How much do I need to sell this year for our spending in 2023?

Posted on September 30, 2022

Unless there is a dramatic change in prices for stocks and bonds, I will not be happy the first week of December when I sell securities for our spending for 2023. For the past eight years, I sold securities that week for the total that I planned to spend in the upcoming 12 months. I think I should change my normal process this December: I can sell far fewer securities in December at what may be a low point. This post explains my thinking.

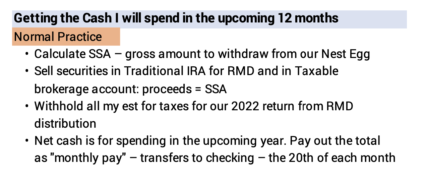

== My normal process ==

1) Immediately after November 30, I calculate our Safe Spending Amount (SSA; chapter 2, Nest Egg Care, NEC) for the upcoming year based on the 12-month returns ending November 30. I sell securities to get the gross proceeds into cash for our SSA. This is the math approach in FIRECalc, and I like having it all in cash for the full year; I don’t have to worry about the downs and ups of the market during the next year; I just have to be concerned when I approach my next date to sell – like now.

2) I sell securities our RMD then. When I sell for our RMD, I withhold taxes – basically all the taxes that I will have to pay on my current-year return: I get this amount from my tax plan that I first worked on in early August. I withhold in December almost all our current-year taxes, since I do not withhold taxes from our Social Security benefits, and I generally don’t make estimated tax payments. When I withhold ~all our taxes for the year in December I effectively get an interest-free loan from the IRS. The IRS treats taxes withheld in one lump before the end of the year as being withheld throughout the year. I transfer the net cash to our taxable brokerage account.

3) I sell added securities from my taxable brokerage account, since our SSA is always greater than our RMD.

4) I now have the net, after taxes in cash for our spending for the up coming year. I schedule automatic transfers from my Fidelity brokerage account as monthly payments throughout the year.

== This year? ==

My change would be to only sell securities in our Traditional IRAs in the first week of December equal the amount I want to withhold for current-year taxes. I’d transfer the balance of our RMD as shares. I’d then execute automatic sales each month throughout 2023 to get the cash I want transferred to our checking for our spending.

The benefit: I’m hoping that the sales over the next year are at better price per share than on November 30. I’m keeping more portfolio value than if I sold all of spending for 2023 in December.

== Here is the example ==

Let’s assume it’s just me who is subject to RMD and that is $50,000 for 2022. I’ll meet RMD requirements the first week of December.

I did not withhold taxes from my Social Security payments; I made no other estimated tax payments for in the year for other income I’ll receive in the year: dividends and interest would be an example.

I prepared a tax plan for the year in early August and I’ll refine it in November before my final decision as to what I will sell. Assume my tax plan says I will pay $15,000 in total federal tax on my 2022 return: taxes on my RMD; Social Security benefits, and other income, including taxes on gains of sales of taxable securities to get to our total SSA.

I want to withhold that $15,000 for federal taxes when I take my RMD. Again, the IRS assumes that I withheld this amount throughout the year. I don’t get hit with any penalties by paying too little in estimated payments throughout the year. I’ve effectively borrowed that $15,000 interest-free throughout the year.

The Fidelity web site allows me to pick the withholding percent on an RMD distribution up to 99%, but if I call Fidelity and ask the representative on the line, they can withhold 100% of an amount. I ask for a distribution of $15,000 with 100% withheld, and Fidelity send $15,000 directly to the IRS. That makes the rest of this easy.

I still must meet $35,000 balance of my required RMD. On the same call I ask Fidelity to transfer shares of a security or securities – let’s assume that’s all bonds and IUSB this year – equal to $35,000. That would be about 764 shares at a recent closing price of $45.67.

I now have 764 shares with $35,000 of value of IUSB in my taxable account; since I have no other IUSB in the account, my cost basis for these shares is $35,000. This will be the source for my spending over the next year. I can then use the “Automatic Transfers and Investments” for Fidelity to sell $2,920 of IUSB each month and transfer that $2,920 to my PNC checking account on the 20th of each month.

If IUSB improves in price throughout the year, I’ll have some shares left over at the end of 2023; I would have made the right bet by not selling all 764 shares for ~$35,000 in the first week of December. I’ll have remaining shares and portfolio value than if I had sold all 764 shares the first week of December.

But if IUSB declines further in value throughout the year, I would have made the wrong bet. I will run out of shares to sell before my 12 months are up; I’ll need to sell something else toward the end of 2023 for our spending needs.

Conclusion: I normally sell securities the first week of December to get the net for our spending into cash the first week of December. Our net for spending is the total proceeds of security sales less withholding all taxes that I expect to pay on our current-year tax return.

I don’t have to do it this way: I am not forced to sell securities when I take RMD. I can transfer shares and then sell those shares later for our spending. I think I will only sell securities from our Traditional IRAs the first week of December equal to the amount of taxes I want to withhold for our 2022 tax return. I’d sell securities for our spending monthly throughout 2023: I’m hoping that share prices improve and that I’ll have more portfolio value near the end of 2023 than I would have had if I sold this December.