$2,000 saved and invested in 1983. It’s $81,000 now. Lots to ENJOY!

Posted on January 11, 2019

I contributed $2,000 to my IRA each year for many years. IRAs that gave a tax deduction for that $2,000 started in about 1981, and I jumped on board. I invested $2,000 each year, the allowable maximum at the time.

I thought of each increment as an amount that would grow and then Patti and I could spend it in a future year in our retirement. I like to think of it as putting each $2,000 in an envelope that sits there until I open at the start of a future year to fully spend in that year. Whatever that $2,000 grows to is what we get to spend in the year. If I start early and make enough investments like that each year, the compounding of each annual amount results in a very significant series of payments to us in retirement. That’s due to the basic math of 7% real annual return stocks and growth that follows the Rule of 72.

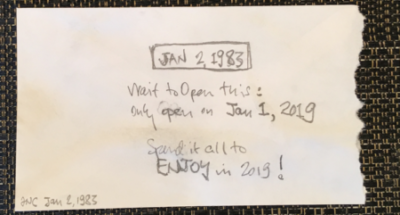

Patti and I opened a Gift Envelope on January 1. This was the envelope from 1983: I put $2,000 in my IRA on Jan 2, 1983 when I was 38; I invested in a stock index fund on that date and it sat there for 36 years. Patti and I ripped open the opened the envelope this January 1 and emptied its contents on the kitchen island counter: $81,000!* “Spend it all this year! We’re going to ENJOY.”

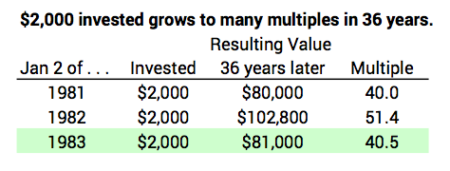

Here’s the history of our last three envelopes: I display results in nominal dollars meaning they include the effect of inflation. Each year, money went into my IRA on Jan 2 for 1981, 1982, 1983. You can read prior posts here and here.

Why do I keep repeating this story? Two reasons.

1. To build a nest egg (and continue to have it be healthy in the future) we have to invest heavily in stocks, even with their annual variability in return. Where else will we find roughly 7% real annual rate of return? Where else can you expect to have a real increase of 10X of your investment (10X is about 25 years following the Rule of 72)? Some friends of mine love bonds; some love gold; some love real estate. I just don’t get it. They can’t expect to average anywhere close 7% per year real annual return over many years.

2. We all want to help make our family successful. We like the idea of them having more money in the future. Patti and I also want them to be savers and investors like we were. We think it’s much better to give them money NOW in ways that encourage them to save and to be smart investors. Let them see and get the benefit of compound growth NOW. Patti and I don’t want to wait to see how big a pile of money we could accumulate to leave them in 15 or 20 years from now (Hopefully it’s this many years!).

The gift I like best is gifts to their IRA accounts. The best recent gift we made was $5,500 to our nephew’s Roth IRA. He’s 23. I just think: at age 63, one could expect that investment in a broad-based stock index fund would have four doublings in real spending power. That’s 16 times the $5,500 or $88,000 tax-free in today’s spending power. I can’t think of another gift that will grow 16 times over time. I hope to heck he contributes year after year.

Why the variation in the amounts in the three envelopes? Relative to the prior envelope, we lop off a year and add a year. The envelope I opened this January 2 was a lot less than the one I opened last year. That’s because it dropped the return for 1982 return (20.4%) and added the return for 2018 (-4.5%). Those annual returns are a combination real return and inflation.

====

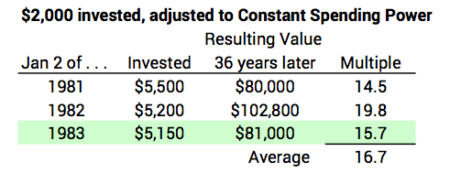

I get a better picture of what really happened when I eliminate the effect of inflation. I always like to look at real results – dollars stated in the same spending power. I adjust the $2,000 invested in 1983 to be in the same spending power as now: a $1 bill in 1983 purchased about 2.6X more that a $1 bill now. Our multiple was 15.7X in real spending power.

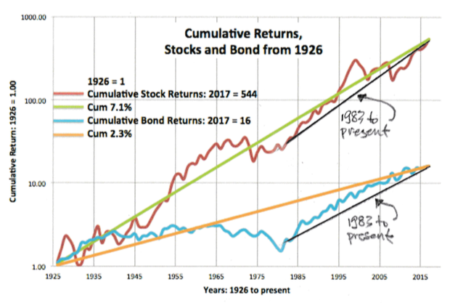

We see a similar variability in real returns. That’s because returns over any period differ from the +90 year average of about 7% real return. You can see this from the graph from this post and below. I’d expect a 16X multiple in 40 years following the Rule of 72 and I averaged more than that for the three 36-year periods. That’s because a line drawn from 1983 to the present is steeper than the long-term 7% trend line: the average annual return from 1983 has been greater than 7%. A staight line that starts from “below the line” that is drawn “to the line” will continue for a few more years.

You can also see the line for bonds from 1983 to the present is much steeper than its 2.3% trend line and is almost as steep as the line for stocks from 1983. That is very unusual and happened because the cumulative return for bonds fell far below their trend line. Bonds had a 50-year funk of zero cumulative return from about 1935 to 1985. What’s this say? If I had invested in bonds and not stocks, the multiple on my $2,000 would have compounded to close to the 41X of stocks! That “below the line” drawn “to the line” will continue for quite a few years for bonds.

Conclusion. We retirees have ridden a very favorable sequence of returns starting in the early 1980s through the 1990s. Those years were “below the line” and therefore it’s steeper than 7% real return to today. Our savings compounded savings by many multiples with a simple investment plan in either stocks or bonds. The 36-year envelope Patti and I just opened increased nearly 41X in purchasing power.

We don’t know the future sequence of returns. But the chances are that a similar, relatively small gift – not to ourselves but to those we love – will compound to many multiples of purchasing power. You can dramatically improve lives of those you love.

* Source. Morningstar. VFINX’s “Growth of 10K” graph. Change the start date to 01/02/1983 and the end date to 01/01/2019. You will see $10,000 grew to $405,700 or just about 40.5X. $2,000 * 40.5 = $81,000.

Inflation data from here.