How much money do you have to spend for FUN, FAMILY, and COMMUNITY?

Posted on March 29, 2019

Two prior posts (here and here) describe how Patti and I view our spending. We divide our spending into four categories. I’ll summarize these as Basics, Fun, Family, and Community. Let’s abbreviate those last three as FFC. The more we have to spend on FFC, the happier Patti and I will be.

My friend, Margie, at our coffee klatch a couple of Mondays ago said that she “worries about money every day.” I know this is true since she often mentions some expenses that would not register at all on my worry meter. “I had to pay $47 for a prescription yesterday.” “I had to pay $300 for the kennel for LuLu when I visited my son and his family in Indianapolis.” “My checking account is down to less than $200 now.” I was pretty sure she has enough and should have NO WORRY about spending those amounts. She should NEVER get close to having just $200 in her checking account. But she worries every day. Why? If you worry about money or are just not clear how much you can (should) spend on FFC, the purpose of this post is to suggest you follow the steps Margie and I went through.

Margie and I met, and I found two problems: 1) she doesn’t routinely “pay herself” what she should from her nest egg; she inadvertently puts unnecessary stress on herself about her spending, particularly in the first three months of every year. 2) She has not calculated her monthly basic spending needs to know what is left over from her total monthly pay – deposits into her checking account – for Fun, Family, and Community (FFC). We went though the following steps.

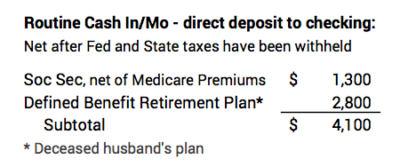

1. Add your monthly income that comes from sources other than your nest egg. Margie’s looked like this.

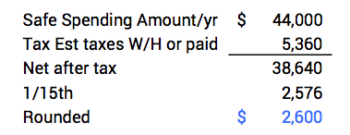

2. Add the monthly amount you should pay yourself from your nest egg. Margie had never calculated her annual Safe Spending Amount (See Nest Egg Care, Chapter 2.) and decided how she wanted to pay herself. (She pays a financial advisor handsomely, but he had never helped her with this.)

I’ll assume in this example that Margie has $800,000 as her Investment Portfolio (See Chapter 1, Nest Egg Care). That would translate to an annual Safe Spending Amount of $44,000 for her age. (See Parts 1 and 2 and Appendices D and G, Nest Egg Care. Note: this math does not work if Margie continues to pay high investing costs: she currently has high fund and advisor fees.)

Margie nets about $39,000 per year after subtracting about $5,000 for taxes from the $44,000.

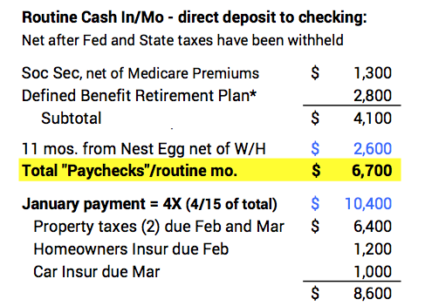

Margie needs far more cash at the first of the year than later in the year: two property taxes are due in the first quarter. I suggested that she divide the total by 15 (about $2,600) and pay 4/15 in January and then 1/15 for the remaining months.

It now looked like this for Margie.

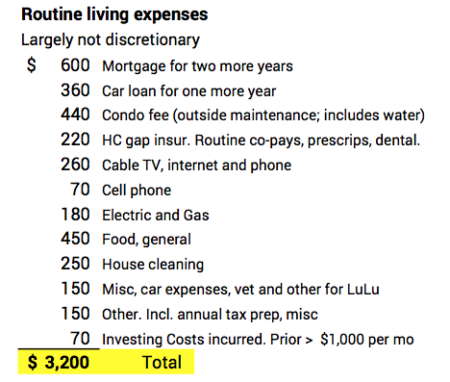

3. Estimate your monthly spending for the Basics. We spent a bit of time on this to include everything we could think of. Basic spending looked like this for Margie.

The first two expenses will disappear in about two years, lowering her monthly by more than $1,200 – about $14,000 per year in the next 24 months.

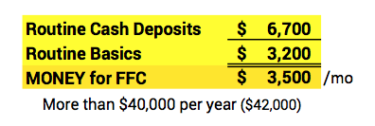

4. Subtract Basics from Monthly Income. Now we’re getting there. The net is the amount she has for Fun, Family, and Community (FFC). In Margie’s case this is more than $3,500 per month – easily more than $40,000 per year. She may have some surprise expenses in some years that will lower FCC, so let’s use $40,000 is a good first cut.

That added $1,200 per month in two years means she’ll have $54,000 per year for FFC. It’s not going to hurt her if she spends more than $40,000 in each of the next two years if she offsets by spending a little less than $54,000 in future years.

5. When you spend, decide whether you are spending on Basics or for FFC. What’s your plan to spend your FFC? I first asked Margie to think about two kinds of spending.

• The $47 for the prescription is part of her Basics. That’s easily covered. Why should she ever worry about that? She should think that way for all her Basic spending.

• LuLu’s kennel cost was $30/day for ten days, and that’s part of her Fun-spending, but it’s less than 1% of her annual budget for FFC. Her bigger task is to think through how she will spend (or gift) the other $39,700 in the next 12 months. I asked her to specifically think through how she would spend $20,000 in the next six months.

6. Write out and repeat a mantra now and then. Here’s the mantra I suggested to Margie.

“I have more than $40,000 per year to spend on Fun, Family, and Community. In 24 months I will have about $54,000 per year. That total will NEVER decline, and there’s a good chance it will be more.”

Conclusion. Are you worried about money? Or are you just not clear how much you can spend for Fun, Family and Community (FFC)? It may be that you have not spent the time to figure out your monthly income including the Safe Spending Amount you should pay yourself from your nest egg. You may not have clearly identified your spending needs for the Basics. Therefore, you aren’t clear as to how much you can spend per year or per month on FFC. You may find that you have much more for FFC than you thought.