What’s your tax plan for 2019?

Posted on November 22, 2019

I finished my tax plan for 2019 this past week. Have you? I’ve written about tax traps – tripwires and breakpoints – in several posts. (Maybe too many! Most recently here, here, and here.) I combine all the key tripwires and breakpoints on one sheet of paper that makes it easier see what I should do to avoid taxes. I can see where I might mess up or where – if I am smart – I can avoid taxes that I do not have to pay. The purpose of this post is to give you a clearer picture of tripwires and breakpoints and describe my plan for this year.

Summary: I always want to get our Safe Spending Amount (SSA) into cash by the end of the year at lowest tax cost. You do, too, of course. This takes some planning and thought. There are more ways that you are taxed and tripwires that set off increased taxes than you probably understood. With modest planning you can avoid tripwires that could cost you $1,000s. My plan is to actually pay more taxes this year to allow me to pay less in a future year!

I used this one page Excel worksheet to see how close I am to a painful tripwire. I suggest you use this. A tiny thumbnail is below. Disclaimer: I’m no tax professional, but I think my one page sheet is right – or right enough.

== Types of income and taxes ==

Over this year I’ve worked to understand how we are taxed. There was a lot I did not understand.

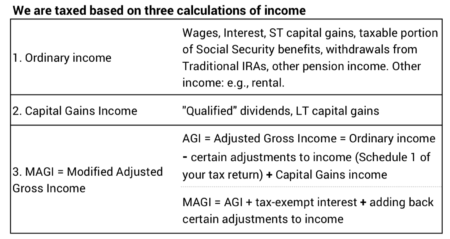

We have two kinds of income that are taxed differently. We also may cross tripwires based on the on the sum of those two kinds of income + the addition of items not counted as components of those types of income. Wow, that’s confusing. I hope this chart helps clarify all that.

== Tripwires and Breakpoints ==

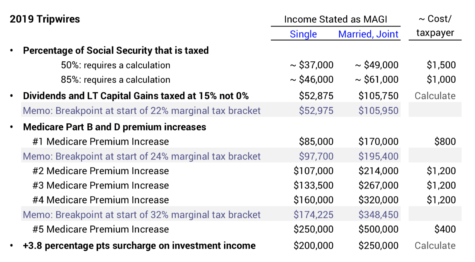

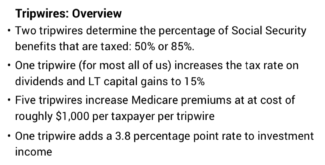

This post summarizes all the tripwires – exceed a specific amount of income by $1 and you can pay more than $1,200 in tax – twice that for joint, married filers.

My one page sheet also shows three major Breakpoints that I discussed in last week’s post. A breakpoint marks the beginning of a bracket of income with greater marginal tax. Example: the income that is the transition point from the 12% to 22% marginal tax bracket. Marginal tax brackets are a concern because our real RMD will likely double over our lifetime. Some of us could be pushed into a tax bracket we would want to avoid. With planning we can avoid tripwires and ugly breakpoints.

== Tripwires are the worst ==

I HATE the thought of having $1 too much income and crossing a tripwire that could cost Patti and me as much as $2,400. I MUST estimate my income for 2019 and peer into to the future – RMD will likely double – to see if I am close – or will be close – to a dreaded tripwire. We have four kinds of tripwires and I display nine tripwires.

== Two initial SS tripwires ==

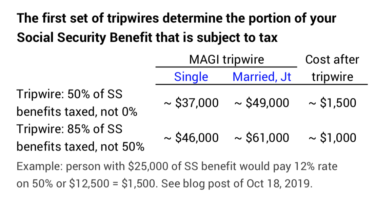

The first two tripwires we face set the percentage of Social Security benefits that gets taxed. If you avoid the tripwires, none of your Social Security benefit is taxed. Cross the first tripwire and 50% gets taxed. Cross the next one and 85% is taxed. Those who are retired but do not have to record RMD have flexibility as to where they get their cash for spending. They may be able to avoid crossing these tripwires. I describe the tactics for these folks in this post.

