Should we lower spending to buy a bit more time for our portfolio to recover?

Posted on October 21, 2022

We can’t control what happens to stock and bond markets. We had no control in 2020 and 2021 when US stocks soared +20% each year, and we have no control over the 25% decline this year. But when the market declines we have the urge to DO SOMETHING to control what happens to our portfolio, and some folks choose to do the exact wrong thing. Doing NOTHING is a good move, but I list some things that I’ll do to help protect the value of our portfolio. The most meaningful decision – the one with the biggest long-term effect – is to spend less than we have been spending. Should Patti and I plan now to spend significantly less in 2023? My conclusion: it’s too early for me to consider doing that.

Let’s first get a view of the stress that this decline places on our portfolio. The decline is bad enough, but we always add stress since we retirees need to sell securities – withdraw from our portfolio in effect – for our spending each year. We start each year with less portfolio value than we had just a few weeks before. Ideally, returns over the next year are good and we earn back what we have withdrawn. We always calculate to a greater Safe Spending Amount when that happens (SSA, Chapter 2, Nest Egg Care (NEC))

But a year of negative returns means our portfolio declines before our next withdrawal for spending. When we withdraw the same real spending amount, the percentage that we withdraw is a greater percentage of our portfolio. We’re adding more and more stress and a bigger and bigger challenge to earn back all that we’ve withdrawn.

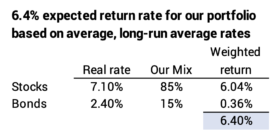

== Our SSA of 5.05% was < expected rate ==

Returns in 2021 meant all of us retirees had more money than we ever had in our lives. All of us calculated our SSA by using our age-appropriate Safe Spending Rate (SSR%, see Chapter 2 and Appendix D, Nest Egg Care). Patti and I used 5.05% for our calculation last November. See here. That’s a greater rate than many use because we’re older.

Our 5.05% SSR% was about 25% less than than the expected real return rate of 6.4% on our portfolio. That means we had a bit of a buffer. If returns starting in 2023 match expected returns, our portfolio will almost certainly earn back more than we have withdrawn. We then calculate to a greater SSA in a future year.

== Withdrawal this year > expected rate ==

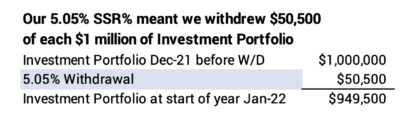

Our Safe Spending Amount really is a constant dollar spending amount divided by our initial portfolio value. We sell securities for – at least – that same real spending power no matter the future sequence of returns. We tested the Most Harmful return sequence in history to know how many years we have of Zero Chance for depletion. 5.05% SSR% means Patti and I would withdraw $50,500 per $1 million of Investment Portfolio, and we have 14 years of Zero Chance of depleting our portfolio.

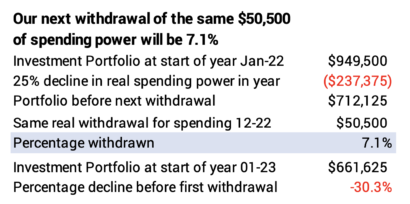

When we sell the same $50,500 in spending power this year, the percentage withdrawn will be greater than last year. I use November 30 for my calculation date. Our portfolio now is down 25% from last November 30 – our calcuation date – measured in real spending power. Assuming we withdraw the same $50,500 in spending power, Patti and I will be withdrawing 7.1% from our portfolio. That’s 40% greater that the percentage withdrawn last year. That 7.1% is obviously greater than the long term expected return rate for our portfolio. We may have thought we had a buffer a year ago. Now we don’t.

If the returns in 2023 are not enough to earn back the $50,500 withdrawn at the start of the year, the annual percentage withdrawn the following year will increase. (We’d need 7.6% real return in 2023 to earn back the $50,500.) It gets harder and harder for a portfolio to earn back the amounts being withdrawn, and our portfolio can continue to decline.

== What can we do to lower the stress? ==

We all have the following options to lower the stress on our portfolio and therefore our emotional stress:

• Sell bonds and not stocks. I likely will sell our Reserve for our spending this year. That means I’m skipping a year of withdrawing any from our Investment Portfolio. I discussed this point here. I’ve effectively lowered our total withdrawals from our Investment Portfolio for our lifetimes.

Even if we don’t use our Reserve, we all will be selling solely bonds for next year’s spending. Bond returns will be better; they’ll decline less than stocks. The math of rebalancing our portfolio works out that we all will be selling bonds.

• Delay sales of bonds. As I discussed in this post, the only amount I MUST sell in 2022 when I take our RMD in December is the amount I want to withhold for the taxes I will pay on our 2022 Federal and state tax returns. That’s going to work out to about 25% of our RMD, since I withhold no taxes and do not pay estimated taxes for Social Security or other income during the year. I’ll transfer to our taxable brokerage account 75% of our RMD as the value of shares of securities (e.g, IUSB).

