You can expect your RMD to double by your age 83

Posted on February 15, 2019

We Nest Eggers always plan for the worst: we assume we’ll be faced with the worst sequence of financial returns ever and that assumption determines how much we spend and how we invest. This post shows that your Required Minimum Distribution (RMD) doubles in real spending power for expected future returns. (Expected is the same as the long-run average return rate: 7.1% real per year for stocks; 2.3% for bonds.) That’s REALLY good news. That really good news can also translate to greater taxes than we would like as described here and here. Those posts showed we can act now to lower the chances that we’ll pay those greater taxes. We and our heirs can keep more of what we have.

A Retirement Withdrawal Calculator (RWC) like FIRECalc also tells you that you can expect good news. (Also see Chapter 2, Nest Egg Care.) An RWC also shows that returns can vary widely from expected for long periods. My use of a constant annual return rate for expected returns for this post is not as rigorous a result as one would get from FIRECalc, but it’s not possible to vary the annual withdrawal rate – the increasing annual RMD percent – in FIRECalc or any other similar RWC I find..

==== Expect RMD to double in ~13 years ====

Your RMD from your Traditional retirement accounts increases over time when stock and bond returns are close to their long-term, expected returns. That’s because of two factors:

1) The expected return from your mix of stocks and bonds is greater than the RMD percent for many years; your IRA grows for many years.

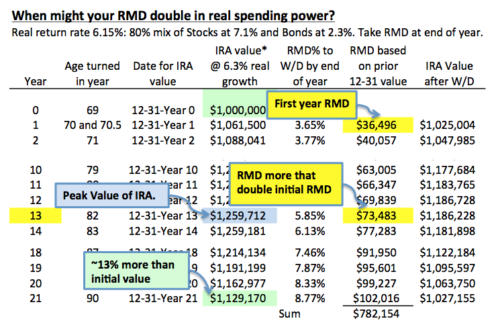

2) Your RMD percent is increasing year after year: it starts in the table I show for this post at 3.65% (That starting percent depends on when your birthday falls in the year.) and increases to 6.13% 13 years later. That’s nearly a 70% increase.

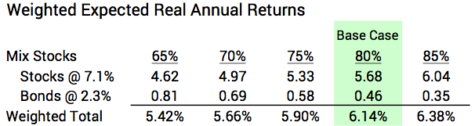

I use a real return of 6.15% as the base case for this post. You can see I could have used a range of returns.

This table you can download shows your RMD doubles in real spending power in 13 years. Even though you are withdrawing a greater RMD each year, at age 83 your IRA is 26% greater than in your first year ($1.26 M compared to $1.0 M). At age 90, you’re RMD is about 2.8X than your first RMD ($102,000 compared to $36,500), and your IRA at the end of the year you turn 90 is 13% more than your initial amount.

==== RMD will double at lower returns ====

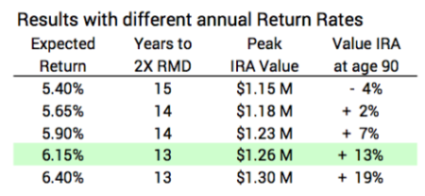

I input the range of expected returns for the different mixes of stocks and bonds shown in the table above. The table below shows the years for RMD to double or the peak value of your IRA does not change much over the range of returns based on expected returns for stocks and bonds. The value of your IRA at age 90 changes most with the change in return. At a lower mix of stocks, your IRA decreases in real spending power by age 90. At a greater mix of stocks the value of your IRA increases by about 19%. The difference in the two is about 25%.

Conclusion: You can expect your RMD to double in real spending power in roughly 13 or 14 years from your first year if stock and bond returns roughly equal their long-term average. This holds true over a wide range of mix of stocks and bonds. A greater mix of stocks, however, results in about 25% more for you or your heirs at age 90 than a low mix of stocks.