The tripwires are not the same for all taxpayers. You have to calculate your tripwires. Tripwires are determined by the sum of ½ your Social Security benefit plus other income. I describe this calculation the post cited above and here is another source.

My example in the table above shows that you may able to both of these tripwires if your total income is less than $37,000 for a single tax payer and less than $49,000 to for married, joint tax payers.

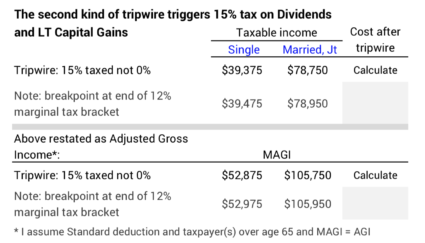

== Tripwires for Capital Gains taxes ==

The next tripwire is at bit more income and triggers taxes on Dividends and Long-term Capital gains. The jump is from 0% to 15% tax. This tripwire almost perfectly coincides with the breakpoint between the 12% marginal tax bracket and the 22% marginal tax bracket. If your ordinary taxable income is solidly in the 12% tax bracket, you will not pay tax on Dividends and Long-term Capital Gains.

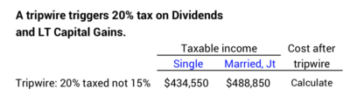

Most retirees with a substantial nest egg will fall into the 22% tax bracket when they take RMD. Their two biggest components of income, Social Security benefits + RMD, drive them to that point. They’ll pay 15% capital gains tax. I didn’t include another tripwire in the table above: folks in the stratosphere of taxable income – who fall into the top marginal 37% tax bracket – would trigger the 20% rate.

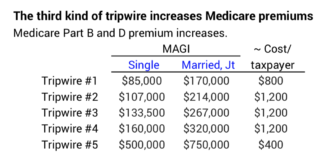

== Tripwires for Medicare premiums ==

Those well into the 22% tax bracket face a different set of tripwires. These are increases in Medicare Part B and D premiums – I call them added taxes – that are deducted from gross Social Security benefits. Older retirees with sizeable retirement accounts will face these tripwires. The amounts that trigger added premiums don’t automatically adjust for inflation; in real terms they hit us at less and less income as the years roll by. It takes and act of Congress to adjust these. As I mentioned in this post RMD will likely double from the amount you initially take at age 70½, meaning more of us might stumble into a tripwire or two in a few years.

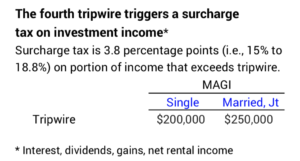

== Tripwire for surcharge tax on investment income ==

The final kind of tripwire kicks in a 3.8 percentage point surcharge on investment income: dividends, short- and long-term capital gains, interest, and net rental income. The surcharge is on the part that puts you over the tripwire. A single taxpayer with $25,000 0f investment income and $180,000 of other income will pay the surcharge on $5,000 of income: that’s the amount over the $200,000 tripwire. In that calculation, the surcharge is a small added cost: 3.8% * $5,000 = $180.

== My tax plan for 2019 ==

I filled out the sheet I cited above and filled out my estimated income for the year. I also increased RMD by 75% to see how it might really look in the future. I conclude the problem is that Patti and I don’t have enough money in the Roth IRA account I opened last year. (I should have opened one even with a little amount years ago.) Roth gives me the ability to get cash for our spending and avoid crossing a costly tripwire. More in Roth and less in Traditional means lower chance that increasing RMD pushes me into a marginal tax bracket that I would hate. I decided on an amount to convert Traditional to Roth that does not result in crossing an expensive tripwire or a breakpoint. I may repeat this next year.

Conclusion: Retirees who have a nest egg are faced two big issues on taxes. Tripwires can trigger $1,200 in added tax per taxpayer with $1 of too much income. RMD may double over our lifetimes and push us well past a breakpoint of a marginal tax that we would want to avoid. Money in Roth IRA gives you flexibility to avoid tripwires and helps to lower future RMD. My 2019 tax plan is to convert some Traditional IRA to Roth. I’m paying more taxes this year, but I’ll come out ahead if I use Roth to avoid a higher tax later.