Should I convert some of my Traditional IRA to Roth?

Posted on October 26, 2018

This post discusses the basics of Roth and Traditional IRA or similar retirement plans and how we should think about them when we’re near retirement or retired. The big issue for me: should I convert some of our Traditional IRA to Roth? The answer is that I should have paid more attention to this in the past, but I really must pay attention now. You should, too.

========

When you save and invest in a retirement plan, you pay tax once, either before you contribute to the plan (Roth IRA) or when you withdraw money for your spending (Traditional IRA and others). Roth and Traditional give you the same financial result if your marginal tax rate later, when you withdraw your money from your IRA, matches your current marginal rate. Both give you the exact same after-tax amount of money to spend.

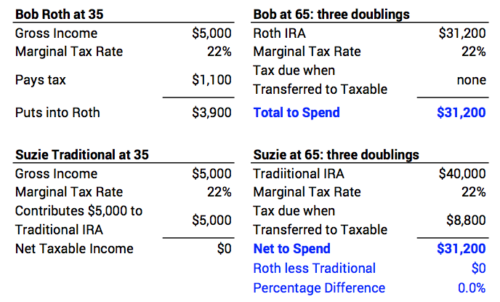

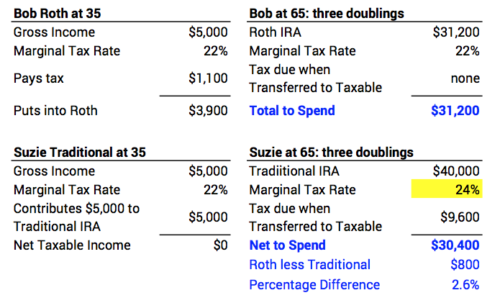

Here’s an example. Bob Roth and Suzie Traditional will have the same 22% marginal rate then as now. Bob and Suzie both start with $5,000. Bob pays his marginal 22% tax now (Roth) and Suzie pays her marginal 22% tax later (Traditional). They both invest now what they can in stocks and wait 30 years. They earn the historical, average real return rate for stocks – 7.1% per year. That translates to doubling of spending power (constant dollar value of their investment) every decade. 30 years is three doublings, and their investment increases by a factor of eight: 1 to 2; 2 to 4; 4 to 8. They both net the same $31,200 when they withdraw the money for their spending.

Roth and Traditional are not equivalent when the marginal tax rate now differs from the one later. It turned out Suzie had greater income later and crossed into the 24% tax bracket. She paid two more percentage points in tax on this increment for her spending than Bob did. Roth wins out and provides 2.6% more than Traditional.

The bottom line: You’re going to have to pay tax one time on the money you put in and then take out of your retirement account: now or then. You try to figure out the lowest marginal tax rate now or then. Do you assume that you’ll be in a higher tax rate in the future? If so, favor Roth and pay the lower tax rate now. And the opposite is true: if you assume you’ll be in a lower tax rate in the future, favor Traditional and pay the lower tax rate then.

========

I got serious about Saving and Investing for retirement in the late 1970s and early 1980s. Marginal tax rates were much higher than now. Avoiding current tax (the deductibility of my contribition to my retirement plan) was a powerful motivator. When I started it was obvious that the first money I put into a retirement plan would come out at a lower tax rate. All my contributions were in my Traditional IRA (or similar that gave me a current tax deduction). Roth was not a consideration then. It started in 1997.

My retirement accounts are much greater than I would have imagined, and they most probably will grow even though I take out at least my RMD each year. I can run FIRECalc and see that I can expect to have 40% more portfolio value in the future after safe withdrawals for spending. (See Nest Egg Care (NEC), Chapter 2.) My RMD percentage will be 6.5% in a decade and the rate I likely would use for the Safe Spending Amount for Patti and me will be more than that (NEC, Appendix G). I’m pretty sure I’ll we withdrawing more from our retirement accounts in the future and will have more taxable income. Should I convert some of my current Traditional to Roth?

I need to figure out how much better off I might be from converting. I’d decide a gross amount to convert; I’d sell securities to provide the cash for tax to be withheld; I’d then transfer the net securities to a new Roth account. My brokerage house (Fidelity in our case) calculates the value of the total converted to report as taxable income.) The benefit is that I avoid a greater marginal tax in the future, and – an added benefit – I lower the amount I’m forced to withdraw in a year (RMD) since my Traditional will be lower; that gives means I can fulfill our requirement for our Safe Spending Amount by selling more from our taxable account at much lower capital gains taxes.

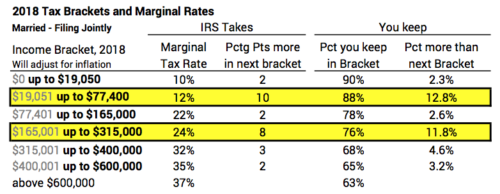

The table below shows when it’s most important to consider converting. (Print here.) The column on the right shows the percentage more you get to keep if you keep taxable income out of the next higher tax bracket. Two breakpoints stand out. I display the table for Married filing jointly; both Billy and Jay in the examples use this table.)

Breakpoint 1: You want to avoid crossing $77,400 in Taxable income. That’s the 2018 amount; this number will adjust for inflation each year. The amount of income that crosses that line will cost you ten percentage points in greater tax.

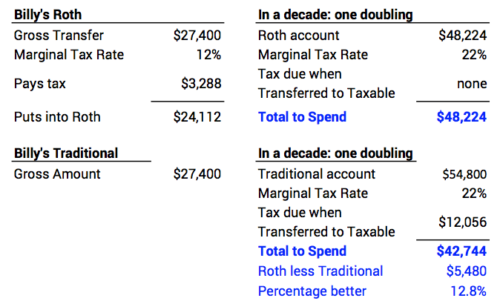

Billy is 58. He estimates his taxable income this year at $50,000. He has a nice nest egg in his retirement account. He thinks through the potential that it will more than double by age 70 and is convinced that at some point in the future he will cross that $77,400 line with his Social Security and just his RMD withdrawals from his IRA. What should Billy do?

Billy: convert gross amount of $27,400 of your Traditional to Roth. Sell enough for the 12% tax you want withheld. Transfer the net $24,110 securities to your new Roth account. You just avoided ten percentage points in tax. You could view it as immediately making $2,740: 10 percentage points * $27,400 in less taxes. You’ll have at least that much more to spend in the future (assuming positive real returns in the future). If you wait a decade before you withdraw your Roth that could be $5,480 in today’s spending power.

Billy, it’s never a mistake to convert. If you never reach that 22% bracket, you haven’t lost a dime. You’re no worse off. Remember Bob and Suzie.

Breakpoint 2: You want to avoid crossing $315,000 in Taxable income. The amount of income that crosses that line means eight more percentage points in tax.

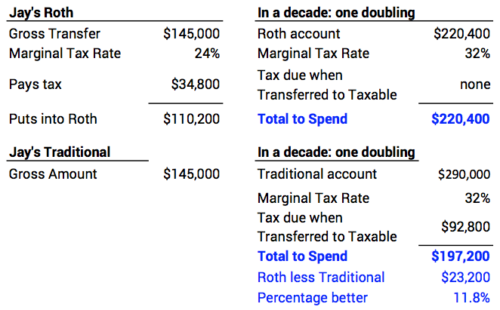

Jay is 64 and he estimates his taxable income for 2018 will be $170,000. Jay hit it big on some investments in his IRA and has $5 million, all Traditional. He thinks through what his portfolio might look like at age 70½ and beyond and is convinced he’ll have income of more than $315,000 in today’s dollars in the future. What should Jay do?

Jay: convert $145,000 of your Traditional IRA to Roth. Follow the same steps as Billy. After your withholding for taxes, you’ll have securities worth $110,200 in your Roth. You just avoided eight percentage points of tax. Just like Billy, you could think of it as immediately making $11,600: 8 percentage points * $145,000. In a decade, that could be $23,200 more for you in today’s spending power. Not bad at all for perhaps an hour of work for planning and implementation. Go for it, Jay.

And you haven’t lost a dime if you never get to that 32% bracket.

========

You can do this same analysis for other brackets. You always save when you can avoid taxable income in a bracket with higher marginal tax rate. For brackets other than these two, it’s either two or three percentage more in future taxes.

Conclusion: Converting some of your Traditional IRA to Roth always saves if you can avoid paying a higher marginal tax rate in the future. There’s no downside to converting Traditional to Roth. (That assumes you aren’t going to drop down in marginal tax rate.) Some folks could avoid as much as ten percentage points in tax on the amount converted; they would net as much as 13% more than they would otherwise have.