What will we be selling for our spending in 2023?

Posted on September 23, 2022

In most years, I mostly or solely sell stocks in December for our spending in the upcoming year. That’s because stock returns have been greater than bond returns in all but one of the last seven years since the start of our retirement plan. Last year – stocks +15% real return and bonds -6% – I sold only stocks for our spending and then sold more stocks in our IRA accounts to buy bonds to rebalance our portfolio: that may seem strange, but that follows the correct math. This year will be different, and I explain in this post why – barring a DRAMATIC turnaround for stocks – we all will be selling only bonds for our spending in 2023.

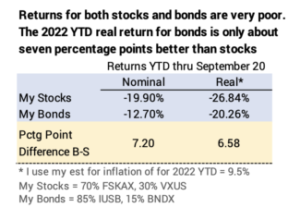

== Stocks and Bonds have tanked ==

Both stocks and bonds have tanked. Stocks are worse than -25% real return and bonds are worse than -20% real return. Both, if unchanged for the year, are among the worst five years out of 97 since 1926. Typically bonds come to our rescue and are 20 percentage points better than stocks in their ten worst years in history. Not this year; bonds are failing us. This is a very abnormal year, one especially harmful to our portfolio.

== A year to Use our Reserve ==

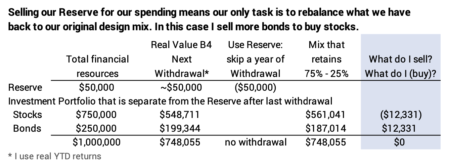

In Nest Egg Care, Chapter 7 I recommend that we set aside 5% of our total financial portfolio as a Reserve at the start of our financial retirement plan. We don’t even think of that Reserve as part of our Investment Portfolio. The Reserve a pile of money we imagine that we keep under the mattress to use in an emergency. The emergency is a VERY HARMFUL year of stock returns.

That Reserve is invested in a short-term bond fund like BSV (DBIRX) or similar. It just sits there until we need it. We probably look at it as a dead weight in the years when stocks and bonds have done well, but this is the year we find the value in that Reserve. We use it to buy time for stocks to recover.

In Chapter 7 I suggest that we use our Reserve in the first year that stocks tank: my arbitrary definition was -17% or worse real return; that’s about a one in ten-year event. Over the past seven years, the worst return for my stocks was -1.6% real return in 2015; I hardly raised an eyebrow. Clearly we’re on track to hit that REALLY BAD one-in-ten-year event. We’re actually closer to a one-in-twenty-year BAD event.

We know our action: we sell our Reserve, BSV or similar, for our spending. We are skipping a year of the normal withdrawal and rebalancing from our Investment Portfolio. We’re clearly giving stocks free run for a year to recover.

We’d still rebalance the amount we have in our Investment Portfolio to back to our design mix. I’ll assume a design mix of 75% stocks and 25% bonds in this example: that would mean I sell more bonds to buy more stocks.

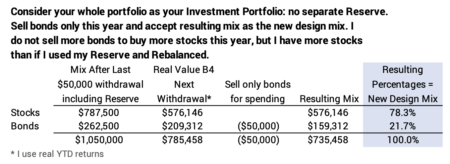

== The “only bonds” approach ==

I described an alternative tactic in this post. This tactic more clearly recognizes the concept that bonds are insurance that we use when stocks crater and we want to give the maximum time for them to recover. We use bonds for our spending when stocks crater, and we employ this tactic in all years when stocks crater.

The tactic was equivalent – or better – to the concept holding a one-year Reserve and using it up when stocks cratered. This alternative tactic resulted in more years of Zero Chance of depleting a portfolio when I tested the two options on THE Most Harmful sequence of returns in history.

The tactic is to sell only bonds for our spending when stocks tank, but then we do NOT REBALANCE back to our design mix. In this example, one sells only bonds and then adopts the resulting mix as the new design mix of 78% stocks and 22% bonds.

We’d rebalance back to that 78%-22% mix in subsequent, more normal years, but If we have another Very Harmful year where stocks crater, we repeat: sell only bonds and keep the resulting mix – that would be more than 78% stocks – as our new design mix. Given too many REALLY HARMFUL years for stocks, we’d deplete our bonds.

== It’s one of the two ==

We all will be employing one of these tactics when we calculate what we need to sell for our spending in 2023. I’ll make my final decision near the end of November.

Conclusion: Real stock returns year-to-date are worse than -25%. If there is no change for the rest of the year, that is about the fifth worst year out of the 97 years since 1926. Barring a DRAMATIC improvement, it won’t be business as usual at the end of the year.

We’ll all be selling solely bonds for our spending in 2023. We will adopt one of two tactics:

1) We’ll sell the Reserve we set aside at the start of our plan; in essence we are skipping a year of normal withdrawal from our Investment Portfolio; we’re giving a full year for stocks to bounce back. Our only task is rebalance back to our design mix.

2) We can view that we are adopting a plan of selling “only bonds” this year and accepting the resulting mix as our new design mix. We’ll rebalance back to that new design mix in more normal years, but revert to “only bonds” every time stocks crater.