My normal practice is to sell all our calculated SSA in December so that it is in cash to then transfer 1/12th monthly to our checking account for 2023. I call these transfers our “monthly pay from Fidelity”.

But I won’t follow my usual practice. I’ll be selling securities for our spending each month in 2023. I can automatically schedule to sell bonds – e.g, $X,000 of IUSB each month – and then transfer the $X,000 to our checking account on a specific date each month. I’m buying some extra time for inflation to decline and – I would expect – for bond returns to improve.

• Carry over any from 2022 that we don’t spend. What we carry over from 2022 means we have to sell less for our spending in 2023. Patti and I have always had some left over in our checking account that I know we will not spend by the end of the year. My practice has been to never carry-over any that we have not spent by the end of the year: Patti and I work through gifts we make to family and to charities. We won’t do that this year. I’ll basically tell the charities that I have donated to that it looks like I’ll be taking a hiatus this year. Cash gifts to our family will be modest, but bigger gifts have only been in years with outstanding returns, so they won’t be disappointed.

• Spend less in 2023 and future years than in 2022. Spending less (including investing costs as spending) than your calculated SSA is the BIGGEST LEVER you have to add safety to your portfolio: when you consistently spend less than your calculated SSA, you extend the number of years of zero chance of depleting your portfolio. In effect you’re using a lower SSR% that ties to more years of Zero Chance for depletion. That’s why using your Reserve for spending this year is important: you have effectively lowered your spending rate from your Investment Portfolio for your total retirement period.

Patti and I have been fortunate. We started our plan almost eight years ago now, and our SSA that I calculated last year was a real increase of 11% from the prior year. It was a 46% increase from the start of our plan. See last year’s calculation sheet here.

I decided not to sell securities equal to our SSA – withdraw our full SSA from our portfolio – but to sell less to pay ourselves the amount that’s more in line with our actual spending. See here. As a result of not paying our full SSA, we had a cushion of “more than enough” portfolio value for our spending. But I can increase that cushion by deciding to spend less than we now spend to enjoy retirement. We can’t lower our investing costs; they are already rock-bottom low.

The simplest way to lower spending is to skip the inflation adjustment or not fully adjust for inflation. If I skipped the 8.7% inflation adjustment, I’d pay ourselves the same number of dollars, but I’d be decreasing our real spending power by 8.7%. Social Security inflation-adjusts to maintain its spending power, but our SSA is a bigger component of our total pay. An 8.7% reduction in spending power from our nest egg would significantly lower our total spending power.

At our age (I’ll be 78 next year and Patti will be 75.), we’d rather face the decision to spend less in a future year, not 2023. We’d have to plan on less travel – our biggest discretionary expense – and we’d actually like to travel more: we didn’t travel as much as we would have liked in 2020 and 2021 because of COVID, and we would have liked to have travelled more this year; my surgery in March squashed that a bit. We are in good health and are energetic enough to travel. We just don’t have that many years where that will be the case. We decided that this is not the time for us to cut back

== Some things make no sense ==

I would not consider any of these two options: 1) change my design mix of stocks vs. bonds; that has almost no effect on the long run safety of your portfolio. 2) sell my total market investments (e.g., FSKAX) to overweight a segment of the market that I think will rebound faster; I’d just be guessing on that.

It’s not very pretty, and it could get ugly, but we plan on riding this out.

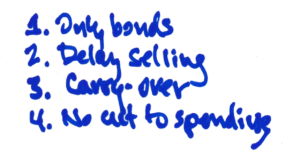

Conclusion: We have limited opportunities to DO SOMETHING in the face of the steep decline in our portfolio. We can: 1) sell only bonds for our spending for the upcoming year to give time for stocks to recover; 2) delay in selling bonds – sell them monthly throughout 2023 rather than in December if that has been your practice; 3) apply money that you paid yourself in 2022 but have not fully spent to your 2023 spending; this means you’ll sell less from your portfolio for 2023; 4) spend less that you have normally been spending. I’ll do the first three, but Patti and I don’t want to decide to spend less – travel less and therefore enjoy less – in 2023.

Great post! We’re looking at it similarly. We’re selling all bonds and will also segregate the bonds in the portfolio instead of selling them outright on December 1st and then sell monthly. Our portfolio is down 20% this year (we’re also invested in the Thrift Savings Plan and have some Apple stock which is only down 14% this year). We’re also going to do #4 and keep roughly the same monthly payment from investments as we have this year. So far, we’ve done OK with the inflation, and keeping the same amount next year shouldn’t cramp our style. My wife and I will be taking Social Security at 62 (I’m 59, and she’s 61), and once we’re collecting SS the amount we take from investments each month will be about $700 per month compared to $3,400 now. Since our pensions and SS adjust for inflation, inflation should be less of an issue in the future, and our remaining portfolio will be less affected by down years like this since we shouldn’t have to sell as much at a loss. Hopefully…