Why do we want money? What are our priorities for spending money? Part 2.

Posted on March 15, 2019

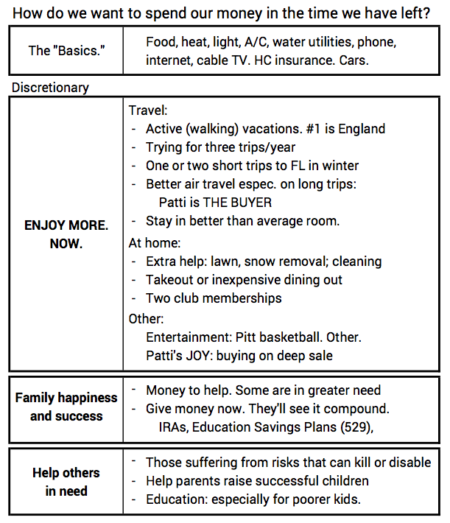

How do we want to spend our money in the time we have left? Last week I wrote that Patti and I have four big priorities, detailed here. Last week’s post discussed 1) The Basics and 2) What it is we ENJOY most. This week’s post discusses the other two: Help family and Help others.

==== Help Family====

We all want our family to be happy and successful. How money plays in that equation is not always clear, but Patti and I think assume some reasonable amount of money can make folks happier and more successful. Deciding on when our family gets our money is simpler for Patti and me to decide than for most. We don’t have children.

We want to help siblings, nieces and nephews. Patti has several siblings and about 14 nieces and nephews we’d like to help. None is expecting to inherit anything from us, so that’s not something we think about. A few can use the help now.

It’s easy for us to decide that it’s better to help them now than later – perhaps in 15 years when we are dead. We don’t have any thoughts about deferring help now to then leave the biggest pile of money possible to them. If you follow the plan in Nest Egg Care, it’s easier to think about giving money now than later. These factors help:

• We’ve all had the benefit of good market returns over the last four years – really it’s been over the last ten. Patti and I took our first withdrawal for our spending in December 2014, so it’s easy for me to track what’s happened since then. (Here’s the description and calculation sheet from last November 30). We had two good years (2016 and 2017) and two not-so-good years (2015 and 2018). The good years outweighed the two not so good.

• I recalculate our Safe Spending Amount (SSA) each November 30. Our first SSA was at the rate of $44,000 per iniital $1 million Investment Portfolio. (See Part 1, Nest Egg Care.) Our SSA for 2019 is $55,500 – 20% more in real spending power. We’re not spending 20% more. This means near the end of each year our thoughts will turn to gifting what we have not spent.

• We’ve taken out four years of Safe Spending Amount (SSA). That’s 188,000 in four years relative to a reference of $1 million starting Investment Portfolio. Right before the withdrawal in December for this year’s spending, we have $1.04 million measured in the same spending power as four years ago. We aren’t depleting our nest egg. You haven’t either if you follow the plan in Nest Egg Care. (See Parts 1 and 2.) However, over time we expect our portfolio to be less: we’re taking a greater SSA; we’re putting more stress on our portfolio; we have fewer years and don’t need the same size of nest egg. Patti and I are fine with that.)

==== Help we provide ====

If family members visit we like to help with travel expenses. Airfare is an obvious one. We like paying for meals when they visit. We generally also pay for all meals out if we’re visiting them.We also like to help with tuition expenses and health expenses.

Beyound those needs, Patti and I agreed on a target amount we would like to give each niece and nephew over a five-year or so period. With 14, you can guess that the amount per individual won’t be huge, but it may be significant depending on when they spend our gift: I always think of these gifts in terms of the Rule of 72: our gift now will compound to something much greater later. We like giving them money that they don’t immediately spend. Here are three options we like.

==== Gifts to IRA accounts ====

We gave gifts to them for their Traditional or Roth IRAs in 2017. Some had not started to save for retirement. (Patti and I were pack rats at their age; we understood the Rule of 72, and I don’t think it’s imprinted in their heads yet.) If we can encourage them to save more in addition to our gift, they’ll be MUCH better off in the future. Some already had an IRA account at Fidelity; we asked the others to open their new IRA accounts there.

==== Gifts to 529 plans ====

We also like giving to 529 plans for great nieces and nephews. Their parents –our niece or nephew – opened accounts at our request, and we give a gift to each every December. Our nest egg is at Fidelity. Their 529 plans are at Fidelity; this is very low-cost plan with a wide range of investment options. Vanguard also has a very low-cost plan. I’m sure there are others as low cost, but you can’t go wrong with these two.

In 2017 we also opened 529 plans with Patti as the owner (The legal term is participant.) – not the parents – with the same children as beneficiaries. We opened the accounts that way, because in a pinch, Patti can always withdraw from those accounts, paying tax only on the growth. I view the total amount we contributed as part of our off-the-top Reserve. (See Chapter 7, Nest Egg Care.) The added benefit for Patti as the owner is that contributions to these plans are tax deductible in our state – Pennsylvania – so 3% of our gift cost nothing.

==== Gifts to Health Savings Account (HSA) ====

This is an option that I have only recently considered. Those who have a high deductible medical insurance plan are eligible. This gift is a better investment option than a gift to a Traditional or Roth retirement plan. It’s a better because the contribution is not taxed (It’s deducted from income.), and the withdrawal is not taxed when used for eligible medical expenses and premiums. WOW. I’ll write more about this. Here’s a good article.

==== Simple mechanics for gifts ====

We make the gifts to each IRA or 529 account by using Fidelity’s bill pay system. I’ve stored their account as a payee; each gave me their account number. In all but one case, the check goes from my Fidelity account payable to Fidelity Investments for the specific account. Making those gifts just takes a few minutes.

Our nieces or nephews then log in and invest the proceeds. All but two of the great nieces and nephews are under the age of six. I’ve advised the parents that the money should be in FSKAX. The oldest is 12, so at the end of this year I’ll advise the parents to start shifting toward a mix that includes much more bonds than stocks five years from now – when they will first tap these accounts for college expenses.

==== Help others in need====

Patti and I are on the same wavelength on this priority. We want to help those who need most help. We use the filter shown above for our gifts. As I mentioned in this post, about 88% of our total donations in 2018 met this priority. The 12% that didn’t were to universities and cultural organizations. We’ll continue to judge as to how much to support them in the future.

Mechanics: Patti and I are both over age 70½, and it always a tax benefit to donate first using Qualified Charitable Distributions (QCDs) from our retirement accounts.

Conclusion. We all have thoughts as to how we want to spend our money in the time we have left. I think it’s a good idea to think through priorities and write them down. Our priorities are to 1) spend on the basics; 2) spend on what we enjoy doing together and makes us happier; 3) help our families to be happy and successful; and 4) help to improve the lives of others.