How many ways can you recast your portfolio?

Posted on December 18, 2020

This is the time of year I recast our portfolio, and you should spend the time to recast yours. Segment it and add it up in different ways. You’ll have a better view of the strength of your portfolio. You’ll know you can control risk in your portfolio. This post describes six ways I like to look at our portfolio.

== It’s not one big pile of money ==

I think most folks think of their portfolio as one big pile of money. Those folks see the whole pile move up and down with the variations of stock and bond returns. The swings in stock returns can be dizzying. Stocks declined -35% in 34 days starting in late February; all of us saw our portfolios shrink. Dramatically. It would DRIVE ME CRAZY if I thought about our portfolio as one BIG PILE. It’s not. Some parts are a lot less variable than others. Some parts are more valuable than others. Here are the six ways I like to segment and look at our portfolio.

== 1. Segment returns by stocks and by bonds ==

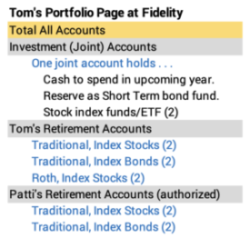

I segment our portfolio by 1) stocks and 2) bonds. I really don’t do anything special on an annual basis, because that’s the basic way our accounts are set up at Fidelity. (See Chapter 12, Nest Egg Care (NEC).) It’s easy to see our total this way, since Patti and I only hold two stock funds/ETFs and two bond ETFs. Patti sees the mirror image of my portfolio page when she logs in at Fidelity.

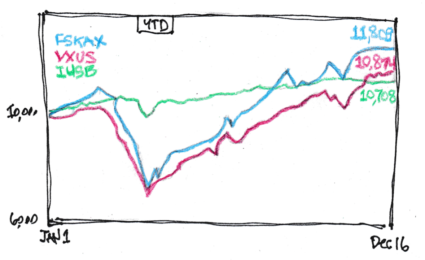

I can use the Morningstar interactive performance graph to track how well bonds perform over any period where stocks dived: bonds are almost always MUCH better. That dip for bonds (represented by IUSB in green) in late February and early March this year was nothing like the nosedive for US (blue) and International (red) stocks.

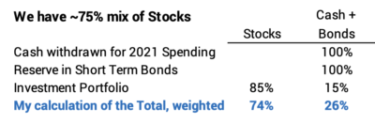

== 2. Calculate Stocks/Total < Stocks/Investment Portfolio ==

85% is closer to 75%. Our total mix of stocks is less than implied by my decision to have 85% stocks and 15% bonds for our Investment Portfolio. (See Chapter 8, NEC.) That’s because our Investment Portfolio is less than our total portfolio. (See Chapters 1 and 7 and “The Patti and Tom File” at the end of Part 2, NEC.) To get our total, I need to add back our Reserve and, right now, all our 2021 spending that’s in cash. When I calculate, I really have an overall mix of 74% stocks.

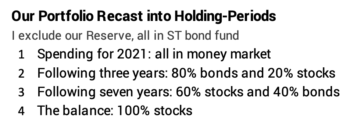

== 3. Segment the total by holding period ==

This is the most important annual recasting of our portfolio. It reinforces that, to me, our overall mix of stocks and bonds for our Investment Portfolio – 85% stocks and 15% bonds – makes perfect sense.

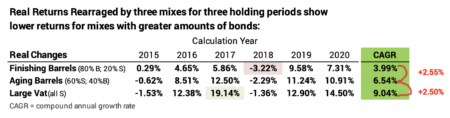

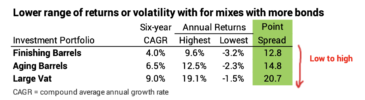

I recast our portfolio into groups of holding-periods. A holding-period is the length of time one holds on to an investment before selling it and using the net proceeds for spending. Every December 15 I recast our most recent 12-month returns by three – actually four – different holding periods ranging from very short to very long. Each holding period has a different mix of stocks and bonds. Shortest holding period = all cash. Short holding period = almost all bonds. Longest holding period = all stocks.

The returns by holding-period are what I’d expect: lower returns and less variation in annual returns from mixes with more bonds.

Some folks group their portfolio into buckets with each bucket representing a different holding period. I like the analogy that our portfolio is divided into ten wine barrels and a large vat. Each barrel holds one year of spending. The vat holds the balance. I’ve described this on the blog post nearest to December 15 in the past. Here’s the post from last year.

In early December I sell securities for all out spending in the upcoming year. That’s analogous to bottling the wine that we’ll drink next year from wine barrel #1. As I bottle it, I am thinking that the wine has aged in a precise way for more than a decade. I’ve described my day when I imagine I go out to the garage, set up the contraption to bottle the wine, bottle the wine from barrel #1, rotate the positions of the barrels, and change the mix of stock-wine and bond-wine in two of the barrels. It’s a busy day!

