Should you Increase your Mix of Bonds as you get older?

Posted on November 6, 2020

One of the three key decisions in your financial retirement plan is your choice of mix of stocks and bonds. In Nest Egg Care (NEC) I assumed you’d keep that same mix throughout your retirement. Now that I am older – I’ll hit 76 soon enough – I’ve been thinking: should I change my mix? You can find conventional wisdom that says you should increase the percentage of bonds as you get older. Do you buy that? This post gives my thinking on my choice of mix over time. My conclusion is that I will not change the mix I selected at the start of our plan. I won’t revisit this issue until I’m in my 80s.

== Mix is not THE key decision ==

The basic risk I want to avoid in the future can be expressed this way: DON’T RUN OUT OF MONEY. That means Patti and I want to spend what we can in retirement knowing that we will NEVER DEPLETE OUR PORTFOLIO. We look way out on the shaft of the hockey stick – at least 15 years in the future. We do not look at the roller coaster of ups and downs in the value of our portfolio month-by-month or year-by-year: we are not focused on minimizing ups and downs.

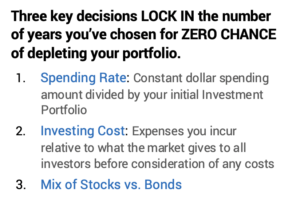

What we choose to spend – withdraw from our Investment Portfolio for spending each year – is THE KEY decision as to safety of our plan. The second key decision is Investing Cost and I’ve chosen really low Investing Cost: we reliably get to keep nearly 100% of what the market gives to all investors. Our decision on mix of stocks is the third decision, and it is the least important decision in terms of impact on the number of years for ZERO CHANCE of depleting our portfolio: I really control risk – the shaft length of our hockey stick – from the first two decisions, and my choice of 85% stocks – factoring in its effect to slightly lower our Safe Spending Rate (SSR%) – is no less risky than a choice of 75% stocks or 65% stocks or 50% stocks.

== Should I change as I get older? ==

The conventional wisdom is that you should shift your mix to more bonds as you get older. Some shifting may make sense, but a broad-brush change makes little sense to me.

I think the key question is, “Who (or whom) am I investing for?” as we get older. We all need to think about three: 1) you and your spouse – or the one who is still alive; 2) your children, grandchildren or other family members; 3) charities you want to support.

== Investing for you ==

As time rolls by, I’m less and less concerned about not having enough money for Patti and me and especially for just one of us when one dies: our Safe Spending Amount (SSA, Chapter 2, NEC) is now 20% more than it was at the start of our plan, and we were happy with what we could spend then. We’re convinced that one will spend less in total than two. And we have more portfolio value – measured in real spending power – despite withdrawing an average of about 5% per year for the last six years. You’ve experienced the same: you have more in real spending power than you ever did in your life.

And I know the lever to pull if I want greater safety or just a greater sense of safety: spend less than our calculated SSA. When we want to lengthen the shaft of our hockey stick – more years of ZERO CHANCE for depletion – we just spend a little bit less. We don’t need to fiddle with the mix of stocks. I conclude I have no real reason to lower our mix of stocks.

== Investing for your children ==

Part of what you have will go to your children, grandchildren or other family members. Here’s how I think about that.

They’re younger. Some are lots younger. They’re not going to be going on a wild spending spree with the money that they will get from us. That’s just not in their nature, and we’ve given and will give them money that will allow them to spend to Enjoy More Now. They may decide to spend some of the money they inherit, but that will mean they will able to put more of their money into their retirement plans. That’s what I would encourage them to do, and that would be the same as if our money went into their retirement plans.

This money has a very long holding-period – the time one holds securities before they’re sold for spending. I’d guess it’s 20 years on average. If I gave money to someone money that they’d invest for 20 years before they spent any of it, how would I tell them to invest it? I’d tell them to read this post and this one, but the bottom line is that money today has to be invested 100% in stocks. And in simple index funds like the ones Patti and I use. Patti and I really are holding money for them that now has to be 100% invested in stocks. More bonds in our portfolio now makes zero sense.

== Investing for charities ==

Patti and I plan on leaving money to charities from our Traditional IRAs. That’s money that will never be taxed. We didn’t pay tax when we contributed and no tax will be due when it is donated at death.

(Patti and I view our Traditional IRAs as about the worst money to leave to our heirs. Pennsylvania takes about 5% off the top for state inheritance tax, and then heirs may be subject to high marginal tax in the future. In effect, we’re paying too much tax when we leave our IRAs to our heirs. When I’m dead I clearly won’t be bugged about paying those taxes, but it bugs me when I think about it now.)

I might consider increasing our mix of bonds for the money that I think will flow to charities. They have a very short holding-period once they get our money. They will be spending it almost immediately. I’d follow the logic of an appropriate mix of stocks for a short holding-period that I describe in this same post.

But should I lower our stock mix now? No, because I think and hope that Patti and I have many good years before we – or one of us – has to look at our mix of stocks in our IRAs that will go to charities. Patti’s life expectancy is 15 years. That’s a long holding-period. This is something to think about once we hit our 80s.

Conclusion: Should I be thinking that I should increase my mix to have more bonds as I get older? I conclude that I’m happy with the mix I chose for Patti and me at the start of our plan. I see no logic to change now.

1) More bonds do not increase the safety of our plan: the lever to increase the safety of our plan is to spend slightly less.

2) More bonds do make zero sense if I think about our heirs: that money should be 100% in stocks, since the holding-period is very long.

3) More bonds do make sense for the money we will leave to charities when we are nearer to the end of our trail: they get it and spend it, and therefore this money has the shortest holding-period. But Patti’s life expectancy is 15 years. That’s still a long holding-period. Changing our mix now for more bonds makes no sense.