A great gift from Tom to Tom and Patti

Posted on January 2, 2018

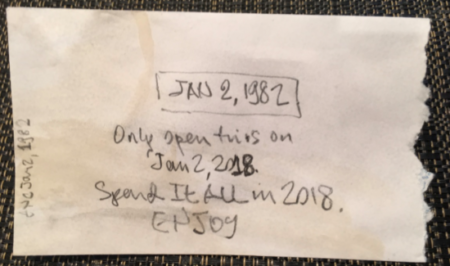

I opened my Gift Envelope this morning, the one I gave to Patti and me on January 2, 1982 – 36 years ago. I emptied its contents on the kitchen island counter: $102,800!*

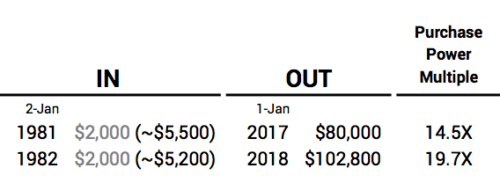

I followed the same investment plan as for the envelope I opened last year: $2,000 put into my IRA and invested in US stocks for 36 years. Stocks are only thing that makes sense for a 36-year holding period; bonds have never outperformed stocks for that length of time. Our return is from investing in a bland, boring US stock index fund for all those years. Because of the fund’s low expense ratio, our return is just a bit less than the gross return from the market.

Now, $2,000 invested then is not the same as $2,000 now. When I do the calculation to adjust for inflation, it was more like $5,200 in today’s purchasing power. So, that means in real purchasing power, I invested $5,200 then and found it compounded to $102,800 over these past 36 years. Nearly 20X.

That’s better than the 14.5X from the envelope I opened last January 2. Both are much better than one would expect from the long run average return rates (maybe 9.5X**). Why is the one I just opened so much more than the one I opened last year? For the sequence ending now, I dropped a bad year (1981: stocks were down about 5%) and added a good year (2017: stocks were up over 20%).

I know the contents of 36-year envelopes I plan to open every January 2 will vary depending on the actual sequence of returns. The returns in the 1980s and 1990s will be hard to match moving forward; my guess is that this one just opened may be the highwater mark in terms of the multiples earned: 1982 was a +20% year, and my next sequence will not include that year. But for now, we’ll ENJOY that $102,800. We’ll spend or give away all of it by the end of this year (or the portion of it within our calculated Safe Spending Amount). Oh, boy. We have work to do to figure that out.

Conclusion. We retirees have ridden a very favorable sequence of returns starting in the early 1980s through the 1990s, compounding savings then by many multiples with a simple investment plan. The 36-year envelope we just opened increased nearly 20X in purchasing power, well above what one would expect.

We don’t know the future sequence of returns. But the chances are that a similar, relatively small gift – not to ourselves but to those we love – will compound to many multiples of purchasing power. You can dramatically improve lives of those you love.

* Source. Morningstar. VFINX’s “Growth of 10K” graph. Change the start date to 01/02/1982 and the end date to 01/01/2018. You will see $10,000 grew to $514,000 or 51.4X. $2,000 * 51.4 = $102,800

** I plant in my head 6.4% real return per year as the average for stocks over the past 90 or so years. 6.4% translates to doubling in purchasing power about every 11.25 years, and 36 years would be about 3.2 doublings or a multiple of about 9.5X.