Whenever I look at this segmentation of our portfolio, I’m convinced that Patti and I have a very low-risk portfolio for the next three years, a very conservative mix of stocks and bonds for the next six or seven years, and an appropriate mix for the longest holding period: it’s a VERY high probability that stocks will outperform bonds in a decade – and most likely by a long shot. Lumping it all together, though, leads some to categorize my total portfolio as “aggressive” – implying “risky”. I don’t relate to that categorization at all.

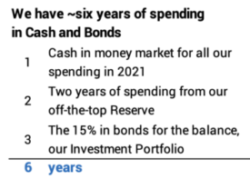

== 4. Add up our years of insurance ==

I add up the number of years of insurance coverage. Patti and I basically have six years of insurance to lower the health risk to our portfolio. In the EXTREME, we could sell bonds for our spending, not stocks. That’s a hefty amount – a lot of time to give stock to recover – in my mind.

Cash and bonds are insurance for our portfolio because they allow us to totally avoid selling stocks when they nosedive. Nest Eggers solely or disproportionately sell bonds when stocks crater. Because I just sold securities to get our 2021 SSA into cash before the end of the year, I have an added, full year of insurance at this time of year. That seems to be waaay more than adequate insurance to me: lots of time to let stocks recover if they crater.

I’m willing to pay for that insurance, just like any other insurance. But I don’t write a check to an insurance company; I pay for that insurance by accepting lower returns Patti and I earn on cash and bonds relative to stocks over the years.

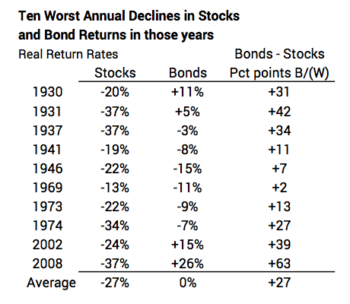

Like all insurance, it’s not valuable if you never need it, but it’s very valuable when you do need it. The insurance for our portfolio potentially is VERY VALUABLE because bonds, on average, have outperformed by 27 percentage points in the ten worst annual nose-dives for stocks. You sell bonds, not stocks, to avoid potential DEVASTATION of your portfolio.

I’ll be VERY HAPPY to tap our insurance – sell bonds and not stocks (or a much smaller amount than usual) – if and when I’m hit with a year like one of those worst ten. (I point out in Nest Egg Care, Chapter 7, that over our retirement period, it’s 90% probable that we’ll see at least one year of very HORRIBLE returns for stocks. I’m hoping all we retirees beat those odds and never have to use our insurance.)

== 5. Add up our after-tax spending power ==

I restate our total in terms of after-tax spending power. Patti and I withdraw our annual Safe Spending Amount (SSA, Chapter 2, NEC), but we have to pay taxes on that to get the net we can spend. I want to know the approximate total we have in after-tax spending power. Most of our money is in our Traditional IRAs, and we pay about 20% tax overall. When I go through the rough math, I find our after-tax spending power is about 83% – 5/6ths – of the total that I see for all our accounts that Fidelity displays on my portfolio page.

I can also see that I have sources for part of our our SSA that are essentially zero tax cost. Our RMD distribution is part of our SSA, but SSA always greater than our RMD, so I want low-cost sources for the added we want. Even though I have used up low cost sources for that added cash over the past six years, I still have a healthy amount I can tap.

== 6. Add up our donation power ==

I add up our donation power. This is the flip side of the above. Patti and I are getting to the point that we know we have More-Than- Enough. (See Chapter 10, NEC.) Returns have just been too good over the last six years! We want to donate now, and we’ll donate from our estate at the death of the last of us to die. I reorder our total portfolio in in terms of best tax advantage for donations. The best to donate clearly is from our Traditional IRAs: I never paid Federal tax on my contribution and charities pay no tax when we donate to them. These are also the least valuable to leave to heirs. Because more than 80% of our money is in Traditional IRAs now, we have solid donation power.

Conclusion: Your portfolio isn’t one big pile of money. Parts of your portfolio are much less variable in return, and parts are much more valuable than others. You should recast your portfolio to look at it differently once a year. You’ll have a better view of the strength of your portfolio. You’ll know you can control risk in your portfolio. This post describes six ways I recast our portfolio.

The recast that is most important to me is the division of our total portfolio into three – maybe four – groups of money with different holding-periods. A holding-period is the length of time you hold on to securities before you sell them to get the net for your spending. I conclude we have a very appropriate level of risk in our mix of stocks and bonds in our portfolio.