What mutual fund or ETF do you want for International Stocks?

Posted on March 26, 2021

It’s easy to get confused as to the the correct choices of mutual fund or ETF for your retirement portfolio. There are about 8,000 mutual funds and 2,200 ETFs in the US. I’m a believer in Total Stock funds, and the purpose of this post it to describe a VERY SHORT list of stock mutual funds or ETFs that fit the bill for international stocks in your stock portfolio. Pick one from a list of three.

== You need international stocks in your portfolio ==

You need international stocks in your portfolio in my view. You want the diversification. International stocks are about 45% of the total value of all the world’s stocks. Over the very long run, US and International should perform exactly the same as US stocks. By holding some international stocks, you are narrowing the variability in your total portfolio value when it comes time to sell for your spending.

I also like owning the broadest range of international stocks to have in my head that Patti and I own nearly every stock traded in the world: if there is a hot stock somewhere in the world, I already own it. I think I’m a smart guy for owning it. Of course, if there is a stock in the world cratering to zero, I also own that, but I’m not going to think about that!

As I mention in Nest Egg Care (NEC), you can find recommendations of the percent of international stocks that you should own generally ranging from 20% to 40% of your total stocks. Vanguard recommends 40%; Fidelity recommends 30%. I picked 30% for Patti and me, and I’ll stick with that.

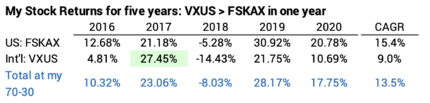

Over the past six years international stocks have underperformed US stocks in all but one year, but that says nothing about how they will perform in the future.

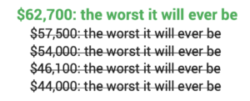

Should I be bothered that I’ve held too much International stocks? Our annual Safe Spending Amount (SSA; see Chapter 2, NEC) has marched up much faster than I would have expected. Like almost all retirees, we have more now than we’ve ever had in our lives – even after what I consider more than sufficient withdrawals for our spending.

I guess I could beat myself up and calculate that our SSA might be a bit more now if I held less international and more US stocks, but I’m not going to do that. I could even extend this thinking to judge that I shouldn’t have held any bonds as insurance for a potential devastating decline in stocks, and I certainly wouldn’t do that.

== Picking a fund can be simple ==

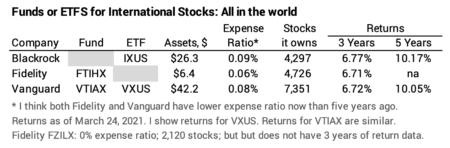

I say, “Keep It Simple”. Simple is to hold a fund that owns almost everything. If you agree with that, the choices get narrow. I think it boils down to three. These three – IXUS, FTIHX, and VTIAX/VXUS – have the objective of replicating an index for the performance of all the stocks in the world: developed markets and emerging markets; large, medium and small cap stocks. The performance of all three is very similar.

They all use some sort of sampling method for the smallest stocks – the ones that aren’t going to have much effect on the total return for the fund. Vanguard holds at least 2,500 more stocks than the other two, meaning it doesn’t use sampling to any degree. IXUS has been slightly better in return. It may have lucked out on its sampling. Its prospectus shows it has bettered its benchmark index pretty consistently over the past decade, so maybe it has some special sauce that the other two don’t.

(Patti and I own VXUS and a smattering of FTIHX; we hold FTIHX because it made rebalancing a bit easier; I can do an exchange between FSKAX – my holding for US Total stocks – and FTIHX on the same day.)

== You can get more complex ==

Probably the least complex thing you can do is to leave out some kinds of stocks. I don’t think there is much logic in that, since you gain very little from a lower expense ratio from the reduction in stocks held and administrative complexity. The Vanguard fund/ETF of VFWAX/VEU owns 3,900 fewer stocks than VTIAX/VXUS, but the expense ratio is the same. The performance of the funds/ETFs that leave out small cap stocks is similar to the fund/ETFs that don’t.

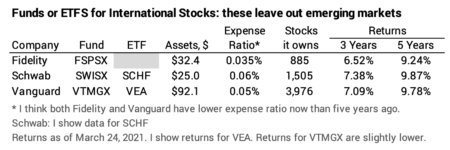

You can find funds/ETFs that leave out emerging-market stocks. I would not suggest that. At times – most obvious is in the early 2000s – emerging market stocks dramatically outperformed US or other international stocks when they tanked. That says nothing about the chances of them repeating that feat. My friend, Chet, wanted to pick an index fund that left out stocks from emerging economies; I’m not remembering his reasoning. I find three funds/ETF that do that. The five-year performance of these three is a bit lower than the five fund/ETFs above, meaning recent past returns from stocks from emerging markets have been a bit better than from developed markets.

You can move beyond these eight and get very complex by trying to over- or underweight a part of the world, capitalization of stock, or kind of stocks (e.g., international real estate). That’s complexity for the sake of complexity in my view.

Conclusion: The bottom line is that you MUST BE a low-cost investor now that you are retired; that means you only own index funds. You want international stocks for some diversification. The simplest way to own your targeted percentage of international stocks is to own one of three funds/ETFs that hold bits of all international stocks in the world: stocks from developed and developing countries; large, mid and small cap stocks.