Have you completed your draft tax plan for 2022?

Posted on August 5, 2022

My tickler file (application) told me that this is the week for my first cut on my tax plan for 2022. I’m following my checklist that I provided in my blog post of January 28. The purpose of this post is to give you a spreadsheet you can use for your tax planning for this year; it’s similar to the one I provided last August and displayed in my post on February 4.

I try to solve a puzzle to avoid taxes that we don’t have to pay in our lifetimes. With planning I can avoid taxes now and much greater taxes in the future. You also may have a puzzle to solve, even if you can’t see it now. I can’t tell you if you have a puzzle or how to solve it, but this post describes my thinking on the puzzle and my tax plan.

== Our RMDs can increase significantly ==

I’ve discussed this before. If future returns match expected or long-run average returns, $RMDs will be much greater than they are now.

• The value of your traditional IRAs will increase in real spending power over time: your annual RMD% is below the expected, real return rate for your portfolio for many years – generally to your mid 80. I turned 77 this year. My 4.70% RMD% for this year is less than ¾ of the expected 6.4% real return on our portfolio.

• Your RMD% increases every year for the rest of your life. It increases by more than 50% from age 72 to age 85, as an example.

Combine these two effects and at about age 82, your real $RMD would be twice what you took age 72. And it doesn’t stop there. If you live to 92, your real $RMD would be four times the amount you took at age 72.

Patti and I are older. Our RMD%s are higher than at our start. When I run the math, it says our real $RMD could increase by 50% in eight years. If I live another eight years, it could be double our current RMD.

== Two taxes I want to avoid ==

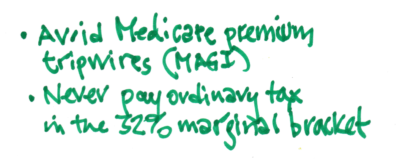

• I want to avoid increased Medicare premiums. (I call that a tax.) This is a real possibility for the sole survivor of Patti and me.

• I don’t want either one of us to pay taxes in the 32% marginal tax bracket. I judge that that is too big of jump from the 24% bracket: I keep 11% less of income in that bracket relative to the 24% bracket. That would mean paying a very high taxes on money that is well beyond our spending desires. The start of that bracket is distant, but I want to be aware of it. (I don’t plan on heroic efforts to avoid the 24% marginal tax bracket relative to the 22% marginal bracket.)

== How to forecast our future tax return ==

I can judge the impact of greater $RMD by increasing our $RMD reflected in my 2021 tax return by 50% – line 4b of our tax return; alternately, I increase the RMD I have in cell C31 on the spreadsheet by 50%. The spreadsheet calculates to a greater MAGI and taxable ordinary income. I can then see if that MAGI has the potential to cross Medicare tripwires for a single taxpayer. I can then see if taxable income reaches 32% marginal tax on ordinary income for a single taxpayer.

== What can I do? ==

If I see Patti and I are near a Medicare tripwire this year, I can prudently use my Roth instead of sales from our taxable investment account to lower MAGI and dodge the tripwire.

If I have concerns about future Medicare premium tripwires and marginal taxes, the only way to avoid them is to get more out of our traditional IRAs now. That means I make a judgment that it is better to pay more tax now to avoid much more tax in the future. I should be happy to pay more tax now at the 22% marginal rate to avoid paying at the 32% rate in the future. More taxable income now could mean crossing Medicare tripwires in one year but avoiding them in for a number of future years.

You have three ways to lower the amount in your traditional IRAs; Patti and I have done all three to some extent. 1) You can convert traditional IRA to Roth. 2) You can donate from your IRAs earlier than you might otherwise plan to do. 3) You can withdraw more from your traditional IRAs and give the net to your heirs for their IRAs; the sum for you and them is, basically, no taxes paid: you pay tax, but they avoid tax, in effect, on their contribution to their IRA.

== Steps I take ==

I list the steps for my tax planning on the template. My sheet differs slightly from the template. I don’t enter my SSA on the spreadsheet (cell C24). I will pay us less than my calculated SSA, as I described in this post. I enter our desired after-tax amount for our spending on my altered sheet. I then find the total gross security sales for that.

Conclusion. I complete a draft plan for our taxes the first week of August. The template I provide starts with your estimated SSA for 2023. You complete a spreadsheet that estimates total taxes for your 2022 return and the balance you will need to pay for the year. You then know the after-tax amount you have for your spending for 2023. You can jiggle with the three sources of cash to adjust your total 2022 taxes and your net for spending: sales of securities and withdrawal from your traditional IRAs; sales of securities in your taxable investment account; and sales of securities and withdrawal from your Roth account.

I think about future taxes, since our RMD could very likely increase by 50% in real spending power in a decade, and it could just be one of us alive then. I would like to avoid income levels that consistently trigger higher Medicare premiums and far too high of marginal tax relative to our spending desires. Solving this puzzle means incurring greater taxes now to avoid much greater taxes later.