Do you properly pay yourself in retirement? Most don’t.

Posted on April 12, 2019

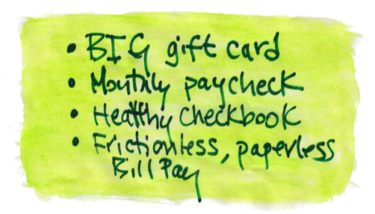

If we are to truly enjoy our retirement, we must properly pay ourselves from our nest egg. We first need to pay the right amount each year – our annual Safe Spending Amount (SSA). (See Chapter 2, Nest Egg Care (NEC); see here for the current SSA for Patti and me.) Second, we need to pay ourselves in a way that makes it easier to enjoy that money. The purpose of this post is to help you think about the process of paying yourself (or yourselves).

This post is an expanded discussion of Chapter 13 in NEC. I also discussed this topic in last week’s post. I credit this book, Dollars and Sense, Chapters 5 and 6, for clarifying my thinking on this topic. Here’s the concept:

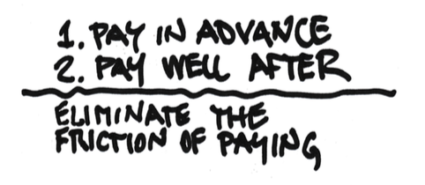

• You will be happier – enjoy your money more – if you separate the time you pay for something from when you consume it. It is uncomfortable and painful when payment coincides with consumption – you are less happy with pay-as-you-go. You have two ways to do be happier.

1. Pay in advance. That’s a big, difficult and not enjoyable decision – but once you’ve made that purchase decision you then are happier when you consume what you’ve already paid for: that consumption will seem to be a bargain.

2. Pay for something after you’ve consumed it. You are happier when you purchase something with a credit card, as an example, and wait – up to almost two months! – before you have to pay for it.

== Step 1 ==

Get cash to spend – your SSA

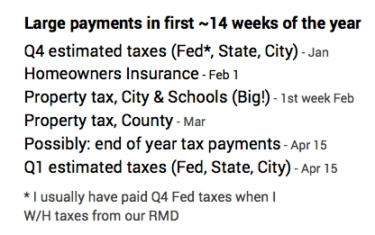

Selling securities to get the cash that we can spend throughout the year is the biggest decision we retirees make each year. Calculating our SSA is one thing. Actually selling securities to get it into cash to spend is another. We worked decades to build our nest egg. It’s invested to put us in the top 6% of all investors over time. When I sell I obviously know we’re depleting it; the Rule of 72 tells me I will have a lot more in the future if I don’t sell. At the same time I sell, I’m figuring out the taxes and paying them: more discomfort.

Two things help me with this decision. First, I think of this as buying a really nice prepaid gift card for two really nice people – Patti and me. They’ve earned that amount I calculate that’s safe to pay them, and there’s no reason I why I would sell less securities than their SSA and pay them less. It’s a big gift amount, but I think of how much fun the two of them can have with that total amount. Nice folks.

Second, I couple selling for our SSA with the task the IRS makes me do: sell securities to fulfill our RMD. (Patti and I are both over 70½.) That’s a painful task, since I know the taxes on those sales will be high, netting us less than the other sales we’ll need to get to our total SSA. (All we nest eggers will find that our SSA is always greater than our RMD(s), and therefore we always must sell more than our RMD.) The task of selling more isn’t that much more daunting. It adds a small amount of added time and effort to figure out what’s best to sell for lowest taxes.

== Step 2 ==

Auto-transfer your SSA to checking

I now disburse our total SSA – net of taxes withheld. I issue a monthly paycheck, in effect, as an automatic, direct-wire transfer from our Fidelity investment account into our PNC checking account.

I want to keep our checkbook balance healthy throughout the year. I never want to put myself in a position of having to go back to get more cash because the balance in our checkbook has gotten too low. I make the equivalent of two payments in January – 2/13ths of the total for the year. I recommended here that Margie make the equivalent of four payments (4/15ths) to herself in January.

== An alternative ==

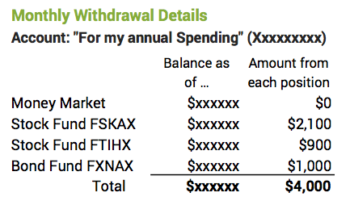

My friend Bill completes these two steps – selling securities and issuing paychecks to his checking account – differently than I do. Bill calculates his SSA for the upcoming calendar year in December and sells just enough securities then for the taxes that he will withhold and pay in Q4. He divides the net by 12. He then automatically sells each month a portion from stock funds and bond funds he designates. Then he transfers the proceeds to his checking account.

You can see how Fidelity, as an example, let’s you implement the process in my mock-up of their Automatic Withdrawal page. My withdrawal is always from money market.

My once-a-year process to get the total cash our SSA for the upcoming years lets me be pretty precise in selling to minimize taxes – I sell higher cost shares from a mutual fund, for example. Bill’s process can’t designate shares to sell within a fund, but – averaging over many years – Bill will earn more on his SSA during the year than I will. Bill will earn the average return for his mix of stocks and bonds, while I will earn money market rates. I don’t like thinking about how the monthly variability of the market affects the value of what I’m selling that month; I’m happy to forgo the opportunity to earn more.

== Step 3 ==

Automate payments from Checking

I further disconnect the effort of payment from consumption. I let as many vendors as possible debit our checking account for their monthly charges for what we’ve consumed in the prior month. Payment is frictionless. Ten vendors debit our checking account: heat, light, water, internet and cable, cell phone, car and home insurance, health insurance and three others. l always have plenty of cash in the checking account for these. I don’t give them a thought.

I store payment information about 30 other vendors that I’ve paid over the years in PNC’s Bill Pay, and I only pay them through Bill Pay. Every time I use Bill Pay I feel good about giving PNC the cost and pain of printing checks, putting them into envelopes, adding postage, and going to the post box to mail them. PNC does all that work at no cost to me. I write fewer than 20 hand-written or computer printed checks in the year.

== Step 4 ==

Post-pay your largest expense

Our credit card is by far our largest monthly payment. In some months it’s more than all other expenses combined. When we use our credit card, we’re consuming but paying much later. We’re happier about what we consume.

I also have MasterCard debit our checking account on the date payment is due. For our current bill, MasterCard will debit our checking account at the end of April; the first charge on that statement was at the end of February. On average, we pay 28 days after we consume.

I picked the pay-day for the direct deposit from Fidelity as two days before MasterCard hits our checking for payment. I know I’ll easily have more than MasterCard will take. I have zero stress about incurring the pain of a Late Fee and the horror of 15.5% APR of accumulated interest on two months of purchases.

Conclusion: It’s all about what makes us happier. Behavioral finance tells us we’re happier – enjoy our money more – when we separate payment from consumption. 1) Pay in Advance: sell securities for the cash you need for spending well ahead of consumption; disburse cash to your checking account – your paycheck from your nest egg – well ahead of your needs to spend. 2) Pay Much Later: use your credit card. Lots.

We also are happier when we reduce the friction or effort of paying: have your routine monthly payments (heat, light, phone, etc.) automatically debited from your checking account. The payment I’m most concerned about is the debit at the end of each month to fully pay our credit card balance; I’ve set our pay-day for the direct transfer from our investment account to be a few days before that date.