What US stock funds or ETFs should you own for your retirement portfolio?

Posted on April 2, 2021

I’ve recently suggested choices for US bond funds/ETFs (also here) and International stock funds/ETFs . I thought I might as well complete the full story to lay out your best choices for US stocks. US stocks will be the biggest part of your portfolio. They’re almost 60% for Patti and me; that math excludes our Reserve (See Chapters 1 and 7, Nest Egg Care.) I hope your fundamental decision is obvious. The purpose of this post is to display four index funds for total US stocks. Own one of these and you’re done.

== Total US Stocks ==

Since you’re retired you must be low-cost investor; you can’t add uncertainty in returns by chasing after a fund – with higher costs – that might beat the market: history tells us that – over time – that game loses more than 90% of the time. Your choice has to be an index fund.

You want to own a total US stock fund. When you own every stock in the US in a total market fund, you own, in effect, a market capitalization weighted index fund for any style or subset of stocks: value; growth; large, mid and small cap; sectors like healthcare, technology and many slices of the total of about 3,700 stocks.

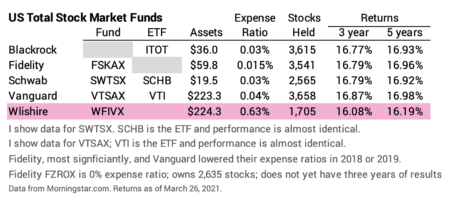

I list five choices for US total stocks in the table below. Pick from the top four and you’ll be fine. Patti and I own FSKAX. (You can print the pdf of three tables in this post here.)

WFIVX is the outlier. Its expense ratio is too high, and you see the direct result of that higher expense ratio in lower returns than the others. It’s the largest US total stock market index fund; it is pushed and sold by financial advisors who receive an annual commission of .25% of assets; that’s a component of its .63% expense ratio. (This is a good example of a fund that clearly is in the best interest of the financial advisor but costs the client roughly 9% of all future growth – .6% cost penalty/7.1% expected real return rate. That’s a big hit on future value over time.)

== S&P 500 funds ==

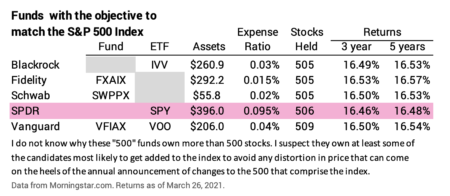

You could also pick a fund designed to closely match the S&P 500 Index. You already own this kind of fund in a US total stock market fund; if this were you only holding, you’d be excluding about 3,200 smaller capitalization stocks. Even Vanguard, which pioneered index funds in 1976 with its fund designed to track the performance of the S&P 500 Index – now ticker symbol VFAIX – thinks this too narrow of portion of the market to own. It no longer offers VFAIX as a choice for its employees’ retirement plan: it offers VTSAX, US Total Stock Market, instead.

SPY is the outlier for the same general reason that WFIVX is the outlier: its expense ratio is too high. You see the effect in lower return for the investor.

I don’t think you’ll be hurt by only owning one of these funds: the total value of the 500 stocks is about 75% to 80% of the total value of the stock market. Over the last 35 years or so, the returns for the 500 largest capitalization stocks have been virtually the same as for the added 3,200 or so smaller capitalization stocks.

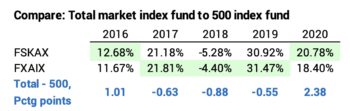

The returns over the last five years have been about .4% lower per year than for the total stock market funds: that means smaller cap stocks have been a bit better over that period. The difference in three and five-year returns comes from last year. The 500 funds outperformed total market funds in three of the last five years, but US total market funds were more than two percentage points better in 2020.

== You can tilt, tweak and fiddle ==

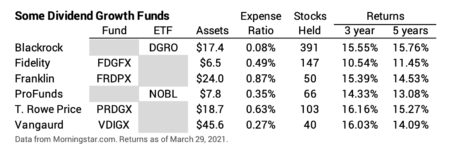

You can tilt, tweak and fiddle. You can pick to own a bit more of some slice of the 3,700 than you already own in your US total market fund. Here’s an example: I’ve seen a number of articles recently that recommend retirees own dividend-growth funds – a theme for a value fund. Some funds focus on stocks that pay higher dividends or stocks that have a record of consistently increasing dividends. Oh, that sounds like the smart thing to do, doesn’t it? You already own these stocks, so you are already smart.

The sample of funds/ETFs I show in the table own a small set of all US stocks. Owning one of these would tilt your portfolio to a bit more of each of those 50 to 100 stocks than you already own in your total market fund.

This falls in to the “fiddling” category to me. Fiddling gives us a sense that we are at least DOING SOMETHING on the important task of managing our retirement portfolio. But I see two problems with this: 1) The higher expense ratio for these funds can only be made up if these are the winning set of stocks to own. 2) I don’t find any logic that would say these stocks are undervalued such that future performance will consistently be better than other stocks. They might do better than other stocks in the fuure, but that’s just a guess.

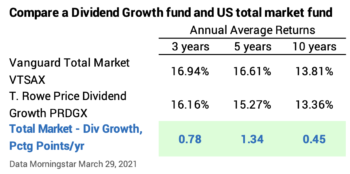

If you would have guessed this way in the past, the guess doesn’t look good so far. These funds have not outperformed over the last three, five or ten years as shown in the table. And as I posted last year, value stocks absolutely cratered in the market decline last February and March.

Resist the urge to fiddle!

Conclusion: Keep it simple for US stocks in your portfolio. Own a US Total Stock market index fund. This post lists four to pick from. One is all you need for your portfolio. That’s all Patti and I own. With just one of these, you are low, low in cost; you have invested to keep the most that the market will deliver to all investors. It’s the smart move.