7.1% per year for stocks in the future. You have low investing costs of .1%; your real return is 7.0% per year. Your 7.0% is the combination of 1.6% dividend rate and +5.3% price appreciation that work together for the 7.0%.

Other assumptions: 1) you pay 15% federal and 5% state tax on dividends and gains. (A different assumption on state taxes does not change the conclusion in the comparison.) I ignore that some investments – mutual funds – have gains distributions in most years that would add to taxes paid; that lowers the net amount invested at the start of each year. I ignore any state inheritance tax. (In my state, Pennsylvania, that’s 4.5% tax for gifts to children and grandchildren; that alone shouts, “Give Now”. 2) Your cost basis is 70% of current value: $4,200. (The higher your cost basis, the greater the reason to give it to your heirs now.)

Option #1: hold your investment until you die. Let’s assume that is 10 years from now. Your heirs will then get your security at its market value and will not incur capital gains taxes. The value of the security on your date of death becomes their new cost basis.

I build a spreadsheet. You can see the first few years and the tenth year below. (A PDF of the two options is here.) At the end of 10 years your heirs get $11,064. That’s their new cost basis; like you did, they’ll continue to pay taxes on the growth.

Option #2: you sell your security and gift the net to a child or grandchild. Your taxable gain is 30% of the $6,000. You pay 20% taxes. Your total tax is $360 or 6% of the $6,000. You gift them $5,640.

The smart thing to do is to directly contribute the net proceeds to an account that grows tax-free. You have three options: your child’s or grandchild’s IRA; a 529 plan; and a Health Savings Account (HSAs) – the best of the three options. (Patti and I mailed our gifts directly to retirement accounts in 2017; we did not make similar gifts in 2018.)

I’ll use the example of gifts to a retirement acccount; the result would be identical for a 529 plan. The result for a gift to a retirement account is the same for either Roth or Traditional IRA; both have the same net benefit to them assuming their marginal tax rate now is the same as when they sell the security and withdraw it for spending. (You can see that detail here.) The result is easier to understand, however, if I display Roth IRA as the example. Your child or grandchild invests the net after you’ve paid tax, and it compounds for a decade at the same 7.0% real rate.

I build a spreadsheet. You can see the first few years and the tenth year below. The amount they have trails Option #1 at the start. But at the end of 10 years the value of their IRA is $11,095 – a shade more than Option #1. Nine or ten years is the breakeven point on this decision.

Option #2 continues to outpace Option #1. It still enjoys the power of tax-free growth. By the 15th year the amount for Option #2 is about 4% more than Option #1.

== I view breakeven as less than ten years ==

I view the breakeven as less than ten years because I assign an added value to giving now. The added value is in your kids and grandkids seeing their money compound over the years; ideally this is a motivation for them to save more and invest wisely. The added value is letting your children use other income for spending on their family: a fantastic family vacation; an educational trip for their kids. The added value is having your kids and grandkids thank you now rather than after you are dead.

Conclusion: This is a very good year to consider gifts to your kids and grandkids. I’d guess that most all of us have not fully spent our 2019 Safe Spending Amount (SSA). Market returns this year tell us our portfolio is in great shape. Clearly we have not been riding on a Most Horrible Sequence of returns.

If we have money left over that we’ve already paid tax on, giving gifts now is a slam dunk: your kids and grandkids clearly will be better off with that money now than if you wait for them to get it after you’ve died.

If you have to pay tax on the sale of a security, do so. Pick highest cost shares to sell and gift the net proceeds to their IRA. It may take a few years for the economics to work out, but your kids and grandkids will have more in the future than if you wait for them to get.