How will next month’s inflation affect the 12-month rate?

Posted on August 19, 2022

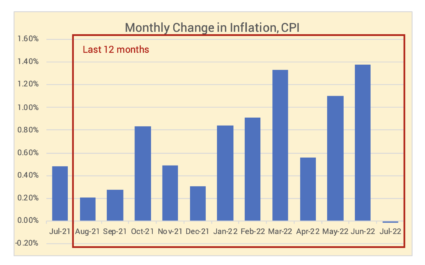

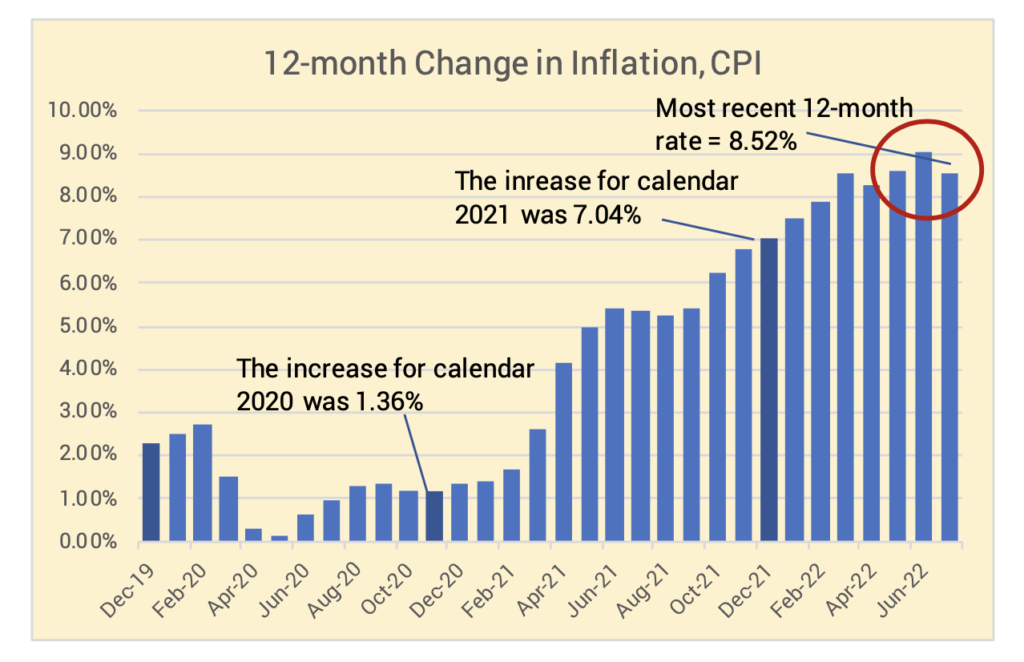

I wrote a prior post on inflation, but I think the two graphs I have in this post more clearly display how monthly inflation affects annual inflation.

== Each month replaces a prior month ==

The annual change in inflation is the compounding (proper multiplication) of the 12 prior monthly changes.

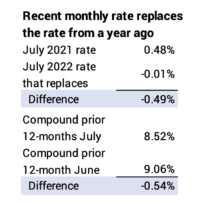

I think you have this, but it’s much easier for me to see on this graph: the most recent monthly inflation rate, replaces the same month of a year ago. The inflation rate for this July 2022 was -0.01%. It replaced the monthly inflation rate for July 2021 of 0.48%.

The 12-month inflation rate in June was 9.06%. This July replaced a higher prior July: the 12-month rate fell. The 12-month inflation rate for July was 8.52%.

The difference in the annual rate is not exactly the same as the subtraction of the rates in the two months: the math of compounding is the culprit.

== The next couple of months ==

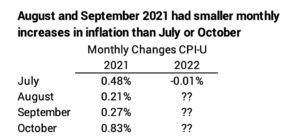

The monthly changes in inflation in August and September 2021 were relatively low. That means monthly changes for this August and September will have to be darn low for the annual rate to decline. It’s easier to envision a measurable decline in the 12-month rate for October 2022 since the monthly rate in October 2021 was roughly four times the rates for August or September.

= Social Security (SS) COLA ==

When folks talk about inflation, they are using the measure of CPI-U – the Consumer Price Index for all Urban Consumers.

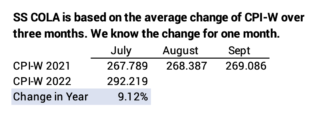

The SS calculation of COLA is based on the change of a different measure, CPI-W – the Consumer Price Index for Urban Wage Earners and Clerical Workers. COLA is based on the average 12-month change for the three month of July, August and September. We now have one month behind us. The 12-month change in CPI-W for July was greater than the change in CPI-U. That mean the three month change in SS will likely be greater than if it were calculated using CPI-U.

Conclusion: This post tries to help clarify how monthly inflation affects the 12-month inflation rate that you hear in the news. The inflation rate for the most recent month (July 2022) replaces the inflation rate for the same month from a year ago (July 2021). If the rate is lower now than the month it replaces, the 12-month rate declines. The 12-month rate for July declined by 0.5%.

Social Security bases its COLA (Cost of Living Adjustment) on a different measure of inflation that we hear in the news. COLA is the average the annual changes for July, August and September. The July 12-month rate was 9.12%. We might expect the COLA increase to our gross Social Security benefits to be in the 9